The press and Bank of Japan officials are uncertain whether the regulator should raise rates in December. The data indicates that the normalization cycle will continue. What will happen, and how will it affect the USDJPY pair? Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The BoJ doubts the sustainability of inflation.

- Japan’s GDP and wages force the BoJ to raise the overnight rate.

- Capital outflow from Japan puts pressure on the yen.

- The USDJPY’s rally may accelerate once the resistance level of 150.8 is breached.

Weekly Fundamental Forecast for Yen

The behavior of markets is influenced by three primary factors: fear, greed, and doubt. As early as the end of the fall, investors were confident that the Bank of Japan would raise the overnight rate and that the Fed would cut the federal funds rate in December. This enabled bears to seize the opportunity and push the USDJPY pair lower. However, as soon as officials indicated a potential for a pause and the media picked up this narrative, the USDJPY pair reached a point near the psychologically important 150 mark. The market is in the doldrums. At what point should we expect a shift in the market?

While new data points to a continuation of the BoJ normalization cycle, investors are experiencing uncertainty. One of the Bank of Japan’s most dovish members, Toyoaki Nakamura, has stated that he is not opposed to raising interest rates but is not convinced that inflation will reach the 2% target in the next fiscal year. A Jiji Press report indicates that the prevailing view within the Bank of Japan is that premature monetary tightening should be avoided unless there is a risk of consumer price index acceleration due to a significantly weaker yen.

This alleged insider has significantly reduced the probability of an overnight rate hike in December from 65% to 37%. This has created a significant obstacle for USDJPY bears, even though core wages for full-time workers reached a record high of 2.8% in October, and Japan’s GDP grew by 1.2% in the third quarter, not 0.9% as previously reported.

Base Salaries in Japan

Source: Bloomberg.

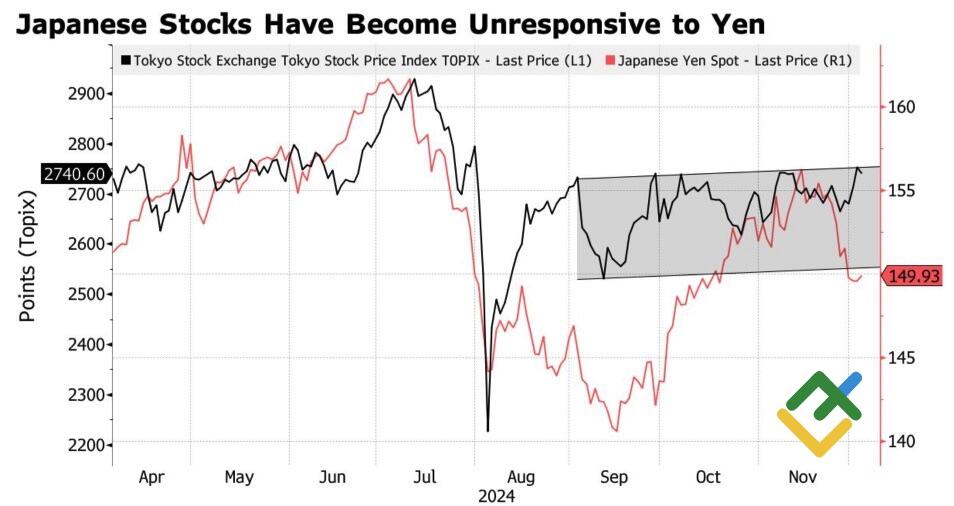

The market is reacting negatively to expectations of an increase in the overnight rate, with Japanese stock indices lagging behind their foreign counterparts. This creates a risk of capital outflow and a weakening of the yen.

TOPIX and Japanese Yen Performance

Source: Bloomberg.

Conversely, USDJPY bears are supported by an uncertain external backdrop. Trump’s trade tariffs will likely impede global GDP growth, while political crises in France and Germany could lead to instability in the eurozone economy. The yen is being actively purchased against the euro, which is creating challenges for the US dollar as well.

Following an increase in the US unemployment rate from 4.1% to 4.2%, the derivatives market has indicated an 85% probability of a federal funds rate cut in December, which has exerted pressure on the US dollar. However, based on comments from FOMC officials, there is no guarantee that the monetary expansion cycle will continue into 2024. If US inflation accelerates more than expected in November, the Fed could call for a pause as soon as its next meeting.

As a result, uncertainty about central bank actions in December is forcing the USDJPY pair to move sideways. In addition, rising uncertainty and elevated volatility are supporting the yen, while capital outflows are creating headwinds for the currency.

Weekly USDJPY Trading Plan

Against this backdrop, one may opt for a conservative strategy and await the release of the US CPI report. An alternative option is to open long positions on the USDJPY pair once the price breaks through the resistance level of 150.8.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.