The US Federal Reserve is adopting a cautious stance, anticipating that the 2% inflation target will be reached later than previously expected. Investors were already aware of this information, which makes the upturn in the EURUSD pair a coherent development. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The Fed failed to surprise the markets.

- ADP private sector employment data disappointed.

- Christopher Waller sees further rate cuts.

- Shorts trades formed on the EURUSD pair at 1.0375 should be kept open.

Weekly US Dollar Fundamental Forecast

The December reduction in the federal funds rate by 25 basis points to 4.5% was perceived by the markets as a “hawkish cut.” The updated FOMC forecasts have triggered a decline in stock indices, pushing US Treasury yields higher and reinforcing the US dollar. Investors had anticipated hawkish rhetoric from the minutes of the FOMC meeting. However, the absence of hawkish rhetoric in the minutes, coupled with Christopher Waller’s comments and disappointing ADP statistics, prompted EURUSD bears to retreat.

The Fed’s statement did not contain any information that could have further alarmed financial markets. Officials acknowledged that inflation was likely to continue falling to the 2% target, but the process may require more time due to potential changes in trade and immigration policies. Inflation rates have become less of a hindrance to the economy, necessitating a cautious approach to any adjustments.

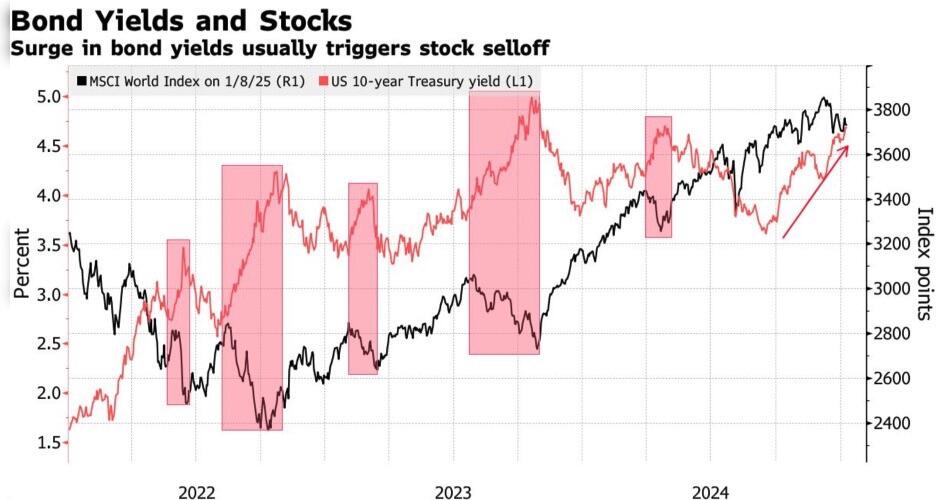

Consequently, the US regulator has not been assured that an uptick in inflation in the latter months of the year signals impending price pressures, nor that the policies of Donald Trump will not spur the CPI and PCE growth rates. The central bank has decided to halt the process of monetary expansion, and the derivatives market is indicating that the next rate reduction will not be implemented until May. As a result, US Treasuries are rising, exerting pressure on the equity market and contributing to the decline in the EURUSD pair.

Global Stocks and US 10-year Treasury yield

Source: Bloomberg.

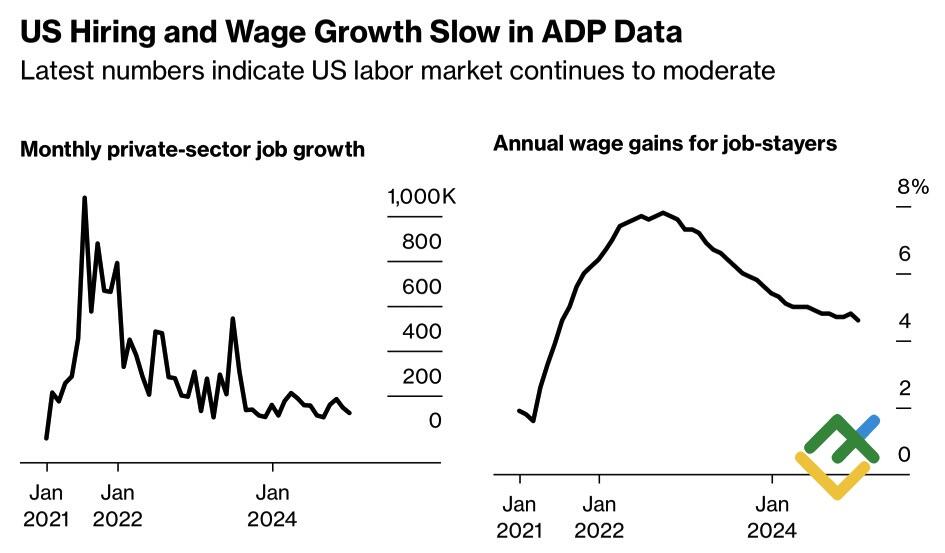

At the same time, it is premature to talk about the end of the Fed’s monetary policy easing cycle, according to FOMC member Christopher Waller. He believes that inflation will continue to move towards the 2% target. For this reason, further reduction in the cost of borrowing looks appropriate. This perspective, coupled with the private sector’s employment growth of 122,000 in December, as reported by ADP, could potentially temper EURUSD bears.

US Private-Sector Job Growth

Source: Bloomberg.

According to the futures market expectations, there is a 95% likelihood that the Fed will maintain the federal funds rate at 4.5% in January, 59% in March, and 45% in May. These figures have decreased since the release of data from the ADP, the minutes from the December FOMC meeting, and Christopher Waller’s remarks. However, these estimates are currently influencing the US dollar’s performance. Notably, the futures market projections are expected to undergo significant changes following the release of the US employment data for December.

Weekly EURUSD Trading Plan

According to Bloomberg experts, employment is expected to grow by 162,000, and unemployment may remain at 4.2%. Stronger statistics will likely push the EURUSD pair lower, while weaker data may lead to an upward shift. At the same time, correction appears unlikely in the context of the European Central Bank’s commitment to reach a neutral rate of 2% as early as possible, as highlighted by the Governor of the Bank of France, François Villeroy de Galhau. In light of these developments, it is advisable to adopt a cautious approach and keep your short positions formed at 1.0375 open, awaiting the release of the US labor market report.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.