The article covers the following subjects:

Key takeaways

- Main scenario: consider long positions from corrections above the level of 1.0665 with a target of 1.1141 – 1.1273. A buy signal: after the level of 1.0665 is broken. Stop Loss: 1.0600, Take Profit: 1.1273.

- Alternative scenario: breakout and consolidation below the level of 1.0665 will allow the pair to continue declining to the levels of 1.0450 – 1.0217. A sell signal: after the level of 1.0665 is broken. Stop Loss: 1.0750, Take Profit: 1.0217.

Main scenario

Consider long positions from a correction above the level of 1.0665 with a target of 1.1141 – 1.1273.

Alternative scenario

Breakout and consolidation below the level of 1.0665 will allow the pair to continue declining to the levels of 1.0450 – 1.0217.

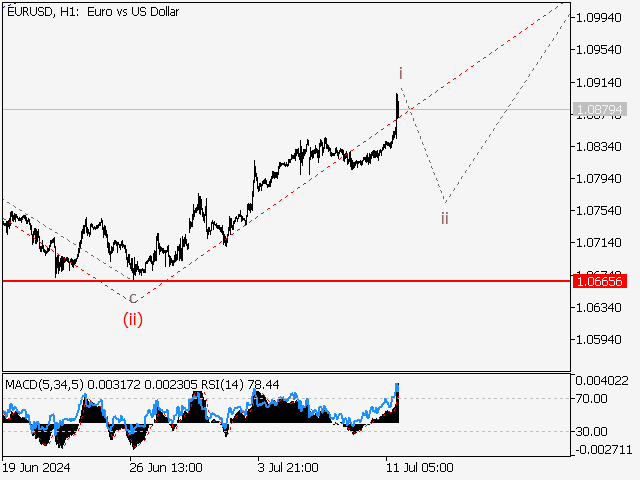

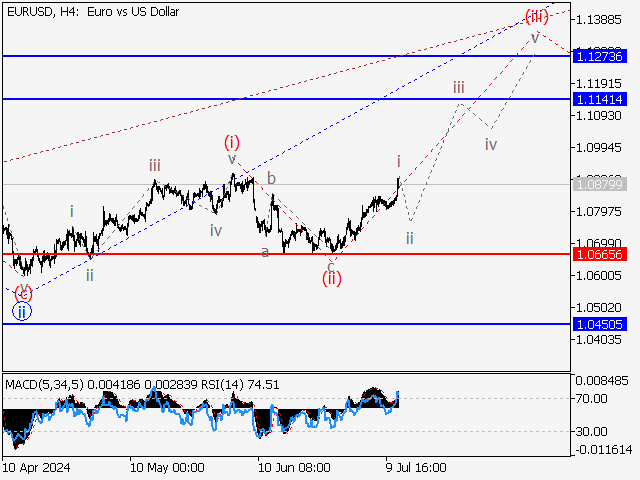

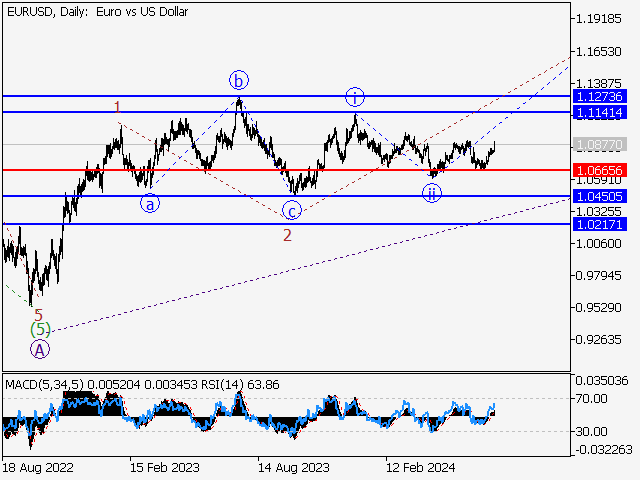

Analysis

A bullish wave B is presumably unfolding on the daily chart, with the first wave 1 of (A) of B and a corrective second wave 2 of (A) of B formed as its parts. Apparently, the third wave 3 of (A) of B is developing on the H4 time frame, within which a descending corrective wave ii of 3 is completed and wave iii of 3 of (A) is forming. The third wave of smaller degree (iii) of iii is developing on the H1 chart, with wave i of (iii) formed as its part. If the presumption is correct, the EURUSD pair will continue to rise to the levels of 1.1141 – 1.1273 after a local correction ii of (iii) has formed. The level of 1.0665 is critical in this scenario. Its breakout will allow the pair to continue falling to the levels of 1.0450 – 1.0217.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.