The new Prime Minister of Japan holds hawkish views, which will allow the Bank of Japan to continue normalizing monetary policy and contribute to the downtrend on the USDJPY pair. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- Hawk Shigeru Ishida has become the new LDP leader.

- The Bank of Japan is in no hurry to increase the overnight rate.

- Extraordinary parliamentary elections may slow down the yen.

- Traders may open short trades at 146.1 or initiate long positions after the US labor market data release.

Weekly fundamental forecast for Japanese yen

The market was anticipating that Sanae Takaichi would lead the Liberal Democratic Party. She contended that the BoJ had erred in increasing the overnight rate. Indeed, the new prime minister will be Shigeru Ishiba, known for his hawkish views. The information regarding his victory allowed traders to employ the strategy of selling the USDJPY pair on an increase to 146.1.

Notwithstanding the Bank of Japan’s operational autonomy, political risks remain a factor. Former Prime Minister Fumio Kishida emphasized the government’s non-interference in the actions of the regulator. However, he did occasionally hold talks with Kazuo Ueda, and the government interacted with the central bank in verbal and currency interventions.

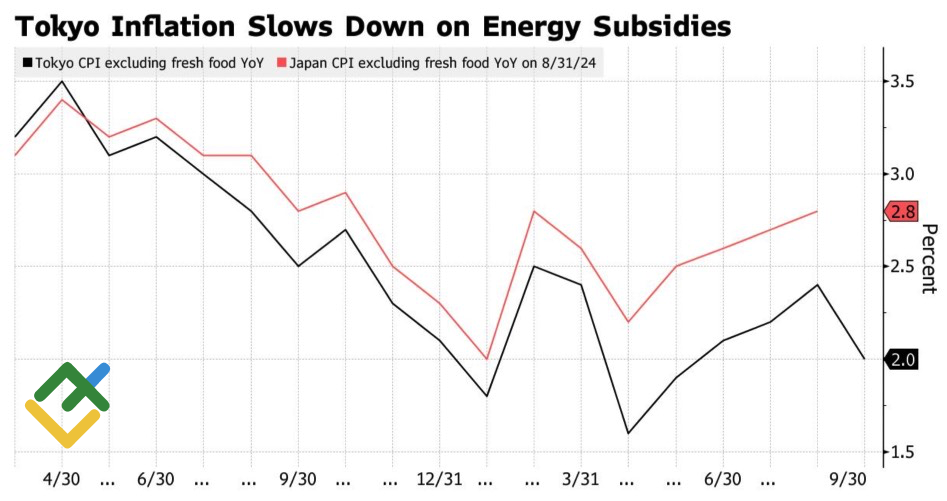

The market anticipated that Sanae Takaichi’s influence on the BoJ would intensify, with concerns that the overnight rate might not revert to negative territory. Additionally, the prerequisites for this are in place, as evidenced by the acceleration of Tokyo inflation, a leading indicator for the national CPI, in September.

Japan’s inflation rate

Source: Bloomberg.

Kazuo Ueda has chosen to adopt a cautious stance in anticipation of the vote for the new leader of the Liberal Democratic Party. He stated that the Bank of Japan had the opportunity to evaluate the outlook for financial markets in Japan and abroad, as well as the situation in foreign economies. The recent increase in import prices results from the yen’s strengthening and is a temporary phenomenon. It would be inadvisable to accelerate the normalization process due to this development.

Prime Minister Shigeru Ishiba has stated that, in the current circumstances, monetary policy should remain accommodative. His remarks regarding the potential for snap parliamentary elections in October have somewhat cooled the enthusiasm of USDJPY bears. Should the elections proceed as planned, the Bank of Japan is unlikely to raise the overnight rate until December.

The correction of the pair was caused by two factors: the growth of US Treasury bond yields due to fears about an approaching recession in the US economy and investors’ misplaced confidence in Sanae Takaichi’s victory. The second factor has already played out, so market attention is shifting back to North America.

The likelihood of a 50 basis-point cut in the federal funds rate in November is rising in light of indications of cooling US employment in September. This is likely to result in a weakening of the US dollar and an opportunity for the USDJPY pair to resume its downtrend. Conversely, robust labor market data will shift the advantage back to the bulls on the currency pair.

Weekly USDJPY trading plan

Given the current market conditions, short positions formed at 146.1 on the USDJPY pair should be kept open in anticipation of potential market movements following the release of the Non-farm payrolls data. Conversely, should the actual data exceed the Bloomberg experts’ forecasts, securing profits and opening long positions would be advantageous.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.