A decline in the yen’s rate accelerates inflation, but a rate rise harms Japanese exports. Where is the golden mean? Let’s discuss it and make a trading plan for USDJPY.

The article covers the following subjects:

Highlights and key points

- Slowing inflation in Japan complicates BoJ’s task.

- Government pressure on the central bank risks increasing.

- Tokyo does not need wide fluctuations in USDJPY.

- The pair will depend on how successfully 150.7-151 and 152.2 levels are tested.

Weekly fundamental forecast for yen

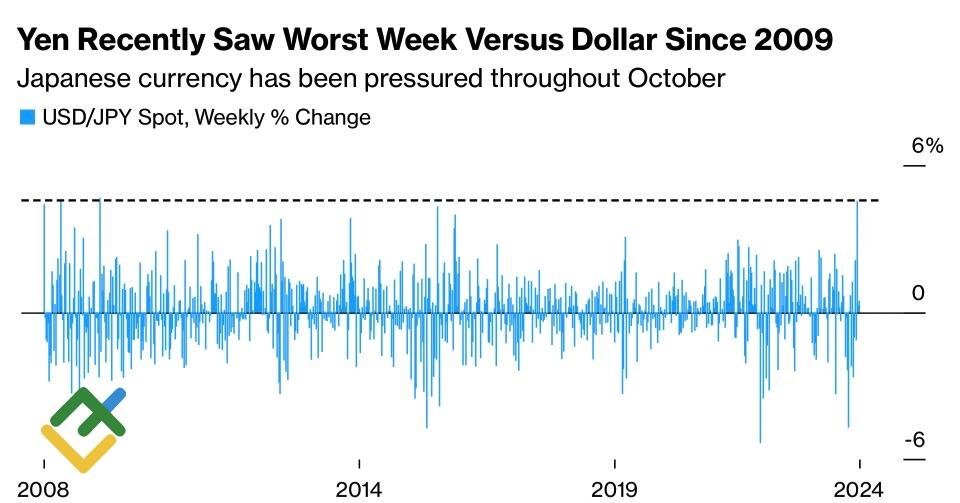

Prime Minister Shigeru Ishiba gave a few instructions to the Bank of Japan and then said it could do whatever it wanted. The problem is that the BoJ does not know what it wants. It seems necessary to normalize monetary policy, but signs of slowing inflation make this doubtful. Concerningly, USDJPY has had its best week since 2009 and is approaching the levels from which Tokyo began its currency interventions.

USDJPY weekly trends

Source: Bloomberg.

In September, Japanese consumer prices slowed from 2.8% to 2.4%. According to Reuters experts, the growth pace of the leading indicator — Tokyo’s inflation — will fall to 1.7% in October, below the Bank of Japan’s 2% target. Such dynamics indicate that it will be increasingly challenging for the BoJ to maintain its monetary restriction path without risking a decrease in CPI.

This is not part of the government’s plans to decisively combat deflation as the Liberal Democrats’ ratings continue to fall. Polls show that the ruling party will gain 22.6% of the vote in the parliamentary elections on October 27, narrowing the gap with the opposition Constitutional Democrats to 8.5 percentage points. The LDP may lose its majority in the lower house and will not be able to secure it even in coalition with its long-standing partner Komeito.

There is a high risk that the government will resume pressure on the Bank of Japan in such conditions. On the other hand, the Cabinet of Ministers has returned to verbal interventions. Officials criticize USDJPY‘s one-sided movements, which increases the risk of government intervention in Forex. About $100 billion was spent on currency interventions in 2024. At the same time, rumor has it that the increase in the overnight rate in July by 80-90% was due to the weakening of the yen.

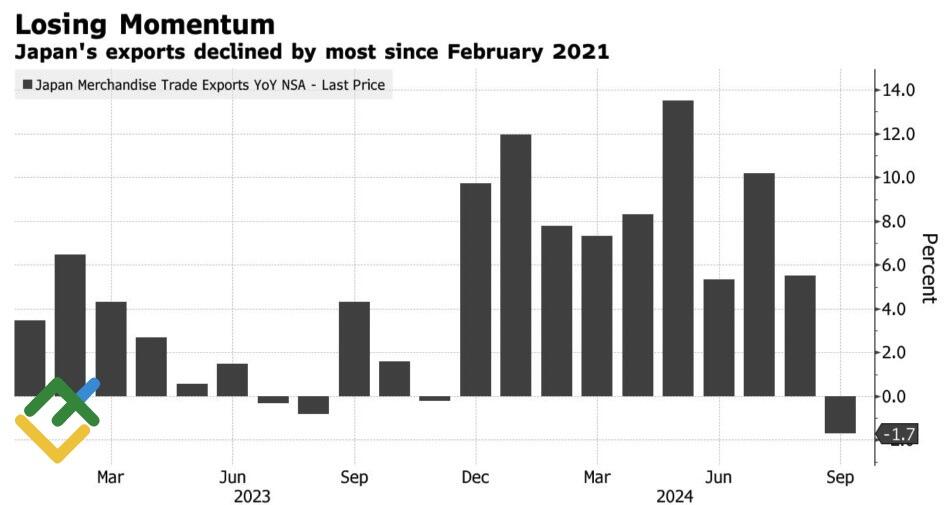

Thus, Tokyo does not want to allow sharp fluctuations in USDJPY. The pair’s rally risks accelerating inflation and prodding the BoJ into continuing its policy tightening cycle. On the contrary, a stronger yen negatively impacts exports, as evidenced by the decline in the September indicator into negative territory and the worst dynamics since February 2021.

Japan’s Export Dynamics

Source: Bloomberg.

Thinking that the Bank of Japan can handle USDJPY‘s sharp fluctuations alone would be unwise. The break in the upward trend during the summer was driven not only by currency interventions and an increase in the overnight rate but also by inflated expectations regarding the Fed’s monetary policy loosening. The pair is growing now that these expectations are declining. Moreover, the Trump trade factor benefits the US dollar.

Weekly trading plan for USDJPY

USDJPY‘s further moves will depend on the bulls’ ability to break through resistance at 150.7-151 and 152.2. If they succeed, the risk of returning to 158 and 160 will increase. A pullback will be a reason to go short.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.