A look at the day ahead in U.S. and global markets from Mike Dolan

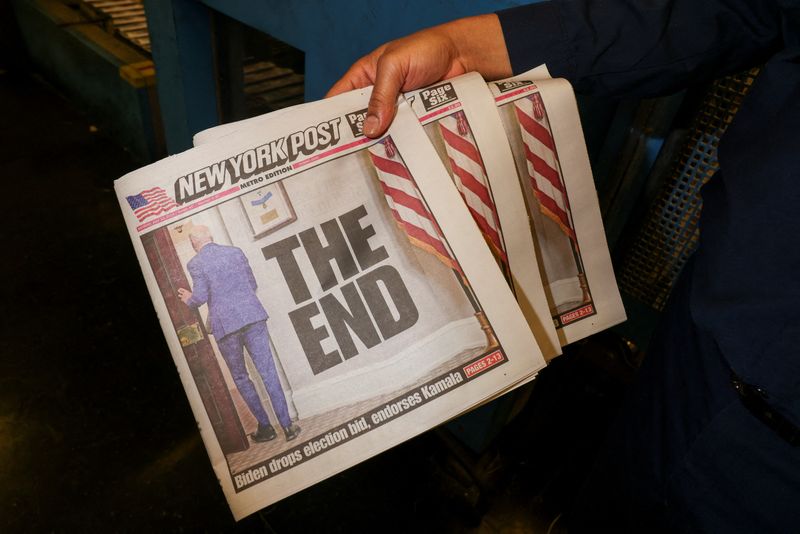

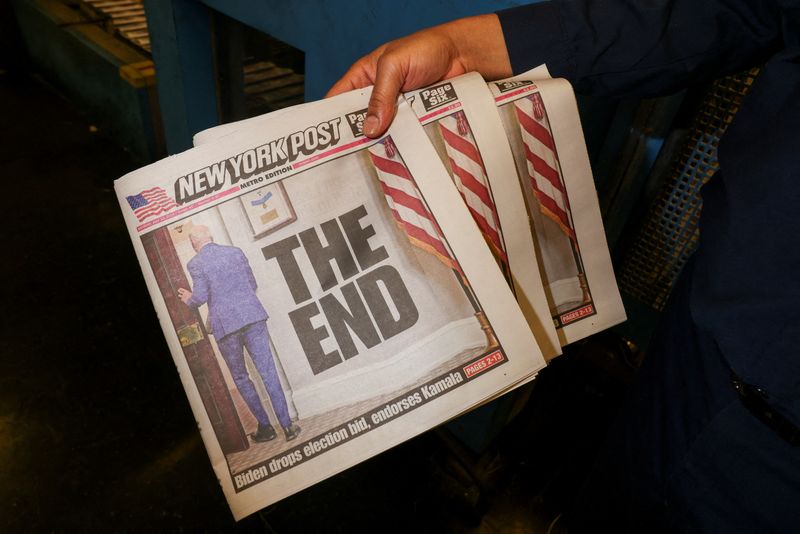

U.S. President Joe Biden’s weekend withdrawal from the White House race can hardly be seen as a big surprise, but it adds some doubts to market bets that Republican challenger Donald Trump is a shoo-in in November’s election.

After a turbulent few days for Wall Street stocks that saw their biggest weekly loss since April, and as big tech megacaps hiccupped into the start of the second-quarter reporting season, volatility had already resurfaced to some degree.

Tightening odds on the next president may just keep that on the boil as some of so-called “Trump trades” were pared back marginally on Monday – long-term Treasury yields and the dollar ebbed a bit, Mexico’s peso firmed, stock futures were a touch higher and the VIX volatility gauge held at last week’s 3-month high.

An unexpected interest rate cut from the People’s Bank of China on Monday added the main international backdrop as the new week got underway and pushed the yuan to its weakest in more than two weeks.

And a nervy tech sector, its head spinning after last week’s sudden investor rotation to small caps and the global computing outage on Friday, now sizes up the next wave of earnings updates – with Google-parent Alphabet (NASDAQ:GOOGL) and Tesla (NASDAQ:TSLA) due to report on Tuesday.

But Biden’s exit and the focus on who replaces him as Democrat nominee will dominate the week’s talking points at least. His endorsement of Vice President Kamala Harris puts her in pole position ahead of next month’s Democratic party convention and that’s where betting markets will lean.

To the extent that betting markets set the tone for investors minded to trade on the outcome this far ahead of the election, there’s been some distortion in recent weeks. What will ultimately be a binary choice was split several ways due to Biden’s difficulties and skewed the odds somewhat.

Now his exit puts Harris firmly in the frame, the picture is becoming more balanced. Even though Trump remains clear favorite, his 70%-plus probability this time last week following the failed attempt on his life has been pared back to 60% – even if much of that had happened by Friday.

PredictIt betting site puts Harris on about 40% – even though she has not yet got the formal nomination and hasn’t campaigned for the role yet. If she does get the nod, there will also be much attention on her choice of running mate.

One possible market twist is that futures markets’ near certainty that the Federal Reserve will deliver its first interest rate cut in September just before the election may wobble a bit if it’s a tighter election race than assumed over the past couple of weeks.

Even though the Fed insists it pays no heed to the electoral calendar or political process in deciding monetary policy, some felt the optics of a pre-election rate cut were less awkward in the light of Trump’s seemingly unassailable odds of winning. That calculation might just change at the margin now.

Otherwise, markets have another busy calendar ahead this week.

Aside from the big earnings releases, the release of the Fed-favored PCE inflation gauge for June on Friday will be a focus. Also, flash business surveys for July are due from around the world and there’s another heavy schedule of Treasury sales.

In Europe, bank earnings are a feature of the week. Wednesday sees Germany’s Deutsche Bank, Britain’s Lloyds (LON:LLOY), BNP Paribas (OTC:BNPQY) in France, Spain’s Santander (BME:SAN) and Italy’s UniCredit all report.

Back on Wall Street, Nvidia (NASDAQ:NVDA) rose 1.3% after Reuters reported the AI chip leader is working on a version of its new flagship AI chips for the China market that would be compatible with current U.S. export controls.

Key developments that should provide more direction to U.S. markets later on Monday:

* Chicago Federal Reserve’s June economic activity index

* US corporate earnings: Verizon (NYSE:VZ), Truist Financial (NYSE:TFC), WR Berkley (NYSE:WRB), Nucor (NYSE:NUE), NXP Semiconductors (NASDAQ:NXPI), IQVIA, Cadence Design (NASDAQ:CDNS), Alexandria Real Estate

* G20 Finance Ministers and Central Bank Governors meet in Rio de Janeiro ahead of G20 Brazil Summit (To July 23)

* New York Federal Reserve President John Williams and Atlanta Fed President Raphael Bostic speak

* US Treasury auctions 3-, 6-month bills

This post is originally published on INVESTING.