Bitcoin Cash, a prominent player in the cryptocurrency market, originated in mid-2017 as a hard fork from Bitcoin to address transaction speed and scalability issues. While some analysts are cautiously optimistic about Bitcoin Cash’s future performance, others point to the uncertain regulatory and economic landscape as factors that could significantly impact its trajectory.

As we delve deeper into the world of Bitcoin Cash and its prospects, it’s crucial to remember the speculative nature of this asset. Are Bitcoin Cash prices expected to go up or down? The answer remains to be determined, with predictions varying based on numerous factors. This article will delve into BCH’s dynamic and unpredictable nature.

The article covers the following subjects:

Highlights and Key Points: (BCH) Bitcoin cash Price Prediction 2024-2030

- Price Today: Current BCH price is $385.30.

- Year-end Price 2024: Expected to range between $434 and $635, reflecting an uncertainty.

- Price for Next Year 2025: Anticipated to be between $494 and $871, indicating the bullish trajectory.

- Long-Term Price 2027-2030: Projected range from $770 to $3770, indicating significant volatility and potential growth.

- Market Trends: Predictions are based on technical analysis, transaction speed, scalability, and global crypto adoption. Analyst insights suggest a cautiously optimistic outlook.

BCH Price Today Coming Days and Week

When forecasting the Bitcoin Cash (BCH) price in the near term, several key factors should be considered. Monitor overall market sentiment and investor behavior in the cryptocurrency space, as these heavily influence BCH movements. Stay updated on regulatory news, as changes can significantly impact market dynamics. Pay attention to Bitcoin Cash’s trading volumes and liquidity, providing insights into market strength and potential volatility. Watch for technological advancements and updates within the BCH network, as improvements can drive adoption and value. Additionally, consider macroeconomic indicators like inflation and economic growth, which affect investor interest in cryptocurrencies as alternative assets.

Analysts’ BCH Price Projections for 2024

Let’s take a look at BCHUSD’s expert forecasts for 2024.

Changelly

Price Range in 2024: $365.13 – $478.54 (as of July 2, 2024)

Based on historical data, Changelly predicts that BCH will see a low of around $365.13 and a high of $478.54 in 2024. The rest of 2024 will be turbulent for Bitcoin Cash (BCH). By September price will climb to its maximums only to immediately drop to near-lowest level on December.

| Month | Minimum, $ | Average, $ | Maximum, $ |

|---|---|---|---|

| July | 365.13 | 393.57 | 422.01 |

| August | 378.57 | 413.30 | 448.02 |

| September | 423.95 | 451.25 | 478.54 |

| October | 413.96 | 442.14 | 470.32 |

| November | 373.14 | 401.28 | 429.42 |

| December | 368.62 | 376.88 | 385.13 |

PricePrediction

Price Range in 2024: $370.56 – $515.91 (as of July 2, 2024)

On the contrary, PricePrediction forecasts that during the remaining months of 2024 Bitcoin Cash (BCH) will be steadily climbing to $465.58. December will also see the growth in both minimum and maximum price levels, indicating the strong bullish movement.

| Month | Minimum, $ | Average, $ | Maximum, $ |

|---|---|---|---|

| July | 370.56 | 409.57 | 421.27 |

| August | 402.15 | 417.76 | 437.65 |

| September | 410.51 | 426.11 | 458.54 |

| October | 427.55 | 443.16 | 475.58 |

| November | 436.42 | 452.02 | 493.31 |

| December | 446.08 | 465.58 | 515.91 |

LongForecast

Price range in 2024: $174 – $434 (as of July 2, 2024)

As LongForecast states, one should not expect much from BCH prices’ 2024 performance. It is expected that the fork of Bitcoin will be on the decline for the rest of 2024, dropping from $316 to $217.

