Cryptocurrency trading is known for its high volatility, substantial risks, and potential for significant returns. Many investors in Zilliqa (ZIL) continue to question whether the asset has long-term growth prospects. Analysts currently express cautious optimism about Zilliqa’s future performance.

Since its launch in 2017, Zilliqa has gone through numerous price fluctuations. Nevertheless, its long-term prospects look promising. The Zilliqa blockchain is actively gaining popularity, especially in the field of decentralized applications (dApps) and across fintech companies. With a strong technological foundation and an evolving ecosystem, the platform is poised for continued growth, and the value of its ZIL token has great potential for appreciation.

This article reviews ZIL value predictions from leading analysts and provides an in-depth technical analysis, helping assess the cryptocurrency’s prospects and guide you in making well-informed investment decisions. Additionally, the review assesses key forecasts and current market conditions, offering insights into the development trajectory of the Zilliqa blockchain platform.

The article covers the following subjects:

Major Takeaways

- The current price of ZIL is $0.01266 as of 20.05.2025.

- The ZIL reached the highest price of $0.256293 on 06.05.2021. The lowest price of ZIL was recorded on 13.03.2020 when the token declined to $0.002477.

- In 2025, the ZIL price is expected to range from $0.0008 to $0.0607, amid the launch of ZIL 2.0 and increased discussion on social media.

- In 2026–2028, the asset is projected to range between $0.0089 and $0.0607, driven by sharding improvements, enhanced scalability, and a growing number of dApps.

- Expectations for 2029–2030 vary, with estimates ranging from $0.0008 to $0.1343. Both surges and sharp slumps are possible.

- In April 2022, ZIL briefly jumped above $0.18 because of the launch of the Metapolis metaverse. This situation is one of the clearest examples of how news can impact prices.

- The price reached its all-time high of $0.25 in May 2021, bolstered by the DeFi boom.

- Projections for 2040–2050 range from $0.00000005 to $13.89, reflecting a wide range of expectations from different analysts.

- Zilliqa is currently trading in a sideways channel. If the price settles above the $0.0200 level, it may signal a potential trend reversal.

ZIL Real-Time Market Status

The ZIL price is trading at $0.01266 as of 20.05.2025.

It is crucial to monitor the following parameters to assess the current state of the Zilliqa (ZIL) market:

- Market capitalization is the total value of all circulating ZIL coins. High capitalization indicates significant market presence and high liquidity.

- Circulating supply refers to the amount of ZIL in circulation. This parameter influences the availability of the asset and price performance.

- Maximum supply is the total amount of ZIL coins that will ever exist. For ZIL, this limit is set at 21 million coins.

- Trading volume (24 hours) is the total value of all transactions involving ZIL over the last 24 hours. High volume suggests vibrant market activity and heightened investor interest.

- The price change over the last year is the percentage change in the ZIL value over the past year, offering insight into long-term trends.

- Market sentiment is the general investor and trader mood, which can be bullish or bearish. Sentiment often correlates with price movements and trading volume.

|

Indicator |

Value |

|

Market cap |

$265.1 million |

|

Trading volume over the last 24 hours |

$20.95 million |

|

Volume to market cap ratio |

7.7% |

|

All-time high |

$0.256293 |

|

Price change over the last year |

-40.26% |

|

Circulating supply |

19.5 billion ZIL |

|

Maximum supply |

21 billion ZIL |

ZIL Price Forecast for 2025 Based on Technical Analysis

Zilliqa continues to trade in a sideways channel, bounded by the support of $0.00965 and the resistance of $0.01554. The price is trading below the 200-day SMA, indicating a fading long-term trend. However, the asset has firmly settled above the 50-day SMA, signalling a short-term strengthening.

In early May, the MACD indicator showed a bullish crossover. The MACD line crossed above the signal line, followed by a positive histogram. However, by the end of May, the upward momentum slowed down, suggesting a possible correction.

