While the Bank of England is reducing interest rates and anticipating stagflation in the country, signs of easing global trade war risks and a potential resolution to the conflict in Ukraine are pushing the GBPUSD pair higher. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The derivatives market expects the BoE to make three rate cuts in 2025.

- The pound strengthens as trade war concerns fade.

- Low GDP forecasts by the BoE may trigger a rally in the pound sterling.

- Long trades on the GBPUSD pair can be opened with targets at 1.26 and 1.272.

Weekly Fundamental Forecast for Pound Sterling

It is never too late to change your heart. The unexpected vote by Bank of England’s most prominent hawk, Catherine Mann, to cut the repo rate by 50 basis points in February should have dragged the GBPUSD pair into the void. However, the pair managed to rebound from the support level of 1.2355, allowing bulls to open long positions in the Forex market.

Catherine Mann’s perspective, which differs from the prevailing opinion, highlights the cooling labor market as a potential indicator of weakening domestic demand, potentially hindering companies’ ability to raise prices. In response to these developments, the Bank of England, along with a substantial repo rate cut from 4.75% to 4.5%, revised its 2025 GDP forecast downward from 1.5% to 0.75% while raising its inflation estimates. It now anticipates a 3.7% acceleration in the CPI by the end of the year, up from the previously forecasted 2.8%. Meanwhile, the UK regulator believes that inflation will reach the target only in 2027.

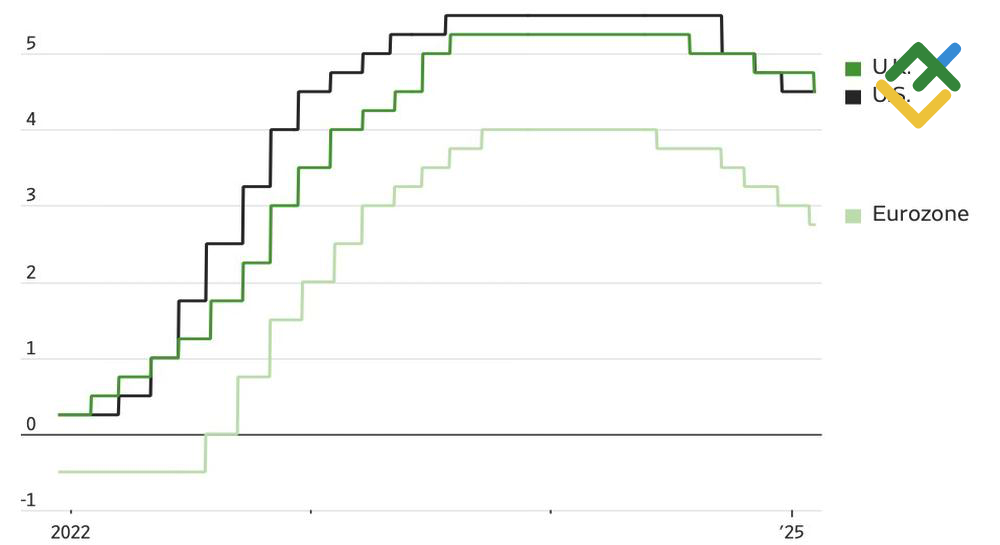

Major Central Banks’ Interest Rates

Source: Wall Street Journal.

According to Megan Greene, the rapid wage growth indicates that the economy is unable to supply more goods, not that there is weakness in domestic demand. Given the limited supply, it is reasonable to maintain rates at levels that curb demand. At the same time, monetary expansion should be approached with great caution.

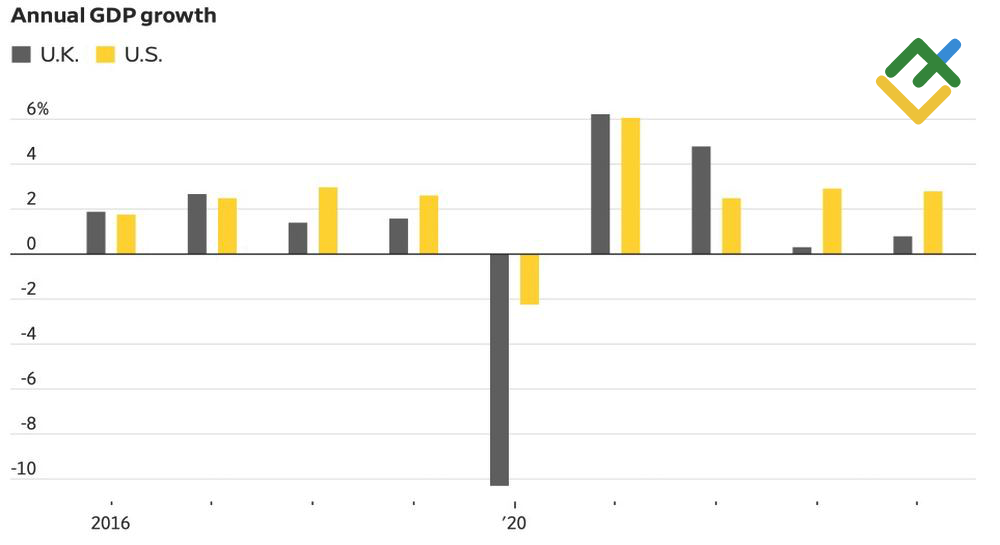

The Bank of England has painted a stagflationary scenario in its latest forecasts, where the country’s GDP will lag behind its US counterpart for the third consecutive year. This, coupled with the markets’ confidence in Catherine Mann’s analysis over Megan Greene’s, suggests that the downward trend in the GBPUSD pair remains robust. The derivatives market anticipates two acts of monetary easing from the Bank of England in 2025, with an 80% probability of a third rate cut, a jump from 40% following Catherine Mann’s unexpected shift to a dovish stance.

US and UK GDP growth

Source: Wall Street Journal.

The British pound has demonstrated its resilience in the face of muted expectations, consistently defying predictions of economic decline. When the outlook for the economy is subdued, any positive developments become a catalyst for the currency’s appreciation. London’s stance on trade wars has been relatively neutral, which has contributed to the stability of the British currency. In 2023, the share of steel exports to the US was a modest 5%, and aluminum exports accounted for 6%. Notably, these exports were subject to 25% tariffs imposed by Washington.

Nevertheless, the pound sterling is a pro-cyclical currency, and London saw the White House’s intention to reshape global trade as a potential threat. However, when the US President shifted his rhetoric to a more favorable position, substituting universal tariffs with reciprocal ones, the GBPUSD pair experienced a significant rally, driven by hopes for a swift resolution to the military conflict in Eastern Europe.

Weekly GBPUSD Trading Plan

The recent decline in the GBPUSD rate allowed traders to open long trades on a rebound from the support level of 1.2355. One can keep them open and initiate more long positions until the pair reaches the target levels of 1.26 and 1.272.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of GBPUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.