At the end of 2024, the weakening of the yen was a source of concern for Japanese officials. Now, as the yen strengthens amid a rapid rally in Japanese bond yields, the government faces a different set of challenges. Let’s discuss this topic and make a trading plan for the USDJPY pair.

The article covers the following subjects:

Major Takeaways

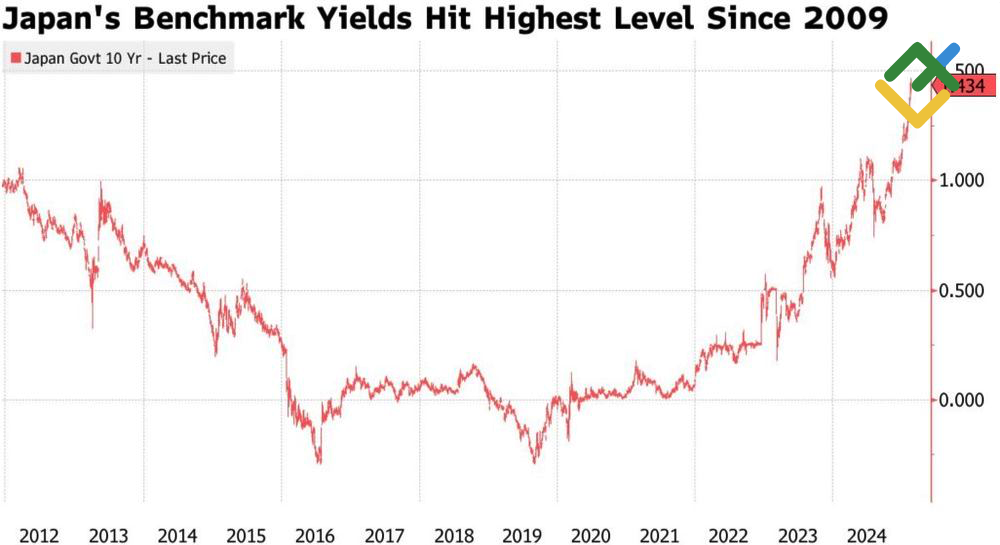

- Japanese bond yields have soared to their highest level since 2009.

- The country has a government debt of 232.7% of GDP.

- Debt servicing increases political risk.

- The USDJPY pair may fall to 147.25 and 145.

Weekly Fundamental Forecast for Yen

The Japanese government and the Bank of Japan expressed concerns over the weakening of the yen, leading to verbal interventions and an overnight rate increase. They have also indicated their intention to continue the normalization cycle. This move came as investors showed a preference for other currencies, resulting in a decline in USDJPY quotes to their lowest levels since early December. However, the outcome was not entirely in line with Tokyo’s expectations.

The expectations of further monetary restrictions by the Bank of Japan led to a surge in the 10-year Japanese bond yield, reaching the highest levels since 2009. The derivatives market increased the likelihood of an overnight rate hike in July to 84% from 70% in early February. Policy Board member Hajime Takata stressed the importance of maintaining a flexible approach to prevent economic overheating and maintain price stability.

Japanese 10-Year Government Bond Yield

Source: Bloomberg.

Meanwhile, the economy of Japan is getting hotter. Japanese exports increased by 7.2% in January, driven by front-loading of US imports due to concerns over Donald Trump’s tariffs. Consumer prices rose from 3.6% to 4%, and excluding fresh produce, CPI soared to 3.2%, the highest figure since June 2023.

Japan’s Inflation Rate

Source: Bloomberg.

The rapid surge in bond yields, which is a natural response to such circumstances, poses a significant challenge for Japan. The nation’s debt-to-GDP ratio stands at 232.7%, and the associated costs are not only a burden on the budget but also a source of concern for the ruling party’s political stability.

According to Prime Minister Shigeru Ishiba, increasing interest rates in the face of a substantial national debt-to-GDP ratio exerts pressure on political spending by raising interest payments. Finance Minister Katsunobu Kato notes that higher bond yields lead to increased debt service costs and create political tensions.

Bank of Japan Governor Kazuo Ueda has dealt a blow to USDJPY bears, stating that the central bank will flexibly increase bond purchases to stabilize the debt market. As a result, interest rates saw a slight decline, prompting the yen to retreat in the short term.

Weekly USDJPY Trading Plan

A decline in the USDJPY exchange rate would be less steep if not for the Trump trade retreat. The US President’s actions and statements have the potential to impact the market more significantly than his actions, leading to a reduction in long positions in the US dollar. If this trend persists, the pair could slide to 147.25 and 145. As long as the quotes remain below 150.75, a focus on selling is advisable. The increase in import duties suggests that the European Central Bank will likely implement an aggressive rate cut, allowing traders to generate profits on diverging monetary policies. In this case, short trades can be opened on the EURJPY pair, adding them to the ones initiated at 158.9.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.