| Month | Opening, $ | Min-Max, $ | Closing, $ |

|---|---|---|---|

| July | 380 | 294-434 | 316 |

| August | 316 | 246-337 | 265 |

| September | 265 | 207-265 | 223 |

| October | 223 | 207-239 | 223 |

| November | 223 | 174-223 | 187 |

| December | 187 | 187-232 | 217 |

BCHUSD Technical Analysis

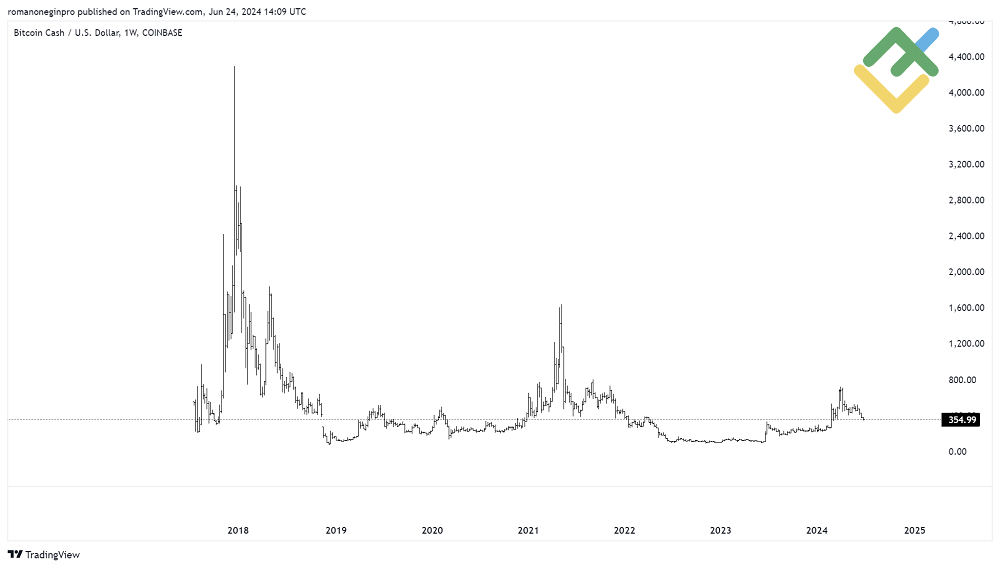

The history of Bitcoin Cash quotes can be seen on the weekly timeframe.

Since its appearance in the market, Bitcoin Cash has grown significantly, peaking at the end of 2017 and declining rapidly after that. At some point, the quotes plunged below the initial price. Since the beginning of 2018, the pair has been moving within a major correction.

The chart shows two global trends. The forming correction presumably consists of five main parts. Let’s use the daily and 4-hour time frames to conduct the forecast.

In addition, we will apply the following technical tools to analyze the BCHUSD price:

- The Elliott Wave Theory allows us to identify chart patterns and predict future price movement.

- Trend lines show the prevailing price direction.

- Fibonacci levels enable us to identify potential pivot points.

- Candlestick patterns are used to evaluate market behavior and psychology, as well as to identify potential price targets.

Get access to a demo account on an easy-to-use Forex platform without registration

