Currency interventions were the catalyst for the collapse of the USDJPY exchange rate, followed by the Bank of Japan meeting and the release of the US labor market report. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The $36.6 billion currency intervention marked the turning point for the USDJPY pair.

- The Bank of Japan appeared more hawkish than expected.

- The prospect of a US recession reinforced the yen as a funding currency.

- The USDJPY pair can be sold on pullback to 142.7, 144.2, and 144.9.

Weekly fundamental forecast for Japanese yen

Recently, USDJPY bulls have had several reasons to celebrate. For example, $36.6 billion in currency interventions, the Bank of Japan’s monetary tightening, and the US labor market report for July were among these reasons. These events resulted in a 12% collapse of the pair’s quotes from the 38-year highs in just half a month, accompanied by the fastest reduction of speculative positions on the yen since 2011. The US dollar has yet to reach its lowest point.

According to Amundi, the USDJPY pair may fall to 140 if there is a combination of three factors: the beginning of the Fed’s monetary expansion cycle, risk aversion, and the Bank of Japan’s monetary policy tightening.

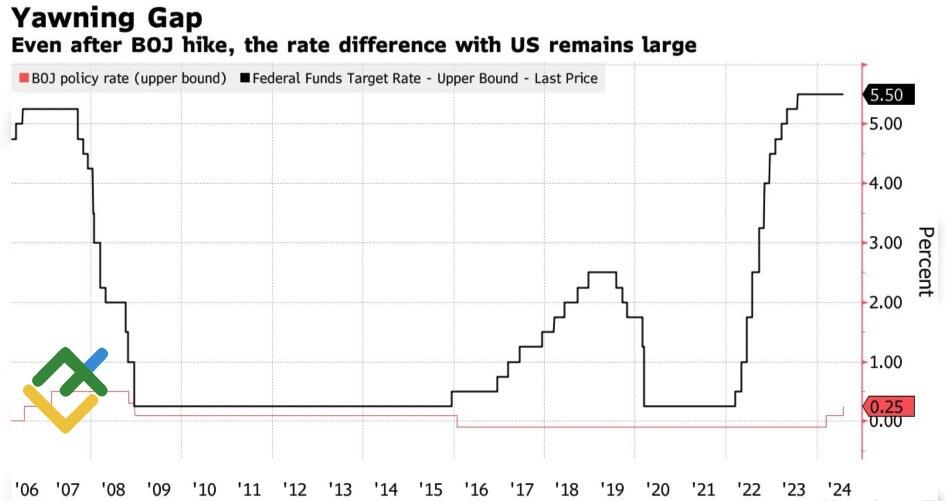

Fed and Bank of Japan interest rates

Source: Bloomberg.

At its July meeting, the BoJ defied expectations by surprising two-thirds of Bloomberg experts who anticipated that the overnight rate would remain unchanged. The central bank voted 7 to 2 to raise the rate to 0.25%. Additionally, the bank announced plans to halve its quantitative easing program, reducing it from ¥6 trillion to ¥3 trillion by 2026. It is possible that the Governing Council would have taken a more drastic step if not for the need to find buyers for the remaining securities. The Ministry of Finance is already taking steps in this direction, and capital inflows into Japan could be another bearish driver for the USDJPY pair.

Kazuo Ueda expressed concern that the falling yen could accelerate inflation and hinder economic growth. He cited the weak currency as one of the reasons for the rate hike, which contrasts with the approach of other central bank governors who do not factor exchange rates into their decision-making process.

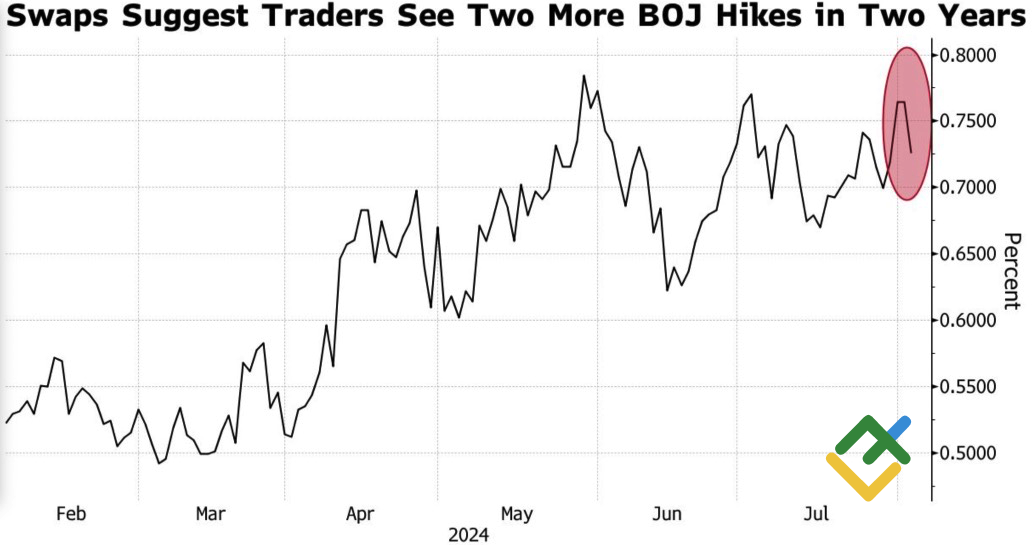

The interest rate swap market anticipates that the overnight rate will reach 0.73% within two years, which suggests two acts of monetary restriction of 25 bps each over such a prolonged period. Bloomberg experts anticipate that the Bank of Japan will act more promptly. 68% of respondents project that monetary tightening will persist into 2024: 44% voted for December and 24% for October.

Bank of Japan’s tightening cycle

Source: Bloomberg.

Despite the notable divergence between the Fed and BoJ rates, USDJPY quotes have declined significantly. The plunge is largely attributed to the anticipation of Fed monetary policy easing in the derivatives market. The expectations indicate five acts of monetary expansion in the remaining 2024 meetings, suggesting two aggressive 50 bp cuts in the fed funds rate at two of the three FOMC meetings.

Weekly USDJPY trading plan

In light of the approaching recession, USDJPY bears may see an opportunity to capitalize on market volatility, prompting carry traders to close trades and buy the yen as a funding currency. The pair’s collapse will likely continue. Therefore, short trades initiated above 160 can be kept open. One can open more short trades on pullbacks to 142.7, 144.2, and 144.9.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.