By Tom Westbrook and Stefano Rebaudo

SINGAPORE (Reuters) -The yen sank to a 3-month low on Monday as investors figured the loss of a parliamentary majority for Japan’s ruling coalition in weekend elections would slow interest rate rises, while the U.S. dollar headed for its biggest monthly gain since April 2022.

In the Asia session, the yen weakened as far as 153.88 per dollar and 166.06 per euro, on both counts the softest since late July. The yen was last down about 0.7% on the dollar at 153.35, with a 6.4% drop through October, the largest of any G10 currency.

A period of wrangling to secure a coalition is likely after Japan’s Liberal Democratic Party and its junior partner Komeito won 215 lower house seats to fall short of the 233 majority.

Traders said the vote would likely result in a government without the political capital to preside over rising rates and could usher in another era of revolving-door leadership.

Shigeru Ishiba was Japan’s fourth prime minister in a little over four years and further instability was widely expected to breed caution at the central bank, which meets to set rates this week.

“It’s one more thing for them to consider when they should be looking at the economy,” said State Street (NYSE:STT)’s Tokyo branch manager Bart Wakabayashi. “Are we going to have another series of prime ministers every 10-12 months? That would not be good for the yen.”

Analysts at BNY said the next immediate target for dollar/yen would be 155 with 160 a likely line in the sand that would draw intervention from the finance ministry.

DOLLAR GAINS

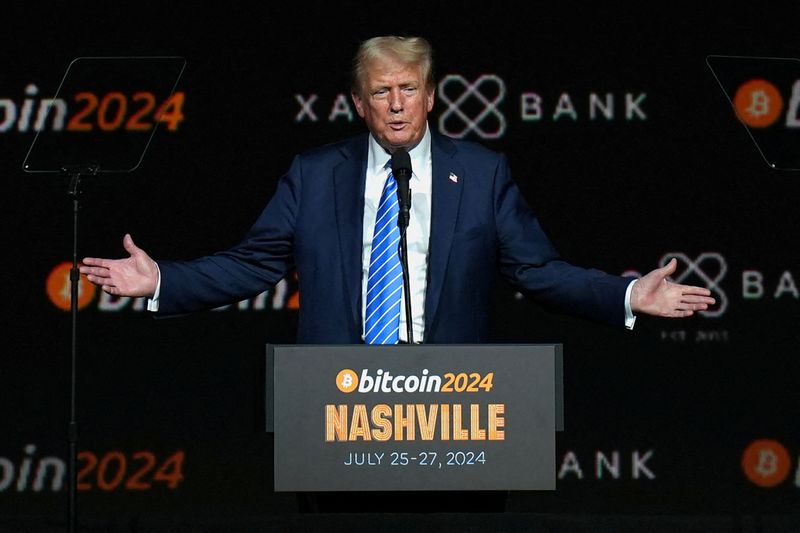

Elsewhere, the dollar was pushing higher and on course for its largest monthly rise in two and a half years on signs of strength in the U.S. economy. Bets on Donald Trump winning the presidency and strong economic data lifted U.S. yields in anticipation of policies that could delay interest rate cuts.

The U.S. dollar index has climbed 3.6% to 104.46 during October, its sharpest monthly rise since April 2022. It was last down 0.1% at 104.28.

Most analysts argued that markets are increasingly pricing in a Republican sweep, with Trump winning the presidency and his party controlling both chambers of Congress.

At $1.0816, the euro rose 0.2% on Monday but was down more than 3% on the month.

Analysts said the single currency could drop further if the U.S. enacts a global baseline tariff, in addition to higher duties on China, and other countries retaliate. Much of the move would come from higher U.S. policy rates in response to the inflationary impact of tariffs.

Meanwhile the dovish repricing of the European Central Bank monetary path is weighing on the single currency.

“The euro short-term rate (ESTR) curve continues to price in a 35 bps rate cut at the ECB meeting in December,” said Chris Turner, head of forex strategy at ING.

“And this could easily swing towards 50 bps should soft euro zone data or a U.S. Republican victory (and protectionism) materialise,” he added.

Investors are now focusing on the October government payrolls report this week, which is likely to be affected by a strike at Boeing (NYSE:BA) and two hurricanes that hit the U.S. Southeast.

Ten-year Treasury yields are up 40 basis points for October against a rise of 16 bps for 10-year bunds and 23 bps for gilts.

A further drag from disappointment in China’s stimulus plans had the Australian and New Zealand dollars under pressure and slipping to 2-1/2 month lows on Monday.

Selling carried the kiwi to $0.5958 and a 6% loss for October so far, while the Aussie inched lower to $0.6579 and is down 4.6% in October.

The week ahead is crowded with data, with inflation readings for Europe and Australia, gross domestic product data in the U.S. and purchasing managers’ indexes for China.

Weekend data showed industrial profit in China plunged in September, with a year-on-year drop of 27.1%.

The yuan hit its weakest since late August at 7.1355 per dollar.

This post is originally published on INVESTING.