Global

fintech investment plummeted to $95.6 billion across 4,639 deals in 2024,

marking its lowest level since 2017, as investors grappled with persistent

macroeconomic challenges and geopolitical tensions, according to KPMG’s latest

Pulse of Fintech report.

Global Fintech Investment

Hits Seven-Year Low as Market Uncertainty Prevails

The

investment landscape showed a clear downward trajectory throughout the year,

with total funding declining from $51.7 billion in the first half to $43.9

billion in the second half. However, a notable uptick in the final quarter,

where investment rose to $25.9 billion from $18 billion in Q3, suggests early

signs of market stabilization.

“It’s

been a rough year for nearly everyone in the ecosystem,” said Karim Haji,

Global Head of Financial Services at KPMG International. “With only a

handful of exceptions, no one wanted to pull the trigger on the largest deals —

which have long been a mainstay in fintech investment.”

The results

confirm

an earlier 2023 KPMG report, which indicated that investments had dropped

to $113.7 billion, already considered the worst figure since 2017. However,

2024 has unfortunately managed to surpass that record.

Regional Dynamics and

Sector Performance

The

Americas continued to dominate the global fintech landscape, capturing $63.8

billion across 2,267 deals, with the United States accounting for $50.7 billion

of that total. The EMEA region secured $20.3 billion across 1,465 deals, while

APAC recorded $11.4 billion across 896 transactions.

In Europe,

the UK continues to dominate. As

Roberto Napolitano, Chief Marketing Officer at Innovate Finance, stated,

“The UK received more fintech funding than all of Europe combined.”

He shared his insights on the future of the fintech industry during FMLS:24 in

a conversation with Finance Magnates’ Jonathan Fine.

“The UK is

still leading in terms of capital investment in fintech after the US,”

Napolitano added. “Although it’s still very positive now, looking into 2025,

maybe this picture will change slightly. But we don’t know yet.”

This is

also confirmed by data

from a Dealroom and HSBC report published nearly a year ago, which showed

that fintech was the most funded sector in the UK. Notably, Monzo secured £340

million, while Flagstone raised £108 million.

KPMG report

shows that the payments sector emerged as the most resilient segment,

attracting $31 billion in investment, followed by digital assets and currencies

at $9.1 billion and regtech at $7.4 billion. This distribution reflects ongoing

investor confidence in established payment technologies while showing increased

interest in emerging sectors.

Emerging Trends and Future

Outlook

Looking

ahead to 2025, several key trends are shaping the fintech investment landscape:

- Artificial Intelligence Integration: The sector is witnessing growing

interest in AI-enabled solutions, particularly in regtech and cybersecurity

applications. - Digital Assets Evolution: Market infrastructure, digital

tokenization, and stablecoins are positioned for potential investment growth. - Payment Innovation: The payments sector is expected to maintain

its leadership position, driven by B2B solutions and cross-border payment

technologies.

“If

what we’ve seen in the broader investment space is any indication, AI could be

a sleeping giant for fintech investment,” noted Anton Ruddenklau, Lead of

Global Innovation and Fintech at KPMG International. “However, right now,

it’s still very early days.”

“There’s definitely a

lot of interest in AI, generative AI, agentic AI and automation, but there’s a

lot of caution too. Over the next year, AI-focused regtechs will likely see the

most traction among investors as financial services companies look for better

ways to respond to the increasingly complex regulatory environment,” he

added.

Market Recovery Signals

Despite the

overall decline, several positive indicators suggest a potential recovery in

2025. The increase in Q4 investment activity, combined with declining interest

rates in various jurisdictions and the resolution of key political

uncertainties, points to improving market conditions.

M&A

activity showed particular resilience in the final quarter, with deal values

nearly doubling from $7.4 billion to $14.2 billion quarter-over-quarter.

Venture capital investment also demonstrated strength, rising from $9.7 billion

to $11.2 billion in the same period.

