By Valerie Volcovici

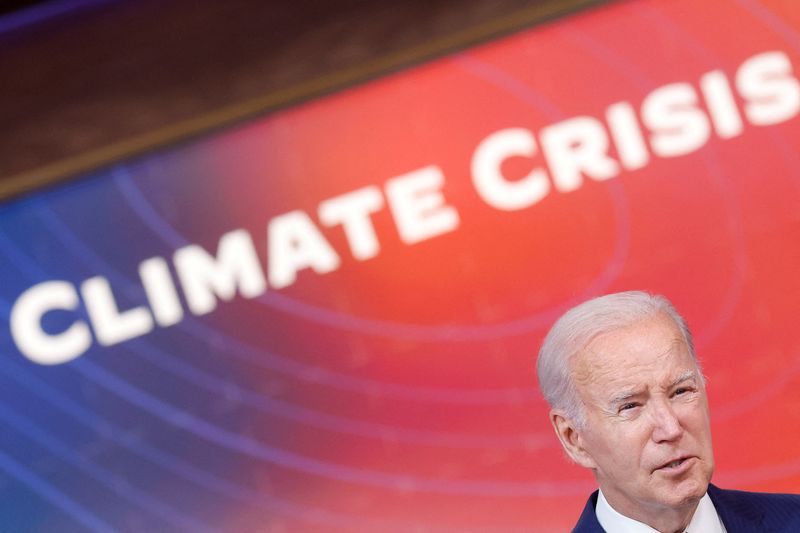

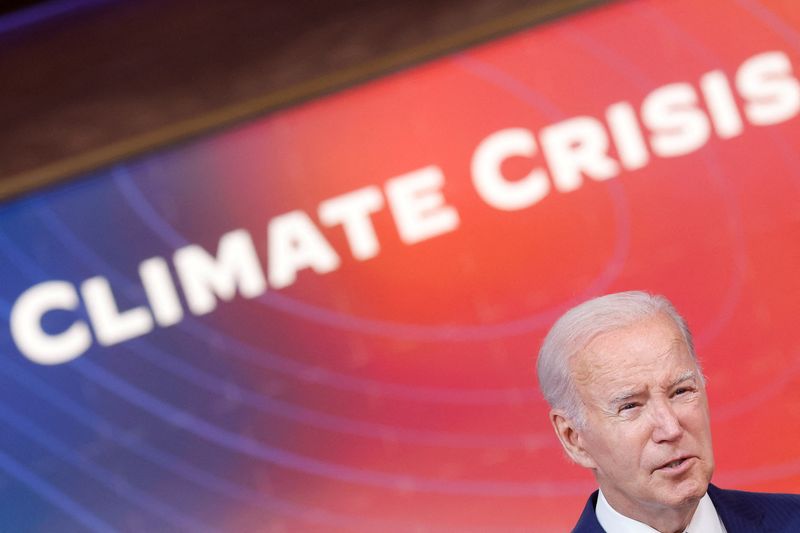

WASHINGTON (Reuters) – The Biden administration on Tuesday announced it would seek to curb U.S. emissions of powerful industrial greenhouse gases such as nitrous oxide as it enters a new phase in the national strategy to fight climate change under the Paris agreement.

The focus on industrial gases follows U.S. measures to reduce methane emissions, which yielded an international campaign to get other countries to make big cuts as well as domestic reductions.

Like methane, nitrous oxide is short-lived but a potent source of global warming, so the U.S. hopes targeting it will yield rapid and inexpensive gains in the fight against climate change.

“Most of the discussion of climate change focuses on carbon dioxide, but super pollutants like methane and nitrous oxide cause half of the climate change we’re experiencing today,” said John Podesta, Senior Adviser to the President for International Climate Policy.

The White House kicked off the effort with an event on Tuesday and announcements by industrial companies, including Ascend Performance Materials, that are taking voluntary actions to cut nitrous oxide emissions, officials said.

Nitrous oxide emissions come from a variety of sources including the production of some fertilizers and synthetic materials such as nylon.

A State Department official told Reuters that it can cost as little as $10 per metric ton to reduce nitrous oxide emissions through projects implemented through the voluntary carbon offset market.

Last year, the U.S. and China agreed to include a commitment to reduce all non-carbon greenhouse gases in their new national climate plans under the Paris climate agreement, which are due to be submitted to the United Nations next year.

Gabrielle Dreyfuss, chief scientist for the Institute for Governance & Sustainable Development, said she hoped the two biggest industrial emitters would cooperate on nitrous oxide.

“When the U.S. and China work together, big things can happen,” she said.

Podesta told another event hosted by IGSD, the Asia Society and think tank Climate Advisers that he will travel to China to meet with counterparts “later this year”.

Tuesday’s event also included a commitment of $300 million from philanthropies for the Global Methane Hub, which supports projects to cut methane emissions around the world.

This post is originally published on INVESTING.