The decline in cash rate from 4.35% to 4.1% does not mean that the monetary expansion cycle will continue in line with market expectations. This was the conclusion of the Reserve Bank of Australia, which supported the AUDUSD pair. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The RBA has started the monetary expansion cycle.

- The central bank intends to act cautiously.

- The aussie is immune to US tariffs.

- Trades on the AUDUSD pair can be opened once the pair leaves the range of 0.6335–0.6375.

Weekly Fundamental Forecast for the Australian Dollar

The term ‘hawkish cut’ frequently made the headlines in 2024, referring to a central bank cutting rates while rejecting the derivatives market’s view on the continuation of the cycle. This year, it has re-emerged in the Forex market. The Reserve Bank of Australia began to loosen monetary policy by cutting the cash rate from 4.35% to 4.1%, a move that did not cause any significant fluctuations in the AUDUSD rate, thanks to Michele Bullock’s emphasis on caution.

The RBA’s approach is nuanced, aiming for a soft landing for the economy and preventing inflation from accelerating. Former RBA Governor Philip Lowe overestimated the transitory nature of the 2022 inflation spike, leading to his eventual resignation. Michele Bullock has adopted a cautious approach, preferring to take a measured and considered decision.

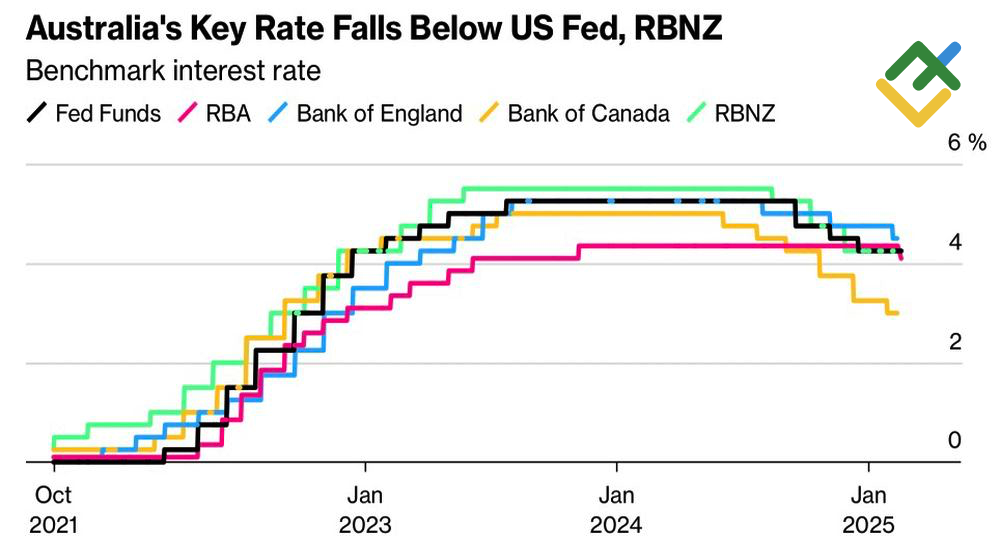

Major Central Banks’ Interest Rates

Source: Bloomberg.

According to the RBA governor, the possibility of ongoing disinflation is encouraging, although the potential for inflation acceleration remains a concern. The derivatives market’s forecasts regarding the cash rate have been inaccurate. The key rate cut in February does not guarantee a continuation of the process, as investors had anticipated. The derivatives market expects more than three acts of monetary expansion in 2025.

ANZ Group Holdings anticipates that the RBA’s caution and its reluctance to act precipitously and reverse prior decisions will provide support for the Australian dollar. In contrast, Indeed Inc. notes that Canberra has never limited itself to a single act of monetary expansion, and the decline in the cash rate will prolong, which is unfavorable for the AUDUSD pair.

The RBA may be inclined to take further steps down the monetary easing road, given the slowdown in average wages in the fourth quarter from 3.6% to 3.2%, which is likely to boost disinflation.

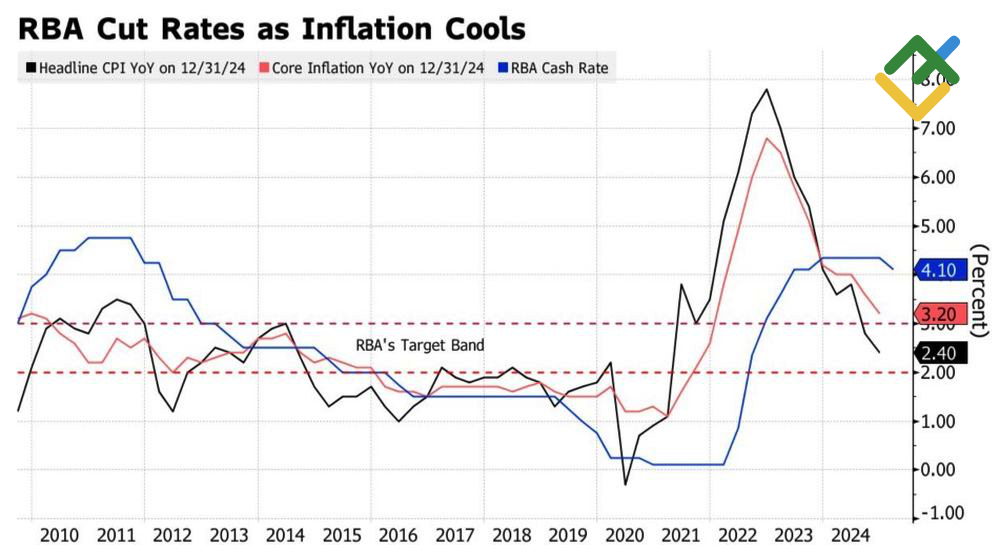

Australia’s Inflation Rate

Source: Bloomberg.

At the same time, if the Australian dollar is showing resilience to US tariffs, it is logical to assume that the implications of the RBA’s monetary expansion cycle may put pressure on the currency. Indeed, while import duties against Canada and Mexico have been postponed, those against China remain in place, which is damaging the economy of Australia’s main trading partner and negatively impacting exports and GDP.

However, investors are becoming increasingly aware that tariff threats are a part of Donald Trump’s negotiating tactics, as he is quick to impose them and just as quick to remove them. Consequently, hedge funds that have built up net short positions on the AUDUSD pair to 44,643 contracts will likely stand to lose if the pair embarks on an opposite trajectory.

Weekly AUDUSD Trading Plan

The AUDUSD pair has reached the first target of 0.635, failing to hit the second one at 0.64. Currently, the quotes are moving in a narrow consolidation range. If the price breaks above the upper boundary of 0.6375, it will allow traders to open more long positions. Conversely, if the support level of 0.6335 is broken through, the pair will likely face a sell-off.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of AUDUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.