BCHUSD Analysis For Next Three Months

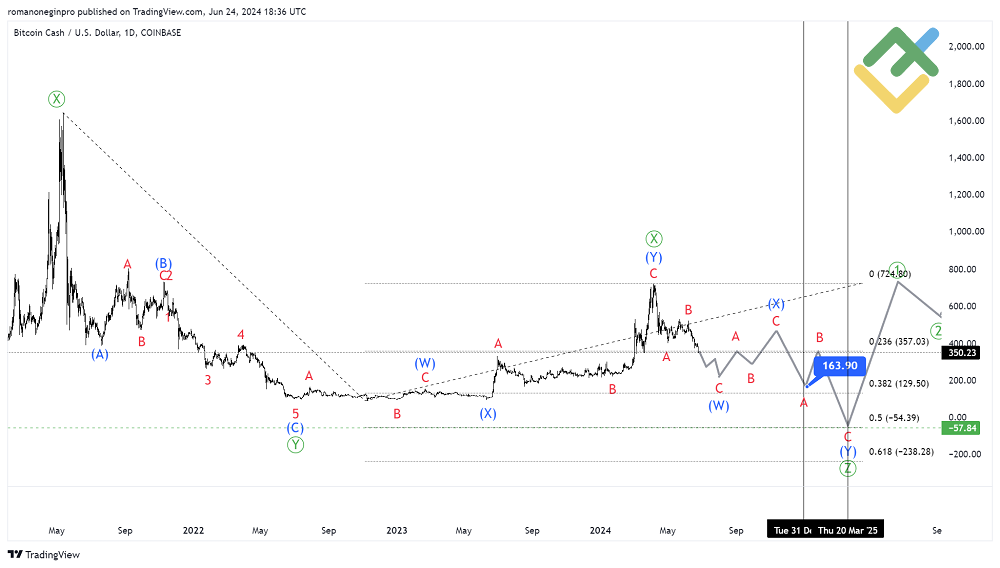

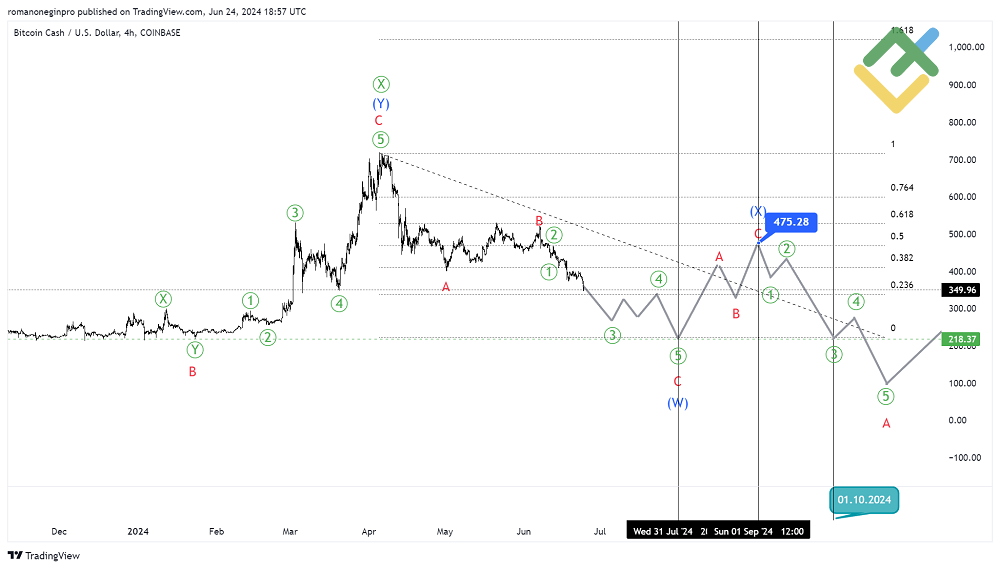

Let’s use the daily time frame to make a forecast for the next three months. The BCHUSD pair is likely to form a major correction as a triple zigzag [W]-[X]-[Y]-[X]-[Z]. The motive wave [Z] will form until the spring of 2025.

Most likely, the wave [Z] will take the shape of a double zigzag (W)-(X)-(Y). By the end of July, the first motive wave (W) is expected to be built, ending near the low of $218.37. After the price reaches this level, a bullish linking wave (X) will start to unfold. In August, BCH may rise to $475.28. At this level, the wave (X) will retrace 50% of wave (W).

In September, the BCHUSD price may start to decline within the impulse wave A. However, the cryptocurrency may reach $218.37 again by the end of the month.

Long-Term BCHUSD Technical Analysis for 2024

The daily time frame is suitable for long-term technical analysis of Bitcoin Cash. Trend lines show an approximate trajectory of possible price movement.

The final part of impulse wave A, sub-waves [4]-[5], is expected to be completed in October. The price may fall to $91.82, the June 2023 low. The linking wave (X) was completed at this mark.

According to the Fibonacci levels, the price may start rising in November within correction B towards $189.36. At this mark, wave B will retrace 23.6% of the impulse wave A.

As we move into December, the potential for a bearish wave C becomes more pronounced. This wave, which could be either an impulse or a final diagonal wave, may see bears pushing the price to the level of $5.69. At this mark, the values of the motive waves (W) and (Y) will be equal to each other according to the Fibonacci levels.

| Month | BCHUSD projected values | |

|---|---|---|

| Minimum | Maximum | |

| July | $218.37 | $341.66 |

| August | $218.37 | $475.28 |

| September | $218.37 | $475.28 |

| October | $91.82 | $275.0 |

| November | $91.82 | $189.36 |

| December | $5.69 | $189.36 |

Long-Term Trading Plan for BCHUSD

We can discuss a trading plan now as the medium-term and long-term forecasts have been made.

