The lower the NZDUSD quotes fell, the more speculators opened long trades on the New Zealand dollar. However, sooner or later, they will realize where their stance will lead them. Let’s discuss this topic and make a trading plan.

Weekly New Zealand dollar fundamental forecast

Exaggerated expectations often turn into lost illusions. In June, the Reserve Bank of New Zealand’s hawkish rhetoric allowed traders to forecast that the local cash rate would remain unchanged longer than the rates of other central banks. Together with the slowdown in the US economy, this allowed NZDUSD quotes to soar to their highest level since mid-January. However, the future was not as rosy as it was portrayed.

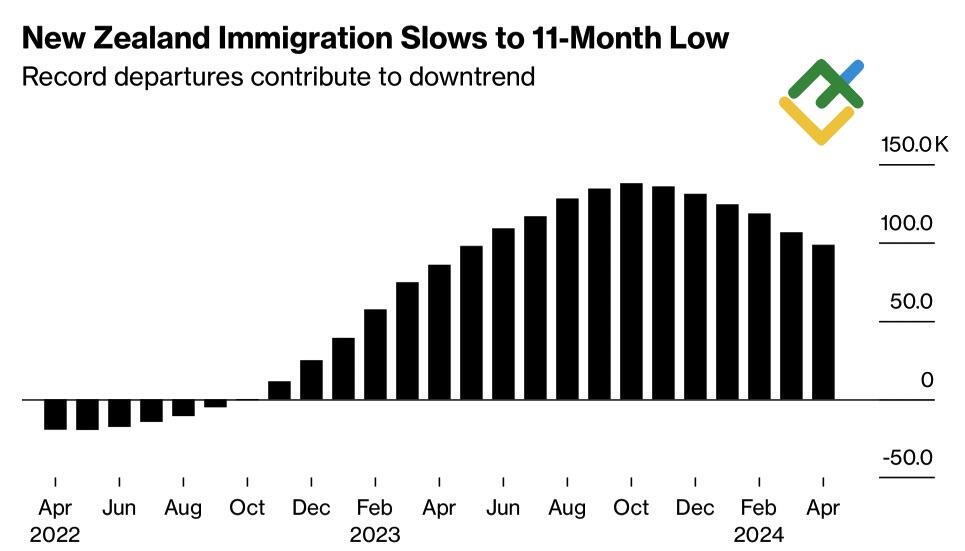

As a rule, a strong economy means a strong currency. This fundamental analysis principle has always been true. Despite recovering from recession in the first quarter, New Zealand’s economy remains weak. Westpac predicts that GDP will post a more than modest 0.1% growth in April-June on the back of net immigration falling to an 11-month low and tight fiscal policy.

New Zealand Immigration

Source: Bloomberg.

The New Zealand Treasury expects to return to a budget surplus in 2028, estimating that net debt will rise to 43.5% of GDP in 2025 and fall to 41.8% of GDP in 2028. The regulator is exploring options to increase revenues and cut spending, which will unlikely aid an economy teetering on the brink of recession.

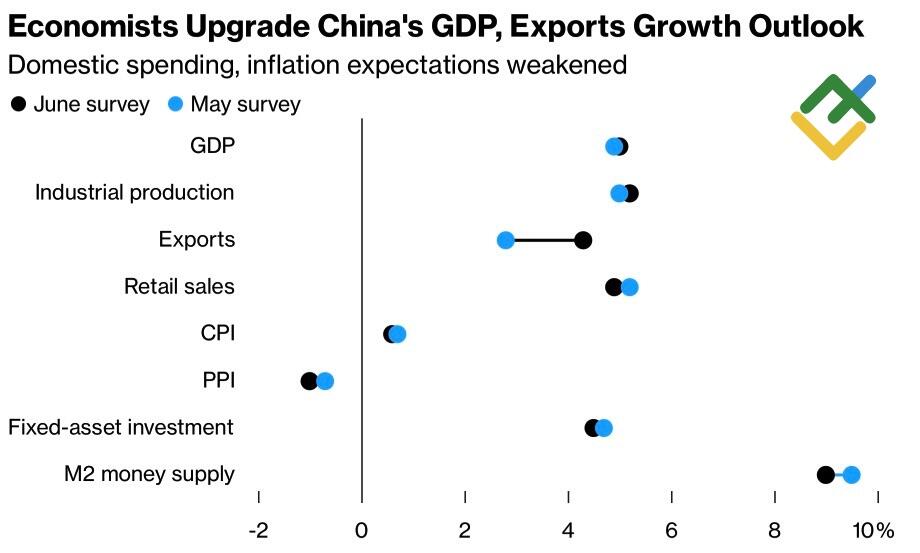

The more surprising is the steady interest of speculators in the New Zealand dollar. In the week to June 25, asset managers piled net long positions to the highest level since January 2021, while hedge funds – since December 2021. Most likely, they were guided by the Reserve Bank’s forecast that the cash rate would not decline until the third quarter of 2025, the ongoing rally of US stock indices, which indicates a high global appetite for risk, as well as an increase in estimates of the Chinese economy by Bloomberg experts.

China’s Economy Growth Outlook

Source: Bloomberg.

Nevertheless, the Fed’s stubborn reluctance to signal a federal funds rate cut in September, the yuan’s fall to an 8-month low against the US dollar, Donald Trump’s rising chances of winning the November election, and the weakness of the New Zealand economy have been a bucket of cold water for NZDUSD bulls.

According to Capital Economics, GDP growth in the first quarter is nothing but a dead cat bounce. A slowdown in New Zealand’s economy will force the RBNZ to cut rates much sooner than expected, as early as 2024. Divergences in economic growth and monetary policies of the Fed and the People’s Bank of China are putting pressure on the renminbi and its proxy currencies, including the kiwi.

If we add Donald Trump’s success in the debate with Joe Biden and the Supreme Court’s decision on some immunity for the 45th president of the US, the risks of renewed trade wars between Washington and Beijing are getting higher. Against this backdrop, markets see increased risks for the New Zealand dollar in the Forex market.

Weekly NZDUSD trading plan

Therefore, speculators are trapped. Only disappointing statistics on the US labor market for June can save them. In this case, the NZDUSD pair may consolidate in the range of 0.605–0.615. Otherwise, the pair risks slipping to 0.595.

Price chart of NZDUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.