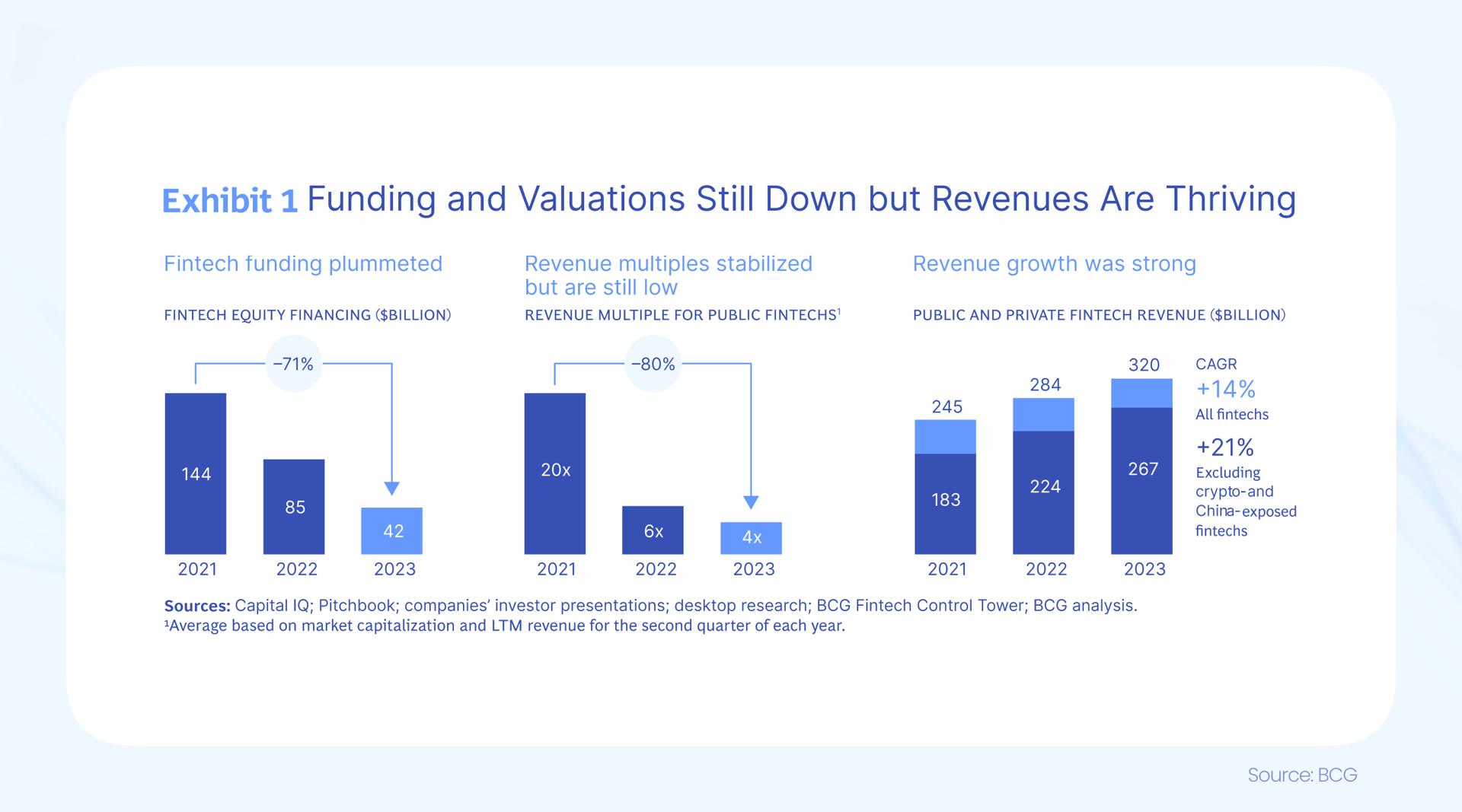

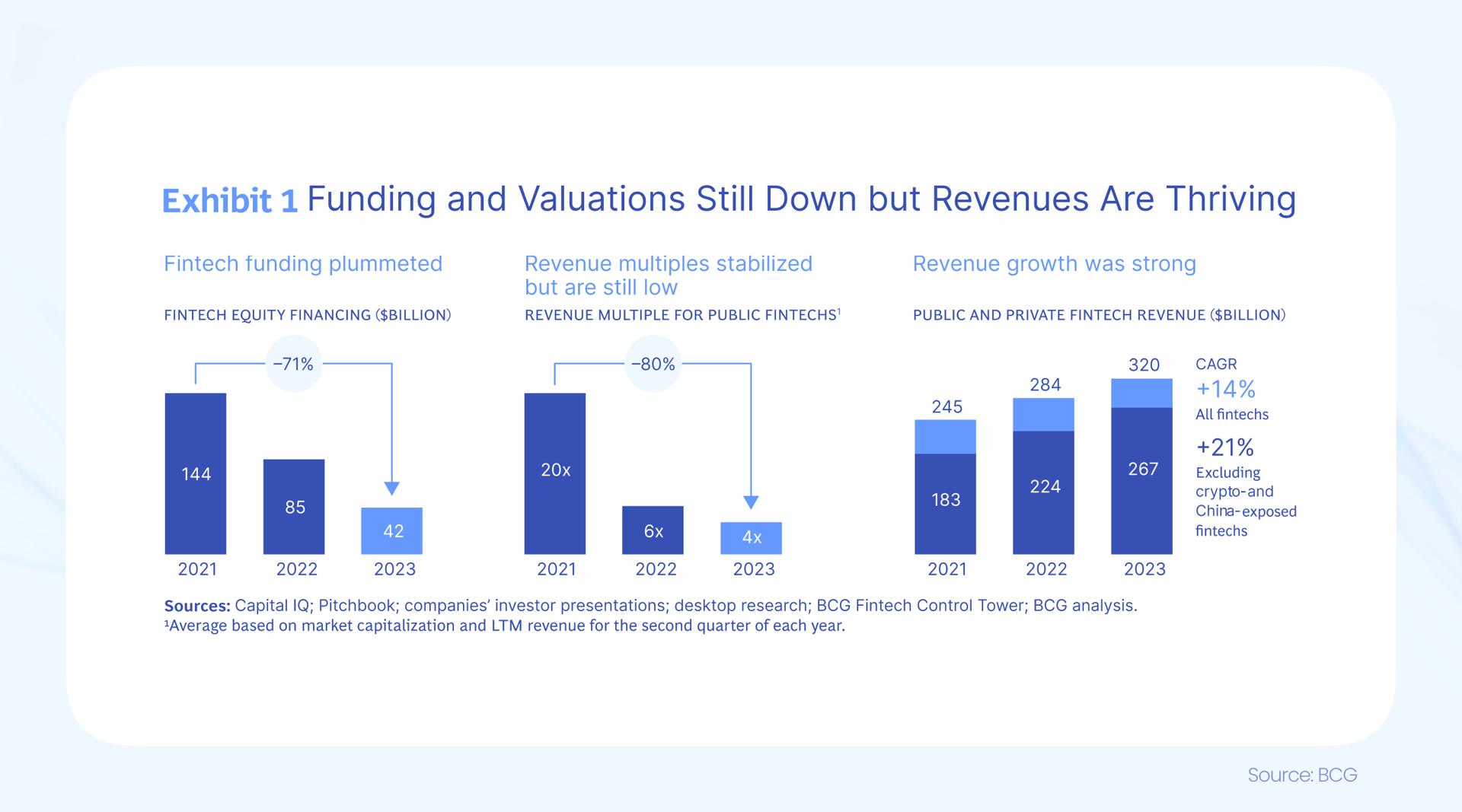

Moreover, a separate BCG

report revealed that despite a 70% financing shortfall, fintech companies managed

to increase their income by 14% between 2021 and 2023. If cryptocurrency

projects were excluded from the equation, the compound annual growth rate

(CAGR) would be 21%.

As the

market enters 2025, investors appear cautiously optimistic, with many watching

for signals from the new U.S. administration and monitoring the impact of

interest rate decisions on investment activity. The evolution of AI

applications in financial services and the continued development of digital

asset infrastructure are expected to be key drivers of growth in the coming

year.

Global

fintech investment plummeted to $95.6 billion across 4,639 deals in 2024,

marking its lowest level since 2017, as investors grappled with persistent

macroeconomic challenges and geopolitical tensions, according to KPMG’s latest

Pulse of Fintech report.