- At the current levels, there is a promising opportunity to initiate short trades with a target of $218.37, a movement in the impulse wave C of (W).

- At the beginning of August, you can consider buying BCH at $218.37 with a target of $475.28, the formation of a linking wave (X).

- Short trades can be opened at $475.28 with the target at $218.37 at the beginning of September when the pair will move within sub-waves [1]-[2]-[3].

- In October, sales can be continued; the target is $91.82 within sub-waves [4]-[5].

- At the beginning of November, consider buying the cryptocurrency at $91.82 with the target of $189.36 in correction B.

- From December until the end of the year, short positions can be considered at $189.36 with the target of $5.69. The pair will form the bearish wave C.

Analysts’ BCH Price Projections for 2025

Let’s take a look at BCHUSD’s expert forecasts for 2025.

Changelly

Price range in 2025: $389.13 – $787.10 (as of July 2, 2024)

Changelly‘s analysts forecast a steady ascent for Bitcoin Cash in 2025, with a minimum average price of $495.03. The expected average trading price is $676.44 at the end of 2025, in the most optimistic scenario the token will nearly reach the $800 level by the time.

| Month | Minimum, $ | Average, $ | Maximum, $ |

|---|---|---|---|

| January | 389.13 | 495.03 | 452.28 |

| February | 413.14 | 511.52 | 482.72 |

| March | 437.14 | 528.02 | 513.16 |

| April | 461.14 | 544.51 | 543.59 |

| May | 485.14 | 561 | 574.03 |

| June | 509.15 | 577.49 | 604.47 |

| July | 533.15 | 593.98 | 634.91 |

| August | 557.15 | 610.47 | 665.35 |

| September | 581.15 | 626.97 | 695.79 |

| October | 605.16 | 643.46 | 726.22 |

| November | 629.16 | 659.95 | 756.66 |

| December | 653.16 | 676.44 | 787.10 |

PricePrediction

Price range in 2025: $442.30 – $787.18 (as of July 2, 2024)

PricePrediction analysts agree on Bitcoin Cash bullish performance in 2025. It is forecasted that the average price will rise from $488.86 to $676.51 through the year.

| Month | Minimum, $ | Average, $ | Maximum, $ |

|---|---|---|---|

| January | 442.30 | 488.86 | 502.83 |

| February | 480.01 | 498.64 | 527.27 |

| March | 495.30 | 518.58 | 547.22 |

| April | 505.68 | 528.95 | 573.14 |

| May | 521.54 | 544.82 | 594.30 |

| June | 547.99 | 566.62 | 621.54 |

| July | 566.00 | 589.28 | 644.21 |

| August | 583.68 | 606.96 | 673.67 |

| September | 606.54 | 625.17 | 704.02 |

| October | 619.05 | 637.67 | 729.03 |

| November | 633.52 | 656.80 | 760.91 |

| December | 653.23 | 676.51 | 787.18 |

LongForecast

Price range in 2025: $217 – $494 (as of July 2, 2024)

LongForecast presents maybe the most pessimistic forecast of BCH 2025 performance, stating that token will reach its highest at $462 in November and then slide down to $432.

| Month | Opening, $ | Min-Max, $ | Closing, $ |

|---|---|---|---|

| January | 217 | 217-270 | 252 |

| February | 252 | 240-276 | 258 |

| March | 258 | 258-320 | 299 |

| April | 299 | 285-327 | 306 |

| May | 306 | 298-342 | 320 |

| June | 320 | 320-386 | 361 |

| July | 361 | 349-401 | 375 |

| August | 375 | 363-417 | 390 |

| September | 390 | 390-484 | 452 |

| October | 452 | 424-488 | 456 |

| November | 456 | 430-494 | 462 |

| December | 462 | 402-462 | 432 |

CoinPriceForecast

Price range in 2025: $670 – $871 (as of July 2, 2024)

Analysts at CoinPriceForecast are the most optimistic in their expectations. By their prediction, BCH will reach $670 by July and exceed $800 by winter.

| Year | Mid-Year, $ | Year-End, $ |

|---|---|---|

| 2025 | 670 | 871 |

Analysts’ BCH Price Projections for 2026

Let’s take a look at BCHUSD’s expert forecasts for 2026.

