Despite Tokyo’s efforts to assure markets of its stance against currency intervention, investors continue to discuss the matter. The USDJPY pair is sliding, and Washington’s intention to strengthen the yen is not the sole factor contributing to this trend. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The Forex market is buzzing about currency interventions.

- Japanese bond yields are rising faster than their counterparts.

- The capital inflow is strengthening the yen.

- Short trades on USDJPY formed at 147.2 can be kept open.

Weekly Fundamental Forecast for Yen

When investor sentiment drives market movements, the outcomes are often predictable. Individual investors, who collectively control 38% of US stocks, have played a pivotal role in offsetting market downturns. Their strategic purchasing has contributed to a notable rebound, as evidenced by the S&P 500’s 23% growth from its April low. Apparently, investors are not concerned about the economic slowdown, the downgrade of the US credit rating, or the Fed’s reluctance to lower interest rates. Therefore, Tokyo’s statement that the topic of currency intervention will not be addressed in trade negotiations with Washington is also disregarded by the markets. It is evident that USDJPY bears have managed to capitalize on this opportunity.

Japanese Finance Minister Katsunobu Kato has stated his intention to engage in discussions regarding currency policy with Treasury Secretary Scott Bessent. The dialogue is planned to be based on an agreement between the two countries that exchange rates should be set by the market and that excessive volatility could have adverse consequences. Despite this rhetoric, investors remain convinced that Washington may demand that Tokyo strengthen the yen. There is already a precedent for this: during negotiations between the US and South Korea, the won rose sharply.

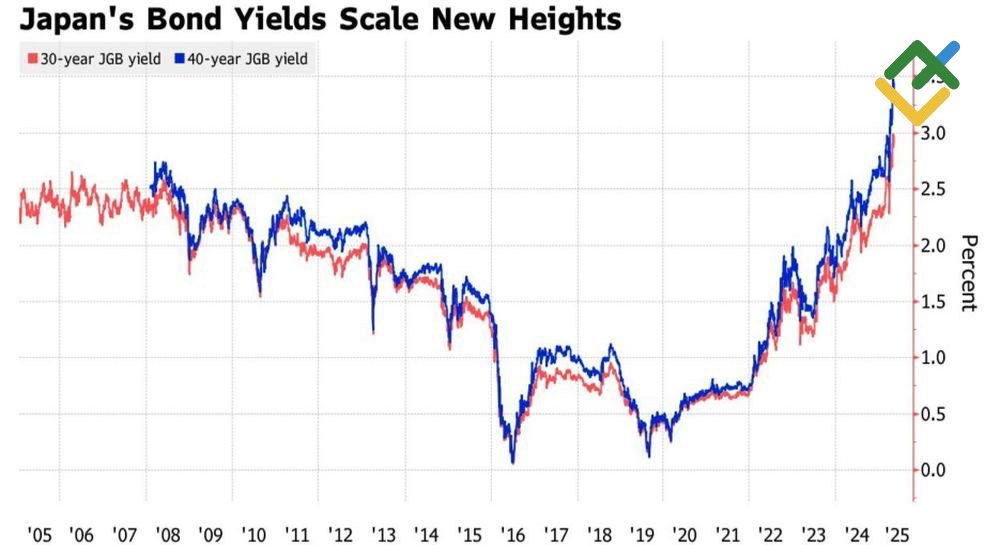

Japanese Government Bond Yields

Source: Bloomberg.

Speculation regarding a recurrence of the 1985 Plaza Accord is not the sole factor contributing to the USDJPY‘s reversion to a bearish trend. The Bank of Japan is maintaining its commitment to the strategy of increasing the overnight rate, though at a more gradual pace. In the context of persistently high inflation, this has led to an increase in government bond yields and a shift in capital flows from North America to Asia. Long-term rates are rising at a faster rate than in other developed markets: 30-year bonds have reached unprecedented highs, while 10-year bonds have doubled.

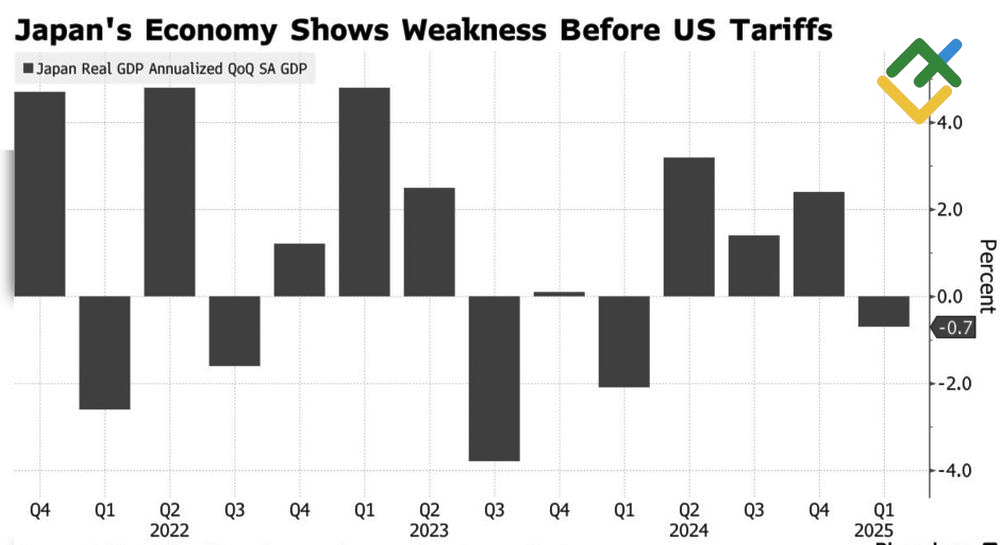

Soaring bond yields pose a significant challenge for Japanese Prime Minister Shigeru Ishiba’s government, as they increase the cost of servicing the country’s substantial public debt. As the July elections approach, this issue is becoming a serious concern for the prime minister, whose approval ratings are declining rapidly. This is particularly noteworthy given that GDP contracted by 0.7% in the first quarter.

Japan’s GDP Growth

Source: Bloomberg.

At the same time, Japan has made no progress in the ongoing trade negotiations with the US. The Japanese government has formally requested a reduction in the 25% tariff on car imports. Tokyo has expressed dissatisfaction with the agreed-upon tariffs of 24% and 10%, respectively. According to officials, the decision to sign the agreement will not be influenced by the actions of other countries. First and foremost, national interests must be prioritized.

Weekly USDJPY Trading Plan

The yen’s strengthening amid growing global risk appetite may seem somewhat unexpected, but USDJPY bears have other key advantages: the US administration’s desire to see lower quotes for the pair and capital flows into Japan. Against this background, previously established short positions at the level of 147.2 can be maintained and periodically increased.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.