Global Fintech Investment

Hits Seven-Year Low as Market Uncertainty Prevails

The

investment landscape showed a clear downward trajectory throughout the year,

with total funding declining from $51.7 billion in the first half to $43.9

billion in the second half. However, a notable uptick in the final quarter,

where investment rose to $25.9 billion from $18 billion in Q3, suggests early

signs of market stabilization.

“It’s

been a rough year for nearly everyone in the ecosystem,” said Karim Haji,

Global Head of Financial Services at KPMG International. “With only a

handful of exceptions, no one wanted to pull the trigger on the largest deals —

which have long been a mainstay in fintech investment.”

The results

confirm

an earlier 2023 KPMG report, which indicated that investments had dropped

to $113.7 billion, already considered the worst figure since 2017. However,

2024 has unfortunately managed to surpass that record.

Regional Dynamics and

Sector Performance

The

Americas continued to dominate the global fintech landscape, capturing $63.8

billion across 2,267 deals, with the United States accounting for $50.7 billion

of that total. The EMEA region secured $20.3 billion across 1,465 deals, while

APAC recorded $11.4 billion across 896 transactions.

In Europe,

the UK continues to dominate. As

Roberto Napolitano, Chief Marketing Officer at Innovate Finance, stated,

“The UK received more fintech funding than all of Europe combined.”

He shared his insights on the future of the fintech industry during FMLS:24 in

a conversation with Finance Magnates’ Jonathan Fine.

“The UK is

still leading in terms of capital investment in fintech after the US,”

Napolitano added. “Although it’s still very positive now, looking into 2025,

maybe this picture will change slightly. But we don’t know yet.”

This is

also confirmed by data

from a Dealroom and HSBC report published nearly a year ago, which showed

that fintech was the most funded sector in the UK. Notably, Monzo secured £340

million, while Flagstone raised £108 million.

KPMG report

shows that the payments sector emerged as the most resilient segment,

attracting $31 billion in investment, followed by digital assets and currencies

at $9.1 billion and regtech at $7.4 billion. This distribution reflects ongoing

investor confidence in established payment technologies while showing increased

interest in emerging sectors.

Emerging Trends and Future

Outlook

Looking

ahead to 2025, several key trends are shaping the fintech investment landscape:

- Artificial Intelligence Integration: The sector is witnessing growing

interest in AI-enabled solutions, particularly in regtech and cybersecurity

applications. - Digital Assets Evolution: Market infrastructure, digital

tokenization, and stablecoins are positioned for potential investment growth. - Payment Innovation: The payments sector is expected to maintain

its leadership position, driven by B2B solutions and cross-border payment

technologies.

“If

what we’ve seen in the broader investment space is any indication, AI could be

a sleeping giant for fintech investment,” noted Anton Ruddenklau, Lead of

Global Innovation and Fintech at KPMG International. “However, right now,

it’s still very early days.”

“There’s definitely a

lot of interest in AI, generative AI, agentic AI and automation, but there’s a

lot of caution too. Over the next year, AI-focused regtechs will likely see the

most traction among investors as financial services companies look for better

ways to respond to the increasingly complex regulatory environment,” he

added.

Market Recovery Signals

Despite the

overall decline, several positive indicators suggest a potential recovery in

2025. The increase in Q4 investment activity, combined with declining interest

rates in various jurisdictions and the resolution of key political

uncertainties, points to improving market conditions.

M&A

activity showed particular resilience in the final quarter, with deal values

nearly doubling from $7.4 billion to $14.2 billion quarter-over-quarter.

Venture capital investment also demonstrated strength, rising from $9.7 billion

to $11.2 billion in the same period.

Moreover, a separate BCG

report revealed that despite a 70% financing shortfall, fintech companies managed

to increase their income by 14% between 2021 and 2023. If cryptocurrency

projects were excluded from the equation, the compound annual growth rate

(CAGR) would be 21%.

As the

market enters 2025, investors appear cautiously optimistic, with many watching

for signals from the new U.S. administration and monitoring the impact of

interest rate decisions on investment activity. The evolution of AI

applications in financial services and the continued development of digital

asset infrastructure are expected to be key drivers of growth in the coming

year.

This post is originally published on FINANCEMAGNATES.