A weak US jobs report for June could be the perfect backdrop for the government and BoJ to intervene in the Forex market. Which level will trigger action? Let’s discuss these topics and make a trading plan for USDJPY.

Weekly fundamental forecast for Japanese yen

According to Mizuho Bank and Sumitomo Mitsui DS Asset Management, USDJPY bulls claim that the previous currency interventions were unsuccessful, predicting the pair to climb to 170. On the contrary, Macquarie Group expects the US dollar to weaken to ¥120. The failures of the government and the Bank of Japan are due to the fact that they are acting on the wrong side. Once the Fed starts cutting rates, there will be nothing left for the pair to do but plummet sharply.

The previous unsuccessful intervention in the Forex market took place in late April and early May and cost the authorities more than $60 bln. According to Citigroup, the BoJ has about $200-300 bln at its disposal for instant currency interventions. However, it is far from money that determines their effectiveness. Until the macroeconomic background changes, it is difficult to expect the USDJPY uptrend to reverse.

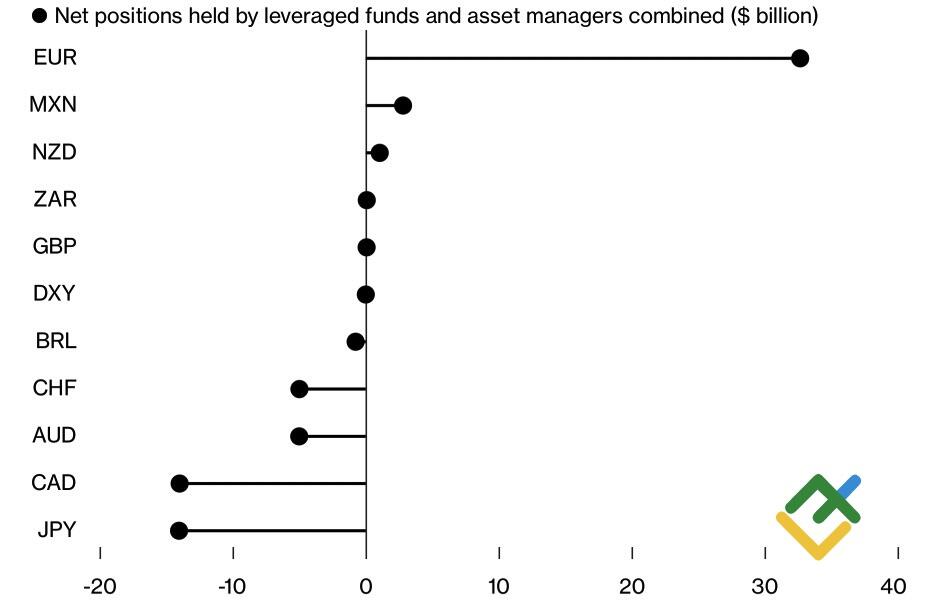

A very wide differential in the US and Japanese debt market rates allows speculators to remain bearish on the Japanese yen. In theory, this may end in huge losses, but it will take both Tokyo and Washington to deprive hedge funds and asset managers of their money.

Speculative net positions on G10 currencies

Source: Bloomberg.

Unsurprisingly, government officials, including Finance Minister Shunichi Suzuki, do not name a specific level that does not meet the authorities’ objectives. They only lavish investors with verbal interventions. MUFG believes the line in the sand for USDJPY will be 162, Wells Fargo names a level of 165. However, tying intervention to important events looks far more realistic than reacting to a specific USD/JPY rate.

The results of the first round of the French parliamentary elections boosted the euro quotes but did not slow down USDJPY bulls. Perhaps the statistics on the US labor market will help their opponents. In the Forex market, some believe that a sharp increase in unemployment in June will force the Fed to talk about a September cut in the federal funds rate, lower the yields on US Treasuries, and help the Bank of Japan to improve the situation.

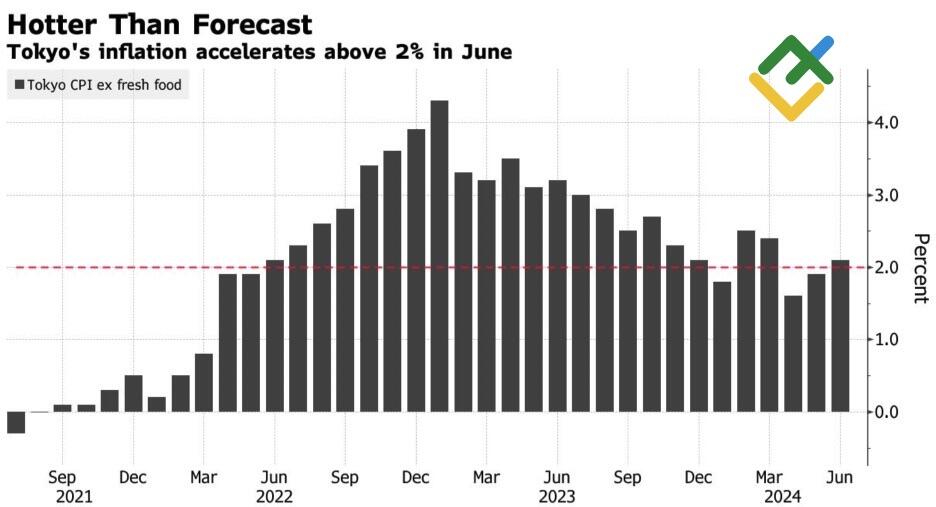

Accelerating inflation in Tokyo, the leading indicator for national consumer prices, allows Kazuo Ueda and his colleagues to raise the overnight rate as early as late July. Coupled with the QE slowdown and currency intervention, this could be a triple blow for USDJPY. However, without the help of the US, Japan is unlikely to be able to stabilize the quotes.

Tokyo’s inflation change

Source: Bloomberg.

Weekly USDJPY trading plan

The USDJPY is on the verge of currency interventions. It is extremely dangerous to buy the Japanese currency. On the contrary, one can place pending orders to sell the pair at 160.25 and 159.5 levels. The Bank of Japan will likely enter the market against weak US employment data for June, which will accelerate the collapse of the US dollar against the yen.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.