In times of sweeping sell-offs, buying opportunities abound. One would assume that robust US inflation data would significantly impact the EURUSD pair. However, while the market focuses on the Trump trade, unexpected events occur. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Accelerating US inflation is putting pressure on the Fed.

- The futures market expects just one Fed rate cut in 2025.

- Reciprocal rates are not as scary as universal rates.

- The EURUSD pair may continue surging towards 1.0535 and 1.0615.

Weekly Euro Fundamental Forecast

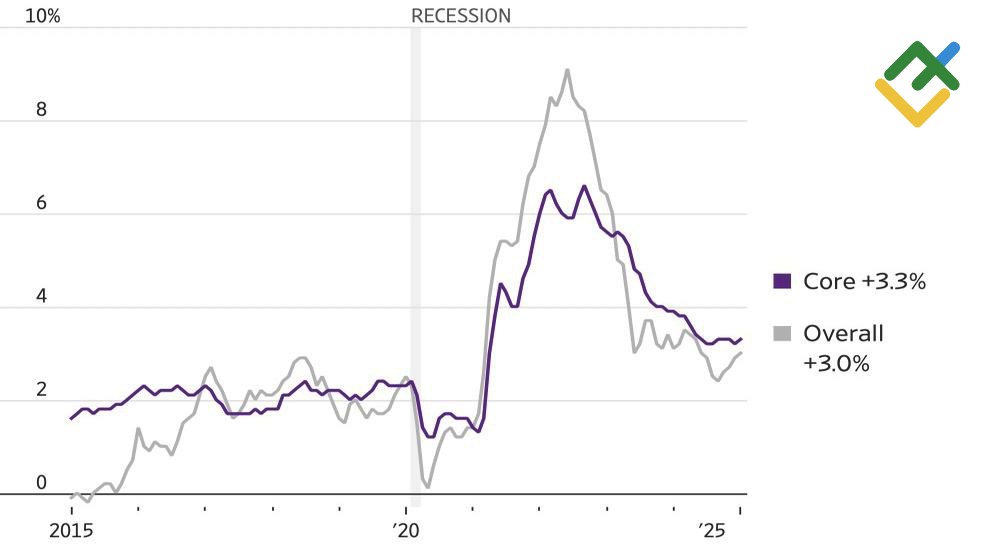

In the face of rising inflation, it is challenging to justify any rate reduction. The recent rise in consumer prices from 2.9% to 3% and core inflation from 3.2% to 3.3% has forced the Fed to reevaluate its approach, reminiscent of the situation in early 2024. At that time, an unanticipated surge in CPI and PCE at the beginning of the year prompted the central bank to postpone its plans to ease monetary policy. That shift in monetary policy boosted the US dollar. In a similar fashion, EURUSD bulls are taking a proactive stance in the market this time.

US Inflation Change

Source: Wall Street Journal.

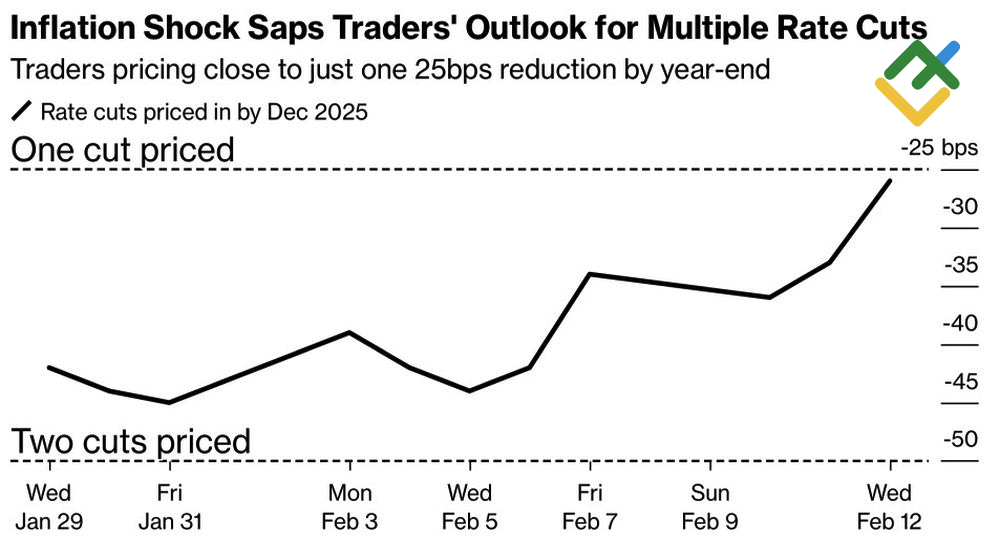

In a recent social media post, Donald Trump called for a reduction in interest rates, which he said “would go hand in hand with upcoming tariffs.” This statement highlights the president’s position on monetary policy, emphasizing that he is the only person willing to justify monetary expansion. However, this statement was made prior to the release of January’s Consumer Price Index data. Before this, Treasury yields had increased, and the derivatives market was indicating a likelihood of a reduction in the federal funds rate in 2025 from two cuts to one.

Market Expectations on Fed Rate Cuts in 2025

Source: Bloomberg.

The White House’s agenda appears to be the primary focus, leaving the Fed and macrostatistics on the sidelines, with President Donald Trump employing tariffs and diplomatic efforts to advance his goals. Trump’s “peace through strength” concept is no longer relevant, and the recent positive developments in US-Russia relations, as indicated by the phone call between the two presidents, have led to a favorable response in financial markets.

At the same time, the end of the military conflict will be beneficial for Europe, as it will reduce geopolitical risks and restore normal oil and gas flows. As a result, the EURUSD exchange rate managed to return above 1.04. This was largely influenced by Donald Trump’s proposal to transition from universal tariffs of 10–20% to reciprocal tariffs. According to the White House, many countries have been exploiting the US, and the country must put an end to this.

The imposition of reciprocal tariffs on imports is considered less detrimental to the global economy than universal tariffs. Furthermore, US allies may consider reducing tariffs in response to the threat of such measures. This could be viewed as favorable news for the euro, given its pro-cyclical nature.

According to the Bank of America, protectionism may ultimately harm the US dollar. Initially, this will impact other countries, but they will likely respond by increasing trade among themselves, reducing barriers, and pursuing development. This shift could potentially diminish the perception of American exceptionalism.

Weekly EURUSD Trading Plan

If the market does not align with your expectations, there is a high probability that it will follow a different trajectory. For instance, the market’s optimism following Donald Trump’s policies has boosted the EURUSD pair. If the pair breaches the resistance level of 1.0445, traders will have an opportunity to open long positions with targets at 1.0535 and 1.0615.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.