Political uncertainty has led to fluctuations in the USDJPY exchange rate. In the wake of the Liberal Democratic Party’s (LDP) underwhelming performance in the recent elections, the question on many minds is: Who will lead Japan’s government going forward? Will Donald Trump’s policies have an impact on the markets? Let’s discuss these topics and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The LDP has lost its majority in Japan’s parliament.

- Election results will make BoJ cautious.

- The Trump trade strengthens the US dollar.

- The USDJPY pair may rally to 158 and 160.

Weekly fundamental forecast for yen

Will the political unrest in Japan harm the value of the yen? Since mid-September, the USDJPY pair has embarked on a steady upward trajectory, driven by expectations of suboptimal outcomes for the ruling party in the Japanese parliamentary elections and the return of Donald Trump to the White House. As anticipated, the expectations have become a reality. For the first time since 2009, the Liberal Democratic Party failed to secure a majority in the lower house. Together with its long-time ally Komeito, the LDP secured 215 seats, falling short of the 233 seats required for an absolute majority. Investors are uncertain about the future leadership of the country and are seeking to divest from the Japanese currency.

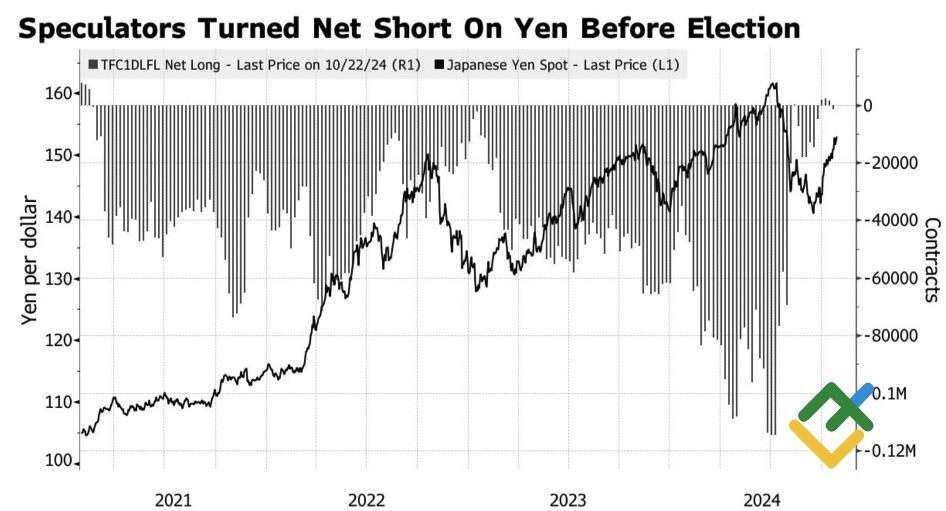

Some of the first to act were hedge funds and asset managers, turning from net buyers to net sellers of the yen in just a week. This was a prudent move, given the prevailing political uncertainty. Such unrest may force the Bank of Japan to refrain from signaling the imminent continuation of the normalization cycle at its meeting on October 31, creating an insurmountable roadblock for USDJPY bears.

Speculative positions on USDJPY

Source: Bloomberg.

At first glance, the divergence in the monetary policy of the Fed and BoJ sets the stage for a stronger yen against the US dollar. The derivatives market anticipates a decline in the federal funds rate to 3.4% from its current level of 5%. In addition, it projects an increase of 50-75 bps in the overnight rate by 2025. The narrowing differential provides a compelling argument for selling the USDJPY. However, two factors – the speed of change and the risks of unexpected outcomes – must be considered.

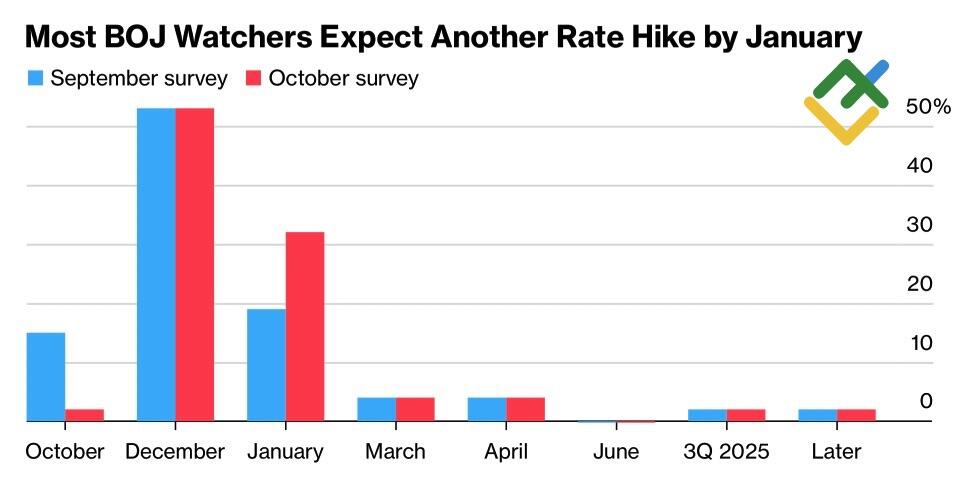

Bloomberg experts previously predicted that the Bank of Japan would take another step toward normalization in December or January. However, slowing inflation and the Liberal Democratic Party’s disappointing election results may shift this timeline to a later date. The Fed may also adopt a cautious stance if the US economy continues to give positive signals.

Expectations on BoJ’s overnight rate

Source: Bloomberg.

The current presidential race, with Donald Trump as the frontrunner, is creating further challenges for USDJPY bears. Should the Republican candidate be elected, inflation will likely accelerate. The introduction of new tariffs on imports will exacerbate existing supply chain issues. Anti-immigration policies could drive up labor market wages. Meanwhile, pressure on the Fed could lead to faster-than-necessary monetary expansion. The US central bank will likely resist and maintain high interest rates, which will support the US dollar.

Weekly trading plan for USDJPY

Therefore, it is possible that the USDJPY pair’s trend may reverse twice within a relatively short period of time. In order to keep hopes alive, bears will need to see a quick coalition forming in the Japanese parliament, as well as weak US labor market statistics for October. If so, short positions may be considered. Otherwise, the pair will likely hit the bullish targets at 158 and 160.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.