Donald Trump said that China had violated the agreement with the US, threatening to raise tariffs on steel and aluminum. In response to this news, the yen has surged as a safe-haven asset. However, USDJPY bears still have some advantages. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The Japanese debt market stabilization supported the yen.

- The BoJ may raise rates as inflation in Tokyo accelerated.

- Trade wars are spurring demand for safe-haven assets.

- Short trades on the USDJPY pair formed at 145.3 can be kept open.

Weekly Fundamental Forecast for Yen

Decisiveness is the key to success. The Japanese government has swiftly taken action to stabilize the Japanese bond market, curbing the USDJPY rally. The pair is returning to its downward trend, although market sentiment remains mixed. While asset managers continue to buy the yen, hedge funds have unexpectedly started selling it.

The rise of USDJPY quotes above 146 was the result of a weak auction. The government sold ¥500 billion of 40-year bonds, yielding 3.135%. The bid-to-cover ratio decreased from 2.92 in March to 2.21, the lowest figure since July 2024. However, according to Capital Economics, the authorities have plenty of tools at their disposal to weather the debt market storm. This is especially true since the situation has slowly subsided in the US. The Bank of Japan’s adjustment of issuance parameters and flexible purchases helped calm investors, strengthening the Japanese yen.

Last week, the USDJPY pair rose on news that the US Trade Court’s ruling struck down Donald Trump’s tariff regime. Investors were concerned that the tariffs would be canceled, which could hurt safe-haven assets.

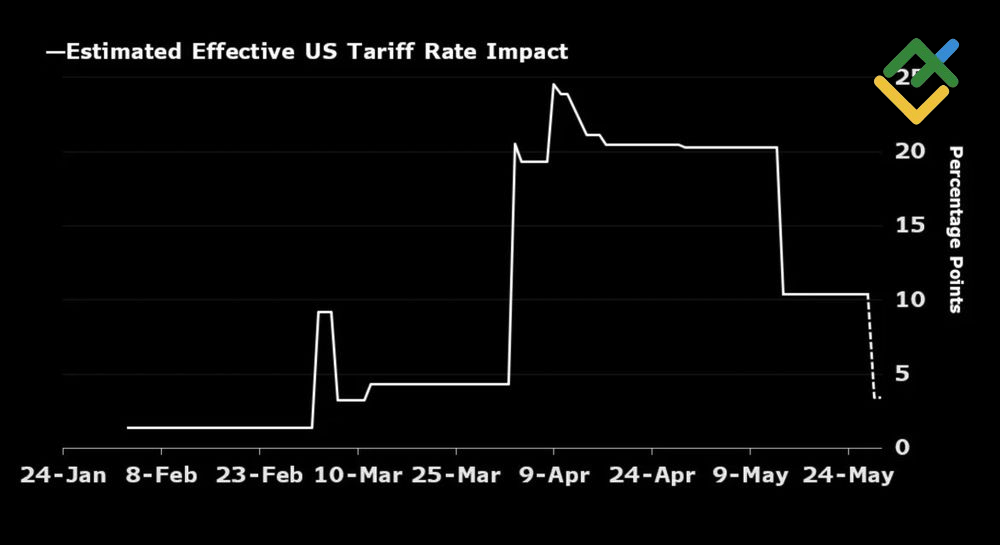

US Tariff Rate Change

Source: Bloomberg.

Markets are characterized by a tendency to respond impulsively, often without much forethought. It became apparent later that the US administration was not willing to reconsider its stance on the trade policy. The USDJPY pair witnessed another sell-off. In response, the US administration has stressed that it will pursue further legislative action to justify the tariffs. According to recent reports, Donald Trump has stated that China has breached the terms of its agreement with the US. In response, Trump has threatened to raise tariffs on steel and aluminum imports from 25% to 50%. The ongoing nature of these trade wars suggests that demand for safe-haven assets will likely remain strong. This development bodes well for the yen.

The USDJPY rate is being influenced by accelerating inflation in Tokyo, which rose from 3.4% to 3.6% in May, sparking speculation about the potential for the Bank of Japan to resume its cycle of monetary tightening. The indicator is regarded as a leading gauge of national prices, and its trajectory underscores the necessity for higher rates. At the same time, the market is anticipating two additional acts of monetary expansion by the Fed before the end of 2025, a scenario that appears to be underestimated.

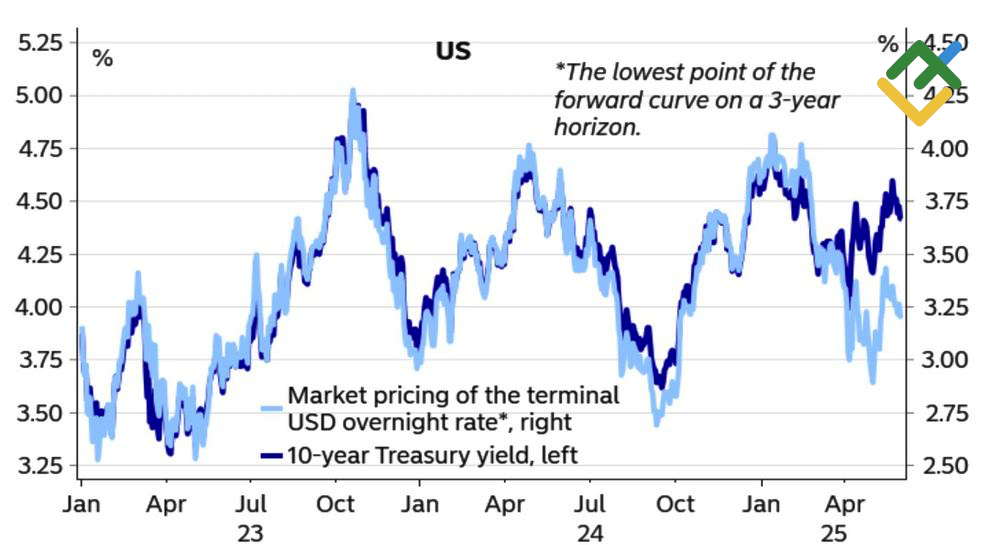

From the perspective of Treasury yields, the Fed should keep the current borrowing costs unchanged until the end of the year. The rally in debt market rates is attributable to fiscal challenges in the US, beginning with Moody’s credit rating downgrade.

US Treasury Yields and Fed Rate Expectations

Source: Nordea Markets.

Weekly USDJPY Trading Plan

Therefore, the stabilization of Japan’s debt market, continued high demand for the yen as a safe-haven currency, and the divergence in monetary policy between the Fed and the BoJ provide solid grounds for the USDJPY pair to continue its downward trend. As a result, short trades formed on a rebound from 145.3 should be kept open and increased periodically.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.