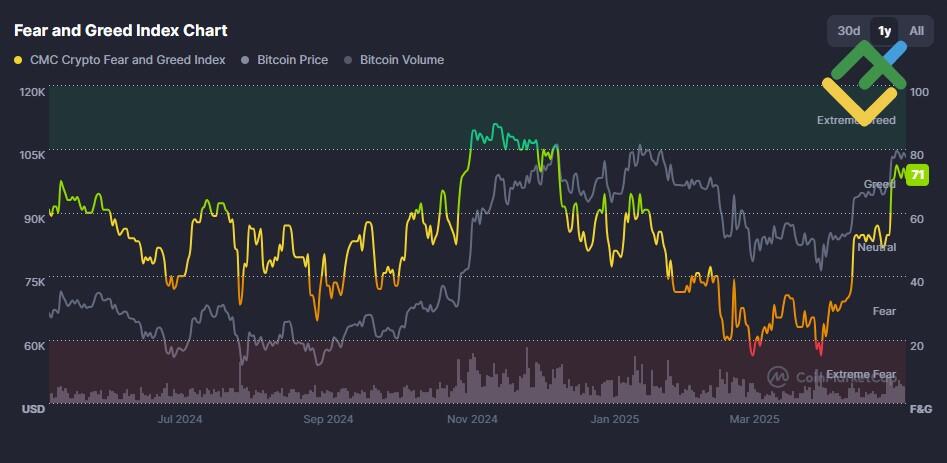

The Fear and Greed Index stands at 71, indicating a greed zone. This value reflects high investor interest but also signals a risk of market overheating. In this phase, both scenarios are possible: the asset may continue to appreciate amid strong demand or experience a correction as major players begin to take profits.

|

Month |

Minimum, $ |

Maximum, $ |

|

May 2025 |

0.0148 |

0.0200 |

|

June 2025 |

0.0160 |

0.0220 |

|

July 2025 |

0.0145 |

0.0190 |

|

August 2025 |

0.0168 |

0.0235 |

|

September 2025 |

0.0200 |

0.0270 |

|

October 2025 |

0.0235 |

0.0315 |

|

November 2025 |

0.0280 |

0.0380 |

|

December 2025 |

0.0325 |

0.0450 |

|

January 2026 |

0.0330 |

0.0445 |

|

February 2026 |

0.0320 |

0.0430 |

|

March 2026 |

0.0305 |

0.0410 |

|

April 2026 |

0.0290 |

0.0385 |

Long-Term Trading Plan for ZILUSD for 2025

The technical analysis performed suggests that long trades can be considered in the $0.0125–$0.0135 range, where a short-term correction may occur. This may be a good opportunity to build positions, with investor interest rebounding after an extreme fear phase. No significant decline is expected. Any pullbacks will likely be short-lived due to new capital entering the market.

A favorable political climate, particularly advancements in international tariff agreements between the US and China, may provide additional support for the asset.

Bullish targets are $0.0220 and $0.0315, with a primary target of $0.0450.

Consider taking partial profits at $0.027 and holding the remainder until year-end.

Analysts’ ZIL Price Projections for 2025

Various market analysis platforms offer their scenarios for ZIL price movements in 2025. The forecasts below include monthly values and estimated ranges for the next 12 months from three independent sources.

CoinCodex

Price range in 2025: $0.010298–$0.013306 (as of 15.05.2025).

CoinCodex anticipates ZIL to experience relatively low volatility throughout 2025, staying within the range of $0.010298–$0.0133, with no clear indications of a resistance breakout. The presence of bearish signals suggests weak momentum and likely downward pressure in the upcoming months.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

May |

0.011112 |

0.011809 |

0.013306 |

|

June |

0.010606 |

0.010896 |

0.011517 |

|

July |

0.010298 |

0.010823 |

0.011519 |

|

August |

0.011266 |

0.011524 |

0.011934 |

|

September |

0.010824 |

0.011182 |

0.011550 |

|

October |

0.011135 |

0.011368 |

0.011585 |

|

November |

0.010421 |

0.010885 |

0.011335 |

|

December |

0.010420 |

0.010625 |

0.010886 |

Cryptodisrupt

Price range in 2025: $0.0135–$0.0203 (as of 15.05.2025).