Changelly

Price range in 2026: $682.48 – $1,143 (as of July 2, 2024)

Analysts at Changelly anticipate Bitcoin Cash to continue its positive trajectory in 2026, with prices ranging between $682 and $1143. According to their expectations, BCH will be establishing itself above $1,000 levels and shows no signs of stopping — the token’s year is projected to finish on $1,005 in the most pessimistic scenario while the most optimistic shows growth to $1,143.

| Month | Minimum, $ | Average, $ | Maximum, $ |

|---|---|---|---|

| January | 682.48 | 706.07 | 816.76 |

| February | 711.80 | 735.70 | 846.42 |

| March | 741.12 | 765.33 | 876.08 |

| April | 770.44 | 794.96 | 905.73 |

| May | 799.76 | 824.59 | 935.39 |

| June | 829.08 | 854.22 | 965.05 |

| July | 858.40 | 883.85 | 994.71 |

| August | 887.72 | 913.48 | 1,024.37 |

| September | 917.04 | 943.11 | 1,054.03 |

| October | 946.36 | 972.74 | 1,083.68 |

| November | 975.68 | 1,002.37 | 1,113.34 |

| December | 1,005 | 1,032 | 1,143 |

PricePrediction

Price range in 2026: $642.68 – $1,143.42 (as of July 2, 2024)

PricePrediction forecasts yet another fruitful year for Bitcoin Cash. As reported, the token is set to reach an average price of $1,031.83 in December, with a min-max range of $1,004.77 – $1,143.42.

| Month | Minimum, $ | Average, $ | Maximum, $ |

|---|---|---|---|

| January | 642.68 | 710.33 | 730.63 |

| February | 704.58 | 731.64 | 759.04 |

| March | 726.53 | 753.59 | 788.30 |

| April | 756.67 | 783.73 | 825.98 |

| May | 772.35 | 799.41 | 865.17 |

| June | 804.32 | 831.38 | 897.15 |

| July | 837.58 | 864.64 | 930.40 |

| August | 863.52 | 890.58 | 973.63 |

| September | 899.14 | 926.20 | 1,009.26 |

| October | 929.42 | 963.25 | 1,055.57 |

| November | 965.09 | 992.15 | 1,103.73 |

| December | 1,004.77 | 1,031.83 | 1,143.42 |

LongForecast

Price range in 2026: $239 – $530 (as of July 2, 2024)

Looks like BCH enters its bearish phase in 2026, as LongForecast experts state. It is projected that the fork of Bitcoin will lose its positions and drop to $271 level by the year-end. This outlook does not seem promising for BCH investors.

| Month | Opening price | Min-Max price | Closing price |

|---|---|---|---|

| January | 432 | 397-457 | 427 |

| February | 427 | 427-530 | 495 |

| March | 495 | 392-495 | 421 |

| April | 421 | 385-443 | 414 |

| May | 414 | 369-425 | 397 |

| June | 397 | 385-443 | 414 |

| July | 414 | 324-414 | 348 |

| August | 348 | 348-432 | 404 |

| September | 404 | 315-404 | 339 |

| October | 339 | 265-339 | 285 |

| November | 285 | 222-285 | 239 |

| December | 239 | 239-290 | 271 |

CoinPriceForecast

Price range in 2026: $871 – $922 (as of July 2, 2024)

Experts at CoinPriceForecast change their forecast to side movement for 2026. BCH will enter 2026 on $871 and reach $922 across the next six months. But then a new decline is expected with the asset reaching its initial $871 level in December. This outlook indicated that the investors are not so confident in the asset’s future performance.

