Despite government officials’ denials, the sharp plunge in USDJPY quotes indicates Japan’s intervention in the Forex market. This time, the intervention was timed to coincide with the release of US inflation data. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The yen has strengthened against the US dollar by almost 3%.

- The government does not talk about intervention, but it does not deny it either.

- It takes efforts from both sides to reverse the trend in the USDJPY.

- More short trades can be opened if the pair slumps below 158.85.

Weekly fundamental forecast for Japanese yen

The Bank of Japan understands that it requires efforts of both sides to reverse the USDJPY’s uptrend. Not only currency interventions are necessary, but also signs of the start of the Fed’s monetary expansion, which will weaken the US dollar. Now, the right time has arrived: the slowdown of US inflation in June allowed the BoJ to intervene in the Forex market. The USDJPY pair collapsed as quickly as it did in late 2022 when Japan managed to cancel the uptrend.

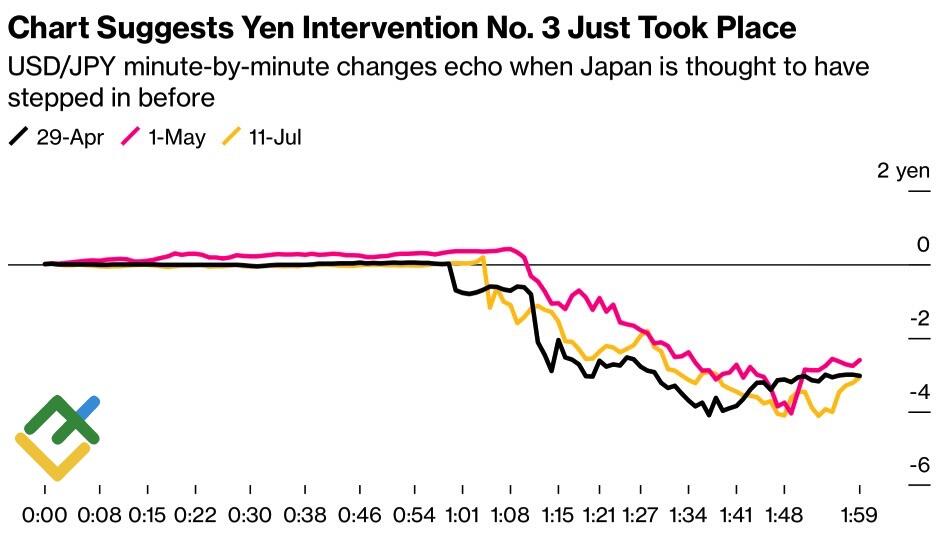

Deputy Minister of Finance for International Affairs Masato Kanda refused to say whether there was a currency intervention. However, the Japanese yen gained almost 3% against the US dollar, pointing to intervention. The pair behaved similarly in late April and early May when the Bank of Japan entered the market.

USDJPY reaction to currency interventions

Source: Bloomberg.

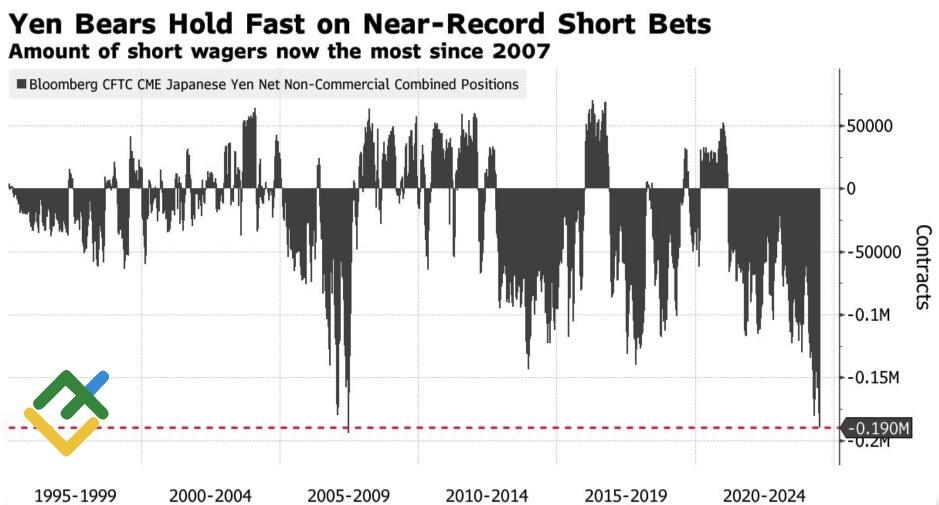

One can blame hedge funds and asset managers, whose net short positions on the yen have reached their highest level since 2007, for supposedly remembering the divergence in monetary policy between the Fed and the BoJ. Their abrupt unwinding could have triggered such a big move. They say that the approaching date of the Fed’s rate cut will trigger capital flows from North America to Asia and reverse the USDJPY’s bullish trend.

Japanese yen net non-commercial positions

Source: Bloomberg.

Even if the Bank of Japan raises the overnight rate in July and the Fed starts easing monetary policy in September, the yield differential between the US and Japanese bonds will remain wide, leading to consolidation rather than a sharp drop in the USDJPY pair. Besides, speculators behave approximately the same way they did at the turn of April and May. They buy the pair on dips, betting on the continuation of the uptrend.

Japan conducted another currency intervention tied to the market narrative that slowing US inflation would force the Fed to launch monetary easing in September. The first Forex intervention of just over $60 billion in 2024 failed due to the Fed’s reluctance to discuss lowering rates. However, the US regulator will likely do so at the July 30-31 FOMC meeting.

Weekly USDJPY trading plan

The BoJ’s intervention has a better chance of success than the spring intervention as it occurred at the right time during a US dollar sell-off. Although markets expected it to happen earlier after the publication of job market data, why not wait for US inflation? That was the BoJ’s reasoning. Therefore, if the USDJPY pair fails to hold above 158.85, more short trades can be opened and added to the ones initiated at 160.25.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.