Cryptodisrupt expects ZIL to climb steadily throughout the year. The forecast indicates that the asset will consistently exceed its swing highs. By December 2025, the price may approach $0.020, reflecting a moderately optimistic outlook for the token.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

May |

0.0135 |

0.0148 |

0.0152 |

|

June |

0.0148 |

0.0152 |

0.0158 |

|

July |

0.0154 |

0.0159 |

0.0164 |

|

August |

0.0159 |

0.0165 |

0.0172 |

|

September |

0.0167 |

0.0171 |

0.0179 |

|

October |

0.0169 |

0.0175 |

0.0187 |

|

November |

0.0176 |

0.0180 |

0.0194 |

|

December |

0.0178 |

0.0184 |

0.0203 |

NameCoinNews

Price range in 2025: $0.009961–$0.012133 (as of 15.05.2025).

According to NameCoinNews, Zilliqa may increase moderately in the second half of the year. Despite subdued expectations for the first part of 2025, a gradual strengthening is predicted for the second half.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

May |

0.010416 |

0.011274 |

0.012133 |

|

June |

0.009961 |

0.010367 |

0.010774 |

|

July |

0.010475 |

0.011005 |

0.011535 |

|

August |

0.010745 |

0.011336 |

0.011928 |

|

September |

0.010597 |

0.010987 |

0.011377 |

|

October |

0.010855 |

0.011185 |

0.011515 |

|

November |

0.010107 |

0.010504 |

0.010901 |

|

December |

0.010518 |

0.010593 |

0.010667 |

Analysts’ ZIL Price Projections for 2026

2026 may become a pivotal year for Zilliqa. Some analysts predict a prolonged correction, while others expect a steady recovery. Below are the annual price estimates from major market analysis platforms.

CoinCodex

Price range in 2026: $0.009480–$0.013337 (as of 15.05.2025).

CoinCodex expects ZIL to slide further in 2026, with the average price projected to drop to $0.0101 and the ROI likely to stay negative. Bearish signals dominate, and analysts suggest the token will remain under pressure, with only minor recovery attempts. The most probable scenario is sideways movement with a bearish bias, keeping the price near the lower end of the range.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2026 |

0.009480 |

0.010168 |

0.013337 |

Cryptodisrupt

Price range in 2026: $0.017500–$0.031300 (as of 15.05.2025).

Cryptodisrupt provides the most bullish forecast for ZIL, predicting it to break through the resistance level and hit $0.03 by year-end. The annual average is expected to rise to $0.0222. Analysts believe that the upside potential is not yet exhausted and anticipate a renewed interest in the project, leading to expanded infrastructure.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2026 |

0.017500 |

0.022283 |

0.031300 |

NameCoinNews

Price range in 2026: $0.008957–$0.013627 (as of 15.05.2025).

NameCoinNews estimates that 2026 will be a period of stagnation. The average price will not exceed $0.0098, and volatility will remain within the previous year’s range. A short-term spike is possible in the spring, but no sustained upward trend is expected. The overall trend is sideways with no clear direction.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2026 |

0.008957 |

0.009791 |

0.013627 |

Analysts’ ZIL Price Projections for 2027

Analytical projections for 2027 are divided: some sources point to steady growth, while others indicate a waning interest in the asset. Below are forecasts detailing expected price ranges and annual average values.

CoinCodex

Price range in 2027: $0.009468–$0.009892 (as of 15.05.2025).

