The AI Economic Impact has become a topic of intense debate. Many believe AI will transform industries and boost productivity. However, the actual effects of AI remain uncertain. This article delves into the realities of AI’s economic influence, cutting through the hype to explore what is genuinely happening.

The Promises of AI: High Hopes and Big Investments

In the tech world, the buzz around AI is undeniable. Companies are pouring billions into AI investments, hoping to harness its potential. The top five tech giants are allocating around $400 billion this year for AI-related projects. This includes research, development, and acquiring AI hardware.

However, technology adoption outside of the tech industry lags. While tech firms push forward, many businesses are cautious. They struggle to integrate AI into their processes effectively. Despite impressive AI advancements, actual economic benefits are not yet widespread.

Adoption Rates: A Slow but Steady Climb

Source: The Economist

Reports suggest that AI usage is growing. According to a McKinsey survey, nearly two-thirds of companies are using AI regularly. This is almost double the previous year’s figures. Additionally, a Microsoft and LinkedIn report shows that 75% of knowledge workers use AI. These statistics indicate a significant AI economic impact.

Yet, a closer look reveals a different story. Only 5% of businesses in the U.S. reported using AI in the past two weeks. Similarly, Canadian data shows just 6% of firms used AI for production in the last year. Although higher, the UK’s adoption rate is still modest at 20%.

Generative AI: A Game Changer or a Gimmick?

Generative AI, which includes models like ChatGPT, has gained much attention. These AI systems can generate text, create images, and even compose music. They promise to revolutionize customer service, marketing, and more.

Despite this potential, many companies use generative AI for narrow applications. For instance, ADP uses it for HR-related queries, while Verizon employs it for personalized recommendations. Starbucks leverages generative AI to customize customer offers. While these uses are innovative, they are not transformative.

Challenges in AI Integration: Data Security and Beyond

One significant hurdle in AI adoption is data security. Companies worry about sensitive information being compromised. Additionally, biased algorithms and AI “hallucinations”—where AI produces incorrect or nonsensical outputs—pose serious challenges.

For example, McDonald’s had to abandon an AI project due to errors. The system wrongly added $222 worth of chicken nuggets to a customer’s order. Such incidents highlight the risks involved in deploying AI systems prematurely.

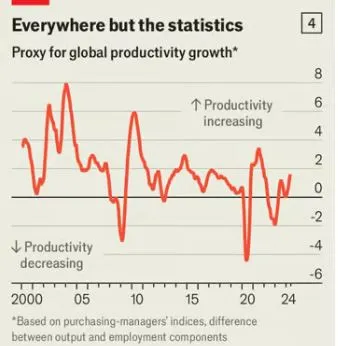

The Productivity Paradox: Why Gains Are Limited

Source: The Economist

One of the touted benefits of AI is increased productivity. Theoretically, AI should streamline operations and enhance efficiency. However, the actual productivity gains are limited. Many firms are still in the experimental phase, running small pilot projects. This scattered approach makes it hard to see significant productivity improvements.

Moreover, some companies hesitate to invest heavily in AI. They fear that rapid advancements might render their investments obsolete. This cautious stance slows down widespread AI adoption and its economic impact.

AI Investment Trends: A Closer Look on AI Economic Impact

While big tech firms are investing heavily in AI, other sectors are not as enthusiastic. Capital expenditure on AI outside the tech industry remains low. For instance, the rest of the S&P 500 companies are expected to reduce their real-term capital expenditure this year.

Overall business investment in AI-related technology is growing at a modest 5% annually. This rate is below the long-term average, indicating cautious optimism. Companies are waiting to see more concrete returns on AI investments before committing substantial funds.

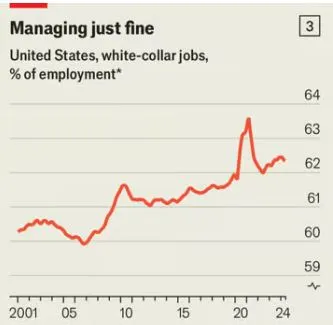

The Employment Conundrum: AI Economic Impact

Source: The Economist

There are fears that AI will lead to massive job losses. High-profile warnings suggest AI could disrupt labor markets significantly. However, current data does not support this. Unemployment rates in rich countries remain low, around 5%. Employment levels are near all-time highs.

In some cases, AI is helping companies become more efficient without drastic job cuts. For example, Klarna’s AI assistant reportedly does the work of 700 customer service agents. Yet, Klarna’s workforce reduction also stems from overhiring during the COVID-19 pandemic.

The Long-Term Outlook: AI’s Future Potential

Historically, major technological advances take time to show their full economic impact. The AI revolution may follow a similar pattern. If AI investments continue to grow at 20% annually, significant benefits might only become apparent after 2032.

In the meantime, firms must strategically integrate AI to maximize its potential. This involves investing in the right technologies and overcoming initial adoption hurdles. As AI matures, its economic impact could become more evident, leading to higher productivity and growth.

Conclusion: Navigating the AI Hype

The AI Economic Impact is a complex and evolving story. While AI promises significant benefits, the reality is more nuanced. Technology adoption rates are climbing, but challenges like data security and biased algorithms remain. Generative AI and other innovations offer exciting possibilities, yet their widespread economic impact is still unfolding.

Investments in AI are crucial, but firms must be strategic and patient. The journey toward realizing AI’s full potential is ongoing. By understanding the realities behind the hype, businesses can better navigate this transformative landscape.

Click here to read our latest article Generative AI Patents Surge

This post is originally published on EDGE-FOREX.