The S&P 500 has risen 14% from its April low, forcing USDJPY bears to flee the market. Reduced demand for safe-haven assets is not the only negative factor for the Japanese yen. The Bank of Japan remains dormant. Let’s discuss these topics and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The Bank of Japan may not raise rates in 2025.

- Tokyo needs to reach an agreement with Washington by July.

- The S&P 500 rally is putting pressure on the yen.

- Short trades can be considered if the USDJPY pair fails to maintain above 147.2.

Weekly Fundamental Forecast for Yen

The Japanese yen’s unconditional advantage is melting away before our eyes, leading to a correction in USDJPY quotes. The yen benefited from the divergence in monetary policy between the Fed and the Bank of Japan, as well as the high demand for safe-haven assets on fears that trade wars could slow global GDP and trigger a recession in the US. Progress in trade negotiations has boosted risk appetite, while rumors that the overnight rate will not rise further until 2025 have dealt a blow to the yen.

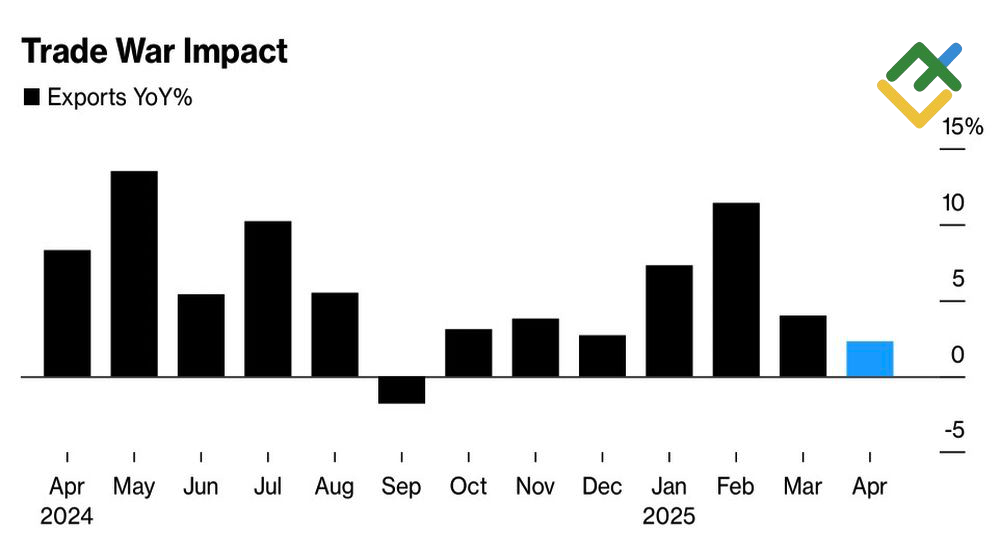

The tariff chill is not only being felt in the US but also in Japan. In the first 20 days of April, export growth slowed to 2.3%. In March, the figure was up 4%, and over the previous six months, including March, it averaged 6.1%. The rate of increase in nominal wages fell from 2.7% to 2.1% in the first month of spring, which was below forecasts. Meanwhile, GDP is expected to contract in the first quarter.

Japanese Exports YoY

Source: Bloomberg.

The economic slowdown is forcing the Bank of Japan to reconsider its stance on continuing the monetary policy normalization cycle. Morgan Stanley, which had previously predicted a rate hike in September, now expects it to remain at the current level of 0.5% until 2025. A further slowdown in GDP due to renewed monetary tightening would be a nightmare for the Japanese regulator. This would be particularly true if Tokyo fails to reach an agreement with Washington before July 9, when the 10% tariffs are set to rise to 24%.

The Fed is likely to maintain a cautious stance until at least mid-summer. The futures market anticipates three acts of monetary easing in the latter half of the year, contingent on a substantial slowdown in the US economy. At the same time, the divergence in monetary policy between the US Federal Reserve and the Bank of Japan will likely prove ineffective in the near future. The bond yield differential will remain significant, and the USDJPY pair will rise due to the substantial spread in debt markets.

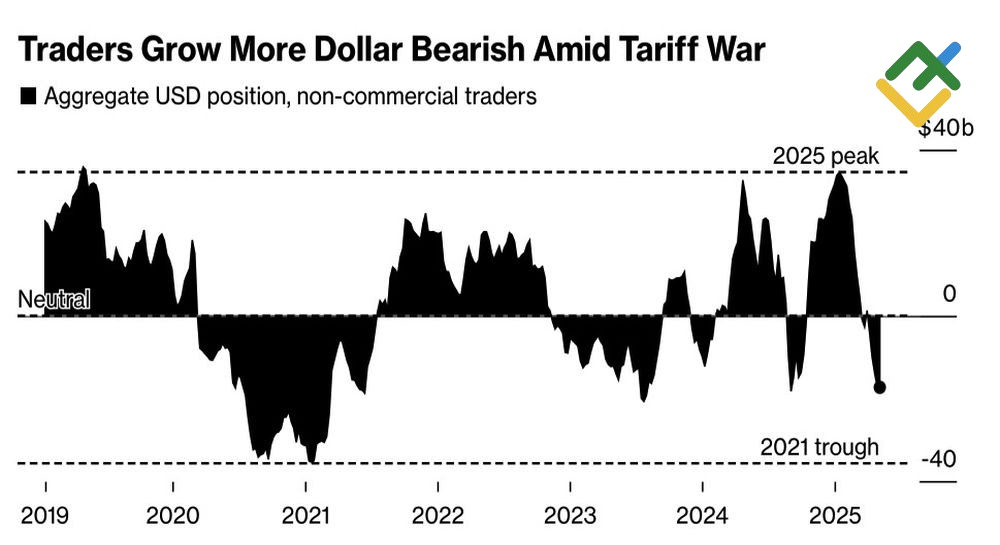

The correction is proceeding rapidly due to extreme positioning. Speculative long positions on the yen have reached record levels, while short positions on the US dollar are at their highest point since autumn 2023.

Speculative Positions on US Dollar

Source: Bloomberg.

In addition, US stock indices drive the correction in the USDJPY pair. The S&P index surged by 14% from its April low, spurring global risk appetite and prompting investors to seek more lucrative opportunities outside of safe havens. However, the recent rally in the US stock market has exhibited a heightened emotional tone. According to Bank of America, speculators were buying the rumor. The time has come to sell the news.

Weekly USDJPY Trading Plan

The decline in the S&P 500 index will likely exert downward pressure on the USDJPY exchange rate. If the pair rebounds from the resistance area of 149–149.25 or fails to stay above 147.2, traders will likely sell the US dollar against the Japanese yen.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.