According to CoinCodex, the ZIL price will trade in a narrow range in 2027, with bearish sentiment dominating. The average annual price will be $0.0096, and the ROI is expected to be negative. The outlook remains gloomy, with analysts pointing to the possibility of making profits only through short trades.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2027 |

0.009468 |

0.009634 |

0.009892 |

Cryptodisrupt

Price range in 2027: $0.024700–$0.043200 (as of 15.05.2025).

Cryptodisrupt offers an extremely optimistic forecast, suggesting that ZIL could advance to $0.0432 over the year. The average price is expected to reach $0.0314. The forecast relies on increased activity within the crypto community and heightened interest in the project, including via social media.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2027 |

0.024700 |

0.031383 |

0.043200 |

NameCoinNews

Price range in 2027: $0.008944–$0.009457 (as of 15.05.2025).

NameCoinNews anticipates that interest in ZIL will subside and the price will gradually depreciate. The average annual value is expected to reach $0.0091, with highs and lows remaining close to 2026 levels. This forecast is influenced by macroeconomic instability and the overall cooling of the cryptocurrency market.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2027 |

0.008944 |

0.009145 |

0.009457 |

Analysts’ ZIL Price Projections for 2028

Forecasts for 2028 provide a wide range of expectations: analysts offer different scenarios depending on their forecasting models and market conditions. Annual estimates from three sources are presented below.

CoinCodex

Price range in 2028: $0.009408–$0.009998 (as of 15.05.2025).

According to CoinCodex, ZIL is expected to continue moving sideways, with an average price of $0.0096 and extremely low volatility. The forecast points to ongoing market pressure and suggests potential opportunities for short trades, without significant signs of recovery or upward momentum.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2028 |

0.009408 |

0.009598 |

0.009998 |

Cryptodisrupt

Price range in 2028: $0.034800–$0.060700 (as of 15.05.2025).

According to Cryptodisrupt, ZIL may experience a powerful upward momentum in 2028. The forecast indicates that the price will soar to $0.0607, with the average price remaining around $0.0459. Experts anticipate a steady increase in demand and a strengthening of the token’s position in the cryptocurrency market.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2028 |

0.034800 |

0.045933 |

0.060700 |

NameCoinNews

Price range in 2028: $0.008879–$0.009595 (as of 15.05.2025).

NameCoinNews maintains a cautious outlook regarding Zilliqa’s performance in 2028. The average price is expected to be around $0.0091, and the overall forecast mirrors the previous year’s trends. While analysts admit the possibility of short-term dips, they also believe that the asset may start to accumulate volume before a larger rally in the future.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2028 |

0.008879 |

0.009101 |

0.009595 |

Analysts’ ZIL Price Projections for 2029

Expert platforms continue to release long-term forecasts for the ZIL token. Below are price predictions for 2029 from three key sources.

CoinCodex

Price range in 2029: $0.002573–$0.009654 (as of 15.05.2025).

According to CoinCodex, ZIL may plummet in 2029, with the average price falling to $0.0063. The projected trading range is exceptionally wide, between $0.0025 and $0.0096, pointing to elevated volatility. This setting may either bring continued downside pressure or create speculative opportunities for active traders.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2029 |

0.002573 |

0.006336 |

0.009654 |

Cryptodisrupt

Price range in 2029: $0.052100–$0.090500 (as of 15.05.2025).

Cryptodisrupt predicts that 2029 could be a breakthrough year for Zilliqa, with the average price projected at $0.0675 and a potential high of $0.0905. This outlook suggests growing investor confidence in the project, supported by strengthening technical indicators that point to a sustained bullish trend.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2029 |

0.052100 |

0.067508 |

0.090500 |

NameCoinNews

Price range in 2029: $0.002936–$0.012717 (as of 15.05.2025).

