The Bank of Japan’s distinct approach to monetary policy compared to that of other central banks has boosted the yen in the Forex market. However, when the BoJ slows its policy, carry traders enter the market, causing the USDJPY rate to surge. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The Bank of Japan kept the overnight rate unchanged at 0.5%.

- Uncertainty surrounding the US trade policy was the reason for the pause.

- The yield spread is a negative factor for the Japanese currency.

- The USDJPY pair can be sold on a rebound from 150.7 and 151.65.

Weekly Fundamental Forecast for Yen

The Bank of Japan has decided to suspend the normalization of its monetary policy, maintaining the overnight rate at 0.5% in March. Kazuo Ueda cited the uncertainty surrounding US trade policy, leading to a divided outlook among traders regarding the BoJ’s subsequent course of action. As a result, the USDJPY pair saw elevated volatility, attempting to return to the 150 psychological threshold.

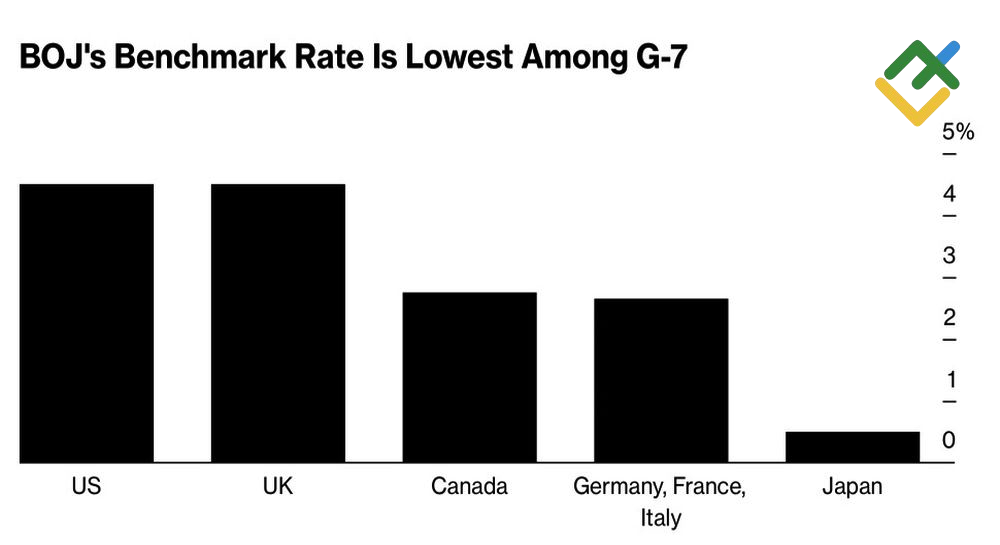

Major Central Banks’ Interest Rates

Source: Bloomberg.

Despite the fact that Japan’s borrowing costs are still significantly lower than those of other G7 countries, the Bank of Japan is raising rates while other central banks are lowering or keeping them unchanged. As a result, the yen has become the main favorite in the Forex market, at least among G10 currencies. Over time, the US-Japan bond yield spread will narrow, pushing the USDJPY pair down.

However, as long as both the BoJ and the Fed maintain their pause, the spread will remain unchanged. The spread remains substantial, allowing carry traders to sell the yen as a funding currency, making the pair undergo a correction.

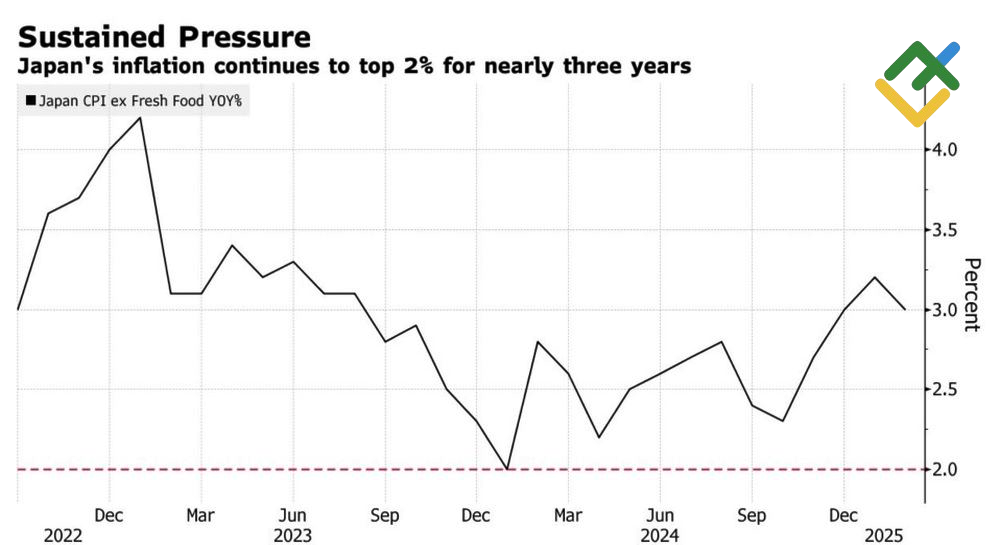

On paper, the still high levels of consumer prices at 3.7% and core inflation at 3%, the acceleration of exports from 7.3% to 11.4% in February, and the fastest spending of cash reserves by Japanese households since 1998 all point to an imminent increase in the overnight rate. However, Kazuo Ueda has noted that the BoJ will have more data to make decisions in April, hinting clearly at the rates announced by the White House.

Japan’s Inflation Rate

Source: Bloomberg.

Meanwhile, the announced reciprocal tariffs may not be as extensive as the markets had anticipated. The US administration is expected to adopt a selective approach. It will prioritize tariffs on countries and regions that bring the most acute pain to the US. Against this backdrop, the USDJPY will likely start a consolidation phase.

However, it is crucial to consider the potential impact of Donald Trump’s eccentric behavior. The US President has repeatedly surprised financial markets with his speeches. He declared April 2 as America’s Liberation Day. Meanwhile, new tariff threats could bolster the US dollar.

The ongoing decline in the differential between US and Japanese bond yields suggests a stable downtrend for the USDJPY rate. However, in the short term, there are risks of correction or consolidation. In light of these potential fluctuations, traders can consider selling the pair on upward pullbacks.

Weekly USDJPY Trading Plan

The USDJPY pair may rebound from resistance levels of 150.7 and 151.65, allowing traders to lock in profits on long positions formed at 149.15. After that, short positions can be opened once the pair declines below 148.8 and 148.1.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.