The overnight rate hikes at the Bank of Japan’s March and July meetings and Tokyo’s $100 billion currency intervention failed to reverse the upward trend in the USDJPY exchange rate. The question arises: what does the future hold for the Japanese yen? Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- In early 2024, the yen was among currency market leaders.

- Despite the BoJ rate hike, it was a bad year for the yen.

- The market is speculating about the levels from which Tokyo will intervene.

- A USDJPY rally towards 160 and 162 is gaining momentum.

Monthly Fundamental Forecast for Yen

The Japanese yen began 2024 as a prominent G10 currency and concluded the year as one of two underdogs, alongside the Norwegian krone. Despite the Bank of Japan having increased the overnight rate twice, in March and July, by a total of 50 basis points, and the US Federal Reserve reducing the fed funds rate by the same amount, the USDJPY pair has surged by nearly 12%. The intervention of $100 billion by the Japanese government did not yield positive results.

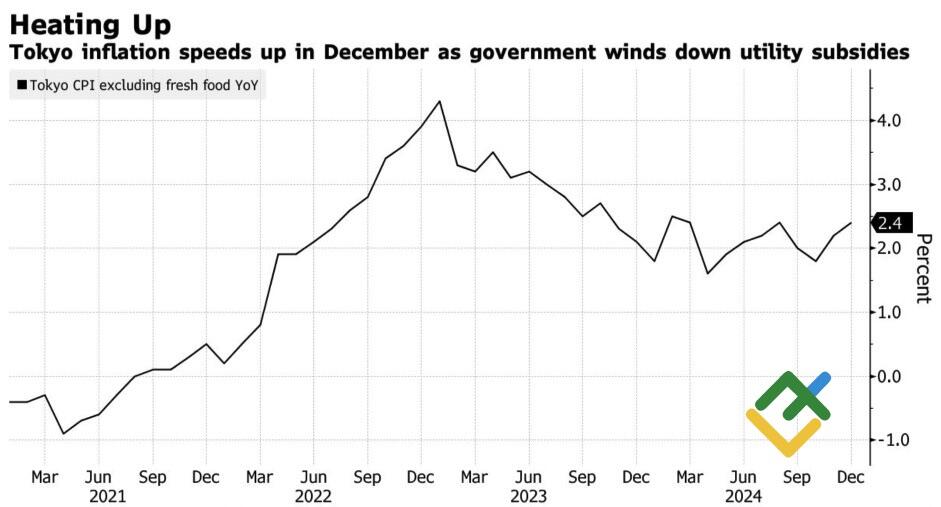

Over three years, the yen has depreciated by approximately 37% against the US dollar. The weakening of the currency has led to increased import prices and inflation, which has surpassed the central bank’s target of 2% since April 2022. In December, consumer prices in Tokyo, a leading indicator for the national CPI, increased from 2.3% to 2.5%. Bloomberg experts predicted growth of 2.4%, and such trends in the indicator may prompt the BoJ to take proactive measures. However, the regulator has delayed action.

Tokyo CPI Change

Source: Bloomberg.

The question of causation is a complex one, with many potential factors contributing to the current economic climate in Japan. One point of discussion is the deflationary mindset that has persisted in the country for decades. Another point is the recent parliamentary elections, in which the ruling party did not prevail. In order to build a coalition, the Liberal Democrats have been compelled to make concessions to other parties that demand the continuation of ultra-soft monetary policy.

As a result, there was talk at the last BoJ meeting that the normalization cycle should be put on pause until the degree of uncertainty in the new US policy is reduced. Another factor is the outcome of wage negotiations between labor unions and companies. The decision to raise the overnight rate was not supported by only one member of the Policy Board out of nine.

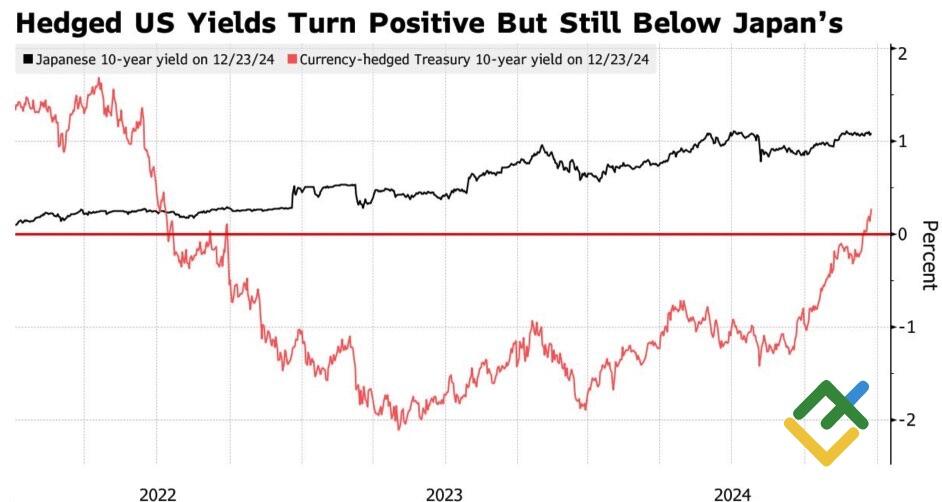

The pause in the monetary policy cycles of the Fed and the Bank of Japan has allowed investors to resume the carry trade strategy, which involves the use of the yen as a funding currency. When the yen is used as a funding currency, it is actively sold, spurring USDJPY quotes. Furthermore, for the first time since 2022, Japanese investments in US Treasuries with simultaneous hedging of currency risks have shown a positive trend.

Japanese and US Bond Yields

Source: Bloomberg.

Tokyo is prepared to take action against USDJPY bulls through verbal and currency interventions. However, history has shown that when the US dollar is not weakening due to dovish signals from the Fed or disappointing statistics from the United States, Japan’s intervention in the Forex market has not been effective.

Monthly USDJPY Trading Plan

In the financial markets, traders are beginning to establish clear boundaries, indicating the potential for currency intervention. Based on my analysis, the USDJPY pair has not reached these boundaries, making it advantageous to open long trades on pullbacks, adding them to the ones initiated at 150.8, with the targets at 160 and 162.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.