NameCoinNews presents a wide price range for 2029. The average annual price is predicted to be $0.0068. However, both significant drawdowns and rapid surges up to $0.0127 are possible. These figures reflect the uncertainty and the presence of various factors that will influence the price throughout the year.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2029 |

0.002946 |

0.006793 |

0.012717 |

Analysts’ ZIL Price Projections for 2030

Analytics platforms continue to publish long-term forecasts for the ZIL token. Below are estimates for 2030 from three key sources.

CoinCodex

Price range in 2030: $0.000755–$0.009325 (as of 15.05.2025).

CoinCodex expects ZIL to continue declining. The forecast for 2030 reflects an extremely wide price range with an annual average of around $0.0023. Amid a sharp drop in the second half of the year, the platform continues to favour short-term positions and speculation within a narrowing channel.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2030 |

0.000755 |

0.002267 |

0.009325 |

Cryptodisrupt

Price range in 2030: $0.075600–$0.134300 (as of 15.05.2025).

Cryptodisrupt maintains a bullish outlook for Zilliqa, forecasting an increase to $0.13 and an average annual price of around $0.1133. Analysts consider ZIL’s performance to be stable, with prices gradually strengthening as crypto infrastructure matures and is adopted on a wider scale.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2030 |

0.075600 |

0.113300 |

0.134300 |

NameCoinNews

Price range in 2030: $0.000870–$0.010602 (as of 15.05.2025).

NameCoinNews offers a neutral yet flexible forecast. The average price is expected to reach $0.0026. The scenario largely resembles 2029 market behaviour, although analysts do not rule out increased volatility towards the end of the year amid possible global changes in cryptocurrency regulation.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2030 |

0.000870 |

0.002581 |

0.010602 |

Analysts’ ZIL Price Projections until 2050

According to Telegaon, Zilliqa is poised for steady gains. The average price is expected to reach $2.58 in 2035, $4.73 in 2040, and $12.62 in 2050. The forecast assumes that momentum will remain positive as long as interest in the project stays strong.

CoinCodex presents a highly pessimistic outlook. The average price may reach $0.00005530 in 2040 and decline to $0.00000084791 by 2050. The platform does not foresee any prospects for the token’s value to recover.

Cryptodisrupt demonstrates strong optimism. The average ZIL price is expected to reach $9.22 by 2040 and $12.18 by 2050. The forecast takes into account long-term growth and positive market expectations.

|

Year |

Telegaon, $ |

CoinCodex, $ |

Cryptodispurt, $ |

|

2035 |

2.58 |

– |

– |

|

2040 |

4.73 |

0.00005530 |

9.22 |

|

2050 |

12.62 |

0.00000084791 |

12.18 |

Telegaon’s forecast appears to be the most balanced. Cryptodisrupt’s prediction is based on an extremely positive scenario, while CoinCodex anticipates that the asset will lose nearly all of its value.

Market Sentiment for ZIL (Zilliqa) on Social Media

Media sentiment is the general mood expressed on the internet, across forums, social media, and news sites, regarding a cryptocurrency or project. If the majority of comments are positive, the sentiment is considered optimistic. Conversely, if negative comments prevail, the sentiment tends to be seen as pessimistic.

This metric is essential because positive media coverage can drive prices up, especially in the short term. However, if the majority of discussions are discouraging, the price may tumble.

A user on X (formerly Twitter) with the username @Javier_Gemhunter compares the performance of the Sui and Zilliqa v2 networks, noting that both are focused on high transaction speeds. The author of the post emphasises that Zilliqa v2 may be slightly faster due to its optimised sharding technology. Besides, the user claims that if ZIL does indeed outperform Sui in terms of speed, it may enter the top 20 cryptocurrencies.

@Quantum_Ascend sets altseason targets for ZIL ranging from $0.108 to $0.14, with $0.12 as the primary level. The user also urges to rely on math, not feelings.

Overall, social media sentiment around ZIL is moderately positive. Discussions center on improvements in network speed, comparisons to Sui, and potential targets for the next altseason ($0.12–$0.14). Interest remains steady, with a strong focus on technological advancements and data-driven predictions.