| Year | Mid-Year, $ | Year-End, $ |

|---|---|---|

| 2026 | 922 | 871 |

Long-Term BCH Price Prediction for 2027-2030

Analysts from two of three agencies agree on constant yearly growth of Bitcoin cash during 2027-2030, though their evaluations slightly differ. The most optimistic forecast is presented by PricePrediction as they expect BCH prices to reach the $3770 level by the end of the current decade. Changelly sees a bit more modest scenario, with prices steadily climbing towards the $3100 mark, crossing it in 2030. The most pessimistic outlook is presented by CoinPriceForecast — the experts do not expect the token to climb, projecting a bearish trajectory instead — the prices will slide down to $770 by 2030.

| Agency | 2027 | 2028 | 2029 | 2030 |

|---|---|---|---|---|

| Changelly | 1334 | 1919 | 2839,5 | 3101,25 |

| PricePrediction | 1276,67 | 1827,68 | 2644,7225 | 3770,965 |

| CoinPriceForecast | 875 | 815,5 | 828,5 | 770 |

Recent Price History of (BCH) Bitcoin Сash

Bitcoin Cash (BCH) was created in 2017 and, in the beginning, was traded at $412, reflecting initial optimism. The market responded positively, propelling BCH to an all-time high (ATH) of $4,355.62 by December 2017. However, the 2018 bear market drastically affected its value, sending it to a low of $75.08. Recovery has been modest and fluctuating; between 2019 and 2021, BCH traded between $200 and $500, peaking at around $1,500.

Which Factors Impact BCH Price?

Several factors affect BCHUSD rate. Those are:

- Supply and Demand Dynamics: The core driver of Bitcoin Cash’s price is the balance between its market supply and demand.

- Protocol Updates or Hard Forks: Significant changes or splits in the Bitcoin Cash blockchain, known as hard forks, can lead to price volatility.

- Institutional Adoption: As more financial institutions start accepting or investing in BCH, its legitimacy and price can increase.

- Regulatory Environment: Political regulations and legal considerations around cryptocurrency can significantly impact BCH.

- Global Economic Factors: Broader economic events, such as inflation rates, currency devaluation, and international crises, can influence investor behavior towards cryptocurrencies like BCH, impacting its price.

Conclusion: Is It Worth Investing in BCH?

The forecasts differ from year to year. The price of BCH projected to reach over $1,000 in 2026 as projected by some analytics. Further bullish predictions estimate the coin could hit highs between $3101,25 and $3770,965 by 2030. Factors like scalability improvements, increasing adoption, and institutional interest point towards positive growth.

However, Bitcoin Cash remains a volatile cryptocurrency. Some analysts see a beginning of a strong bearish movement in 2026 with prices dropping to around $800. The unpredictable regulatory landscape could significantly impact its value. Long-term growth prospects make it a good addition to an investment portfolio aiming for diversification.

FAQs on BCH Price Prediction

The current price that Bitcoin Cash is trading at is around $385.30 per BCH token as of today 02.07.2024.

Analysts predict predominantly bullish movement in BCH prices in 2025. Maximum price ranges between $494 and $871.

No analysts see BCH breaching the $5,000 level anytime soon, though some of those evaluations were made earlier. One should remember the volatile nature of cryptocurrencies and be cautious while making any decisions.

Though some analysts may disagree on that, generally it’s predicted that Bitcoin Cash will be gaining weight in the next 5 or 6 years, potentially reaching $3100 or $3770 in 2030.

Though analysts see potential to grow in Bitcoin Cash future market performance, it is unlikely that it will surpass Bitcoin somewhere in the near future.

Bitcoin Cash price forecasts consider factors like supply and demand dynamics, potential protocol updates, institutional adoption trends, regulations, and broader economic conditions.

With agencies forecasting steady growth of Bitcoin Cash prices over 2024-2030, one can say that BCH can be considered a good investment. However, some analysts predict that the token will drop significantly. It should be kept in mind that cryptocurrencies are subjects of high volatility and should be approached with caution.

Potential Bitcoin Cash hard forks can directly impact price volatility and lead analysts to adjust their forecasts accordingly.

Positive or negative investor sentiment and expectations around Bitcoin Cash significantly influence most price forecast models.

Price chart of BTCUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.