Despite the People’s Bank of China’s (PBoC) commitment to maintaining yuan stability, it is important to face the fact that differing monetary expansion rates with the Fed and a new trade war between Beijing and Washington will likely spur USDCNH quotes. Let’s discuss this topic and make a trade plan.

The article covers the following subjects:

Major Takeaways

- The People’s Bank of China keeps the yuan afloat.

- The yield spread between US and Chinese bonds has notched a new high.

- Beijing is poised to lose the trade war against Washington.

- The USDCNH pair is heading toward 7.45.

Monthly Yuan Fundamental Forecast

Efforts to regulate the yuan may have unintended consequences for Beijing. Since the beginning of the year, the People’s Bank of China has reiterated its commitment to maintaining the stability of the USDCNH pair, setting higher daily fixing rates than the market anticipates. However, these efforts may eventually prove counterproductive.

With Donald Trump’s inauguration approaching, the return of the Republicans to the White House is anticipated to usher in new tariffs on China. In response, exporters have been selling their products abroad at an accelerated pace, leading to a record foreign trade surplus of $992 billion in 2024, marking a 21% increase from 2023. A significant share of this surplus, approximately one-third, is attributable to the United States, indicating that Beijing is unlikely to win a trade war. The Chinese economy has already experienced a trade deficit in 2017–2018 and recognizes the need to explore alternative options.

In response to the 60% tariffs, China is prepared to take retaliatory measures, slamming US firms and pursuing alternative markets to reduce trade with the United States. Finally, fiscal and monetary stimulus is designed to support the struggling economy.

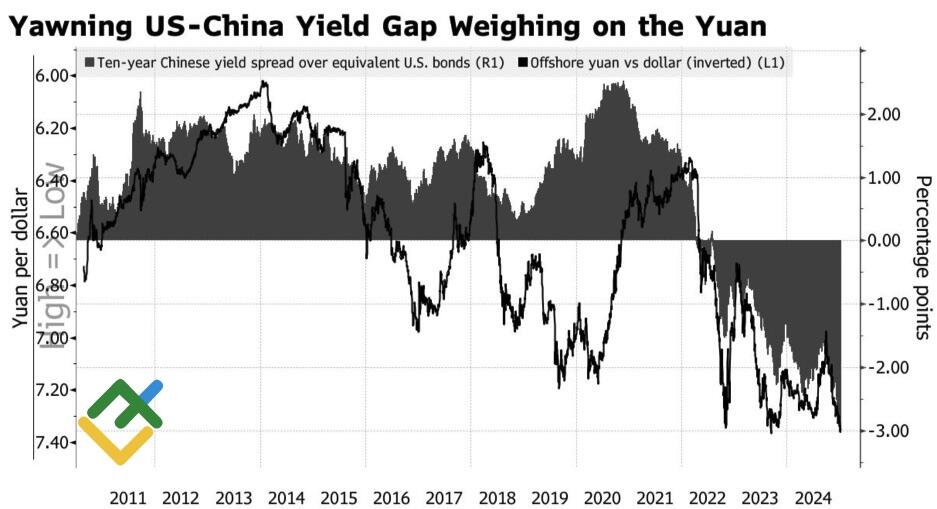

Yuan Performance and China-US Bond Yield Spread

Source: Bloomberg.

The Federal Reserve’s ongoing pause has widened the bond yield differential to 300 basis points. Against this backdrop, the USDCNH pair is expected to rise steadily. Bloomberg experts predict that the pair will reach 7.5 in 2025. However, the rally is unlikely to continue in light of the People’s Bank of China’s substantial foreign exchange reserves of $3.2 trillion and its readiness to intervene in the Forex market.

Disappointingly for China, the strengthening of the USDCNH exchange rate is largely driven by the robust performance of the US dollar, a factor that remains beyond Beijing’s control. The yuan’s gains against the currencies of trading partners, however, mitigate the efficacy of monetary stimulus measures.

Yuan Rate Against Basket of Counterparts

Source: Bloomberg.

At the same time, the People’s Bank of China will eventually allow the renminbi to appreciate, recognizing that doing so is in the nation’s best interest. A weak currency can lead to capital outflow from China, while a strong currency will not allow the regulator to mitigate the negative effects of tariffs imposed by the US. Notably, the yuan lost about 10% of its value during the first trade war between the two countries.

Monthly USDCNH Trading Plan

The USDCNH pair is expected to continue rallying, driven by the divergent monetary expansion paces of the Fed and the People’s Bank of China, along with the economic slowdown in China due to elevated tariffs from the US. The pair has already reached the first target of 7.35 and is poised to hit the second target of 7.45.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of USDCNH in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.