ZIL Price History

Zilliqa’s highest price of $0.256293 was recorded on 06.05.2021. The lowest price of $0.002477 was reached on 13.03.2020.

Below are the highlights of Zilliqa’s token price history, marked by significant events within the ecosystem:

- In May 2018, Zilliqa launched its mainnet, and the price of ZIL exceeded $0.23 amid a broader market rally.

- In March 2020, ZIL dropped below $0.01 due to the COVID-19 market crash.

- In May 2021, the price surged to $0.25 amid the DeFi boom and new exchange listings.

- In April 2022, the asset spiked above $0.18 following the announcement of the Metapolis metaverse.

- In 2023–2024, interest in the token declined, and the price remained in the $0.01–$0.03 range.

- In spring 2025, the launch of ZIL v2 sparked renewed social media buzz and interest in the project.

ZIL Fundamental Analysis

The ZIL token price linked to the Zilliqa platform is affected by a variety of factors, including technological advancements, market conditions, and public sentiment. As a promising project in the Web3 ecosystem, Zilliqa is often targeted by investors, particularly during technological upgrades or periods of a noticeable uptick in the activity of the developer team.

What Factors Affect the ZIL Price?

- Technological upgrades and development. Infrastructure advances such as Zilliqa 2.0 directly influence interest in the project. High developers’ activity and the launch of new features, such as the EVM support or performance improvements, increase the confidence of market participants and boost demand for the token.

- Public perception and media sentiment. Positive discussions about the project on social media and favorable assessments of its potential reinforce investor interest in the asset. Media sentiment, especially on X (formerly Twitter), influences ZIL’s price in the short term, shaping public sentiment and investment expectations.

- The state of the cryptocurrency market. The overall condition of the crypto market, including attitudes towards risky assets, also plays an important role. Bitcoin appreciation or improving economic conditions encourage investors to invest in projects like Zilliqa.

- Partnerships and integrations. Establishing new partnerships and growing utilization of the token across various ecosystems enhance its value. For instance, integrations that simplify access to Zilliqa through the Web3 tools broaden the project’s appeal, making it more accessible to a larger audience.

More Facts About ZIL

Zilliqa (ZIL) is a blockchain platform designed to address the scalability issue faced by many decentralized networks. The company was founded in 2017 by a team of scientists and engineers, including experts from the National University of Singapore. Zilliqa’s main innovation is the use of sharding technology, which allows the network to process a large number of transactions per second while maintaining its decentralized nature.

Zilliqa’s increase is driven by several key factors. Technological upgrades, such as the launch of Zilliqa 2.0 and the introduction of Ethereum Virtual Machine (EVM) support, significantly expand the platform’s usability. In addition, the robust development of the ecosystem and developer support strengthen the project’s credibility.

Zilliqa actively works in the DeFi (decentralized finance), digital marketing, gaming platforms, and NFT industries. The project provides innovative solutions for smart contracts, asset tokenization, and the creation of decentralized applications, making it a versatile tool in the Web3 ecosystem.

The popularity of ZIL among traders is attributed to its high technological potential, regular upgrades, and positive media sentiment. The token is considered a promising asset for long-term investments due to its unique technical advantages and robust growth.

Advantages and Disadvantages of Investing in ZIL

The advantages of investing in ZIL include:

- Technological advantage. Zilliqa uses a unique sharding technology that enables high-speed transaction processing. This makes the platform one of the most scalable in the blockchain ecosystem, drawing in developers and encouraging collaboration on a variety of projects.

- Growth prospects in Web3. Zilliqa is proactively expanding its ecosystem, encompassing solutions for DeFi, NFT, and gamification. This makes the project versatile and strengthens its position in the fast-growing Web3 industry.

- Active development. Constant upgrades and high developer activity, such as the launch of Zilliqa 2.0 and the EVM support, reinforce the project’s credibility.

