Donald Trump’s rising ratings have prompted investors to speculate on which currencies will be the frontrunners and which will be the outsiders on Forex if the Republican returns to the White House. Let’s discuss this topic and make a trading plan for EURJPY, EURSGD, and other currency pairs.

The article covers the following subjects:

Highlights and key points

- USDMXN quotes may soar above 20.5 or fall below 19.

- The yuan risks weakening to 7.4 and then to 8 against the US dollar.

- European currencies will suffer the most rather than Asian ones.

- A red wave will trigger sell-offs in the EURJPY and EURSGD pairs.

Weekly fundamental forecast for euro, yen, and Singapore dollar

Markets believe that Donald Trump will become the President of the United States. While his chances of winning in 2016 were estimated at one in three, now they are two in three. His previous term as head of state showed how eagerly the billionaire rushed to fulfill his campaign pledges. Which Forex currencies will benefit, and which ones will suffer if the Republican returns to the White House?

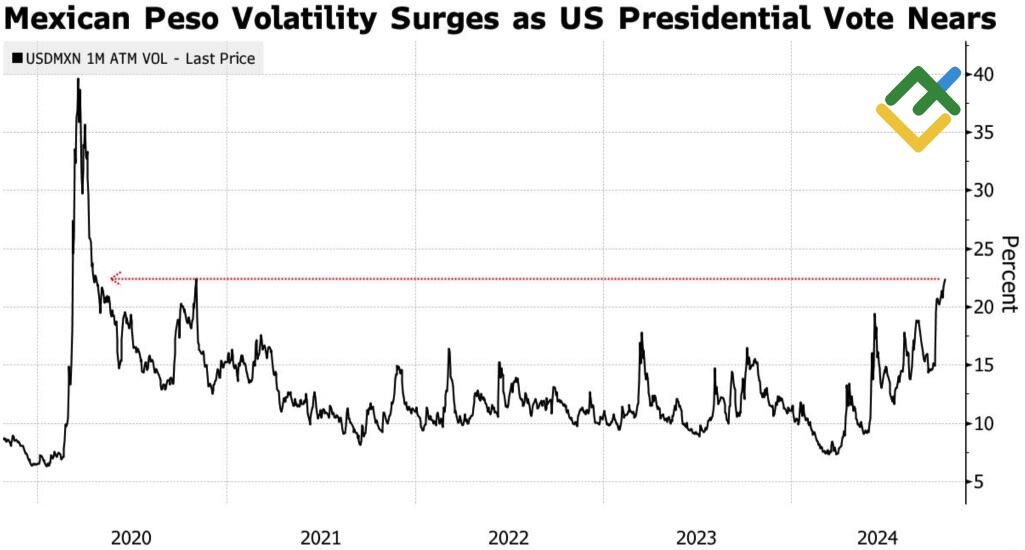

Forex underdogs have been known for a long time. During Donald Trump’s rivalry with Joe Biden, investors were getting rid of the Mexican peso and the Chinese yuan. Kamala Harris’ honeymoon forced them to slow down, but the Republican’s rising approval ratings brought this trend back to the market. USDMXN volatility jumped to its highest level since 2020, and Deutsche Bank estimates that a red wave will drive the pair above 20.5 while a blue wave will drag it below 19. JP Morgan predicts a 6-7% drop in the US dollar against the peso if Kamala Harris wins.

Mexican peso volatility

Source: Bloomberg.

The outlook for the Chinese yuan is similarly pessimistic. Goldman Sachs anticipates that Donald Trump’s return to the White House will push the USDCNH pair to 7.4 and 8 should the Republican implement his pledge to raise import tariffs to 60%.

The 45th US president’s return to power will likely benefit the US dollar, both due to economic growth driven by fiscal stimulus and the Federal Reserve’s decision to maintain elevated interest rates in light of potential inflationary pressures. The issue is that the USD index has been rising for several weeks now due to the Trump trade factor, and there is a growing risk that speculators will lock in profits on their long positions.

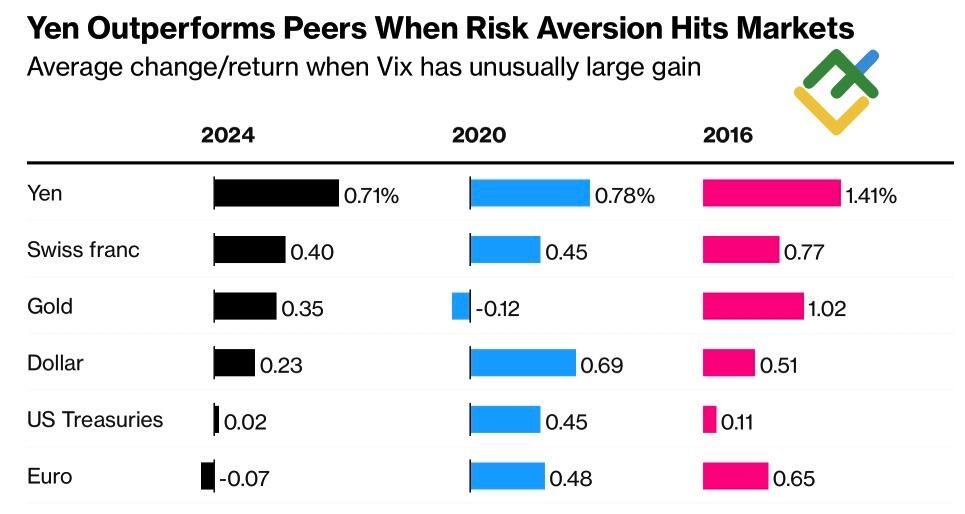

The Japanese yen may emerge as an unexpected winner. During the previous US presidential election, it received preferential treatment, and according to Vanguard, it is currently the best safe-haven asset for hedging political risks in the US.

Currencies’ performance against US presidential elections

Source: Bloomberg.

Buying the Singapore dollar against its US counterpart following the voting day on November 5 also looks promising. The Monetary Authority of Singapore regulates the exchange rate through currency interventions rather than through direct control of interest rates. Furthermore, the victory of Donald Trump may trigger a massive sell-off in the USDSGD pair.

Notably, Asian currencies are among Forex leaders for several reasons. While Donald Trump’s primary economic challenge is China, the Asian giant can redirect its exports to other destinations. Meanwhile, the already bruised eurozone economy will suffer. Against this backdrop, Goldman Sachs predicts that the EURUSD pair will likely collapse below parity to 0.97.

Weekly EURJPY and EURSGD trading plan

Therefore, one may consider selling the EURJPY pair with targets of 163.2 and 161 and the EURSGD pair with targets of 142.7 and 141.5 should Donald Trump win the presidential elections.

Price chart of EURJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.