- Broad usability. The platform is utilized in a variety of industries, including financial services, digital marketing, and gaming. This diversity makes it less dependent on fluctuations in one particular niche.

- Affordable price. The current ZIL price remains relatively low, allowing investors to enter the market at a minimal cost and expect significant growth in the future.

The following factors are usually highlighted among the disadvantages:

- High volatility. Like most cryptocurrencies, ZIL is subject to substantial price fluctuations, which can lead to significant losses for short-term investors.

- Competition. The blockchain platform market is oversaturated with competitors like Ethereum, Solana, and Polygon. Despite its technological advantages, Zilliqa may struggle to compete for its market share.

- Regulatory risks. Cryptocurrencies remain under intense regulatory scrutiny. Any regulatory changes could adversely affect the project’s prospects.

- Dependence on market sentiment. The ZIL price is highly dependent on the overall state of the cryptocurrency market. During bearish trends, the token may lose its appeal.

- Relatively low liquidity. Compared to major cryptocurrencies such as Bitcoin or Ethereum, ZIL is less volatile, making it challenging to buy and sell in large volumes.

How We Make Forecasts

When making forecasts for the Zilliqa (ZIL) token, we employ a comprehensive approach covering short-, medium-, and long-term perspectives. Our analysis integrates technical, fundamental, and market factors to develop a comprehensive view of the price movements.

The following tools and data are used to assess the ZIL price behavior in the coming days or weeks:

- Technical analysis includes the use of indicators such as the RSI, MACD, the fear and greed index, the altcoin season index, support and resistance levels, and trading volumes.

- Using sentiment analysis, we assess social media activity (X, Reddit) and the general discussion tone, including media sentiment.

- We assess short-term factors such as Zilliqa network upgrades, fluctuations in the crypto market, or significant partnerships.

The forecast for several months is based on the following factors:

- Fundamental factors help assess the platform development progress, Zilliqa 2.0 implementation, user base growth, and integration of new solutions such as the EVM.

- Market conditions reveal the general mood of the cryptocurrency market, macroeconomic trends, and changes in the regulatory environment.

- Analysis of Zilliqa’s price behavior under similar market conditions helps identify recurring patterns.

Forecasts for the years ahead are based on:

- Historical cycles of the cryptocurrency market. We study long-term trends and cycles to predict the possible behavior of the ZIL price.

- Global adoption trends. We assess the increasing use of blockchain technology and Zilliqa’s position in various industries.

- Expert opinions. We analyze forecasts from leading analysts and reports from research agencies.

This approach considers both current market conditions and Zilliqa’s long-term outlook, providing more accurate predictions for different time frames.

Conclusion: Is ZIL a Good Investment?

Zilliqa stands out as a promising project with a strong technological foundation and active development. However, limited media coverage, price volatility, and increasing competition diminish its short-term investment appeal. In the long run, ZIL has the potential to appreciate in value, especially if technical upgrades are implemented and demand for the token grows. This makes it an attractive option for patient investors who are prepared to take risks and wait for returns.

ZIL Price Prediction FAQ

The price of Zilliqa is trading at $0.01266.

Key factors include technological upgrades, developers’ activity, the overall sentiment in the cryptocurrency market, and partnerships and integrations. These factors generate demand and investor interest in the token.

Zilliqa provides solid technological advantages, such as scalability and a broad ecosystem. Nevertheless, the cryptocurrency market is volatile, and investment success depends on a proper risk assessment and long-term strategy.

Analysts expect the asset to range between $0.010 and 0.025. The bullish outlook remains intact due to network improvements. However, a significant rally is only possible if the price breaks through the $0.0255 level.

Zilliqa’s competitive advantage in the market stems from its sharding technology and low transaction costs. However, it faces challenges from large platforms such as Ethereum and Solana, which require continuous project development.

Price chart of ZILUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.