Despite the Bank of Japan’s potential rate hikes in 2025, the yen’s weakening is unlikely to be halted. The slowdown in the Fed’s monetary expansion cycle, in conjunction with the ongoing strength of the US economy, will have a greater impact on the USDJPY exchange rate. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Tokyo’s verbal interventions do not frighten speculators.

- The strength of the US economy will support the rally in US Treasury yields.

- The slowdown in the Fed’s monetary expansion is putting pressure on the yen.

- The USDJPY pair may continue soaring to 160–160.5.

Weekly Fundamental Forecast for Yen

Japan is committed to maintaining an ultra-soft monetary policy for as long as possible but is dissatisfied with the yen’s weakening. This stance has allowed speculators to challenge the Bank of Japan. Investors have stopped reacting not only to the verbal interventions but also to Kazuo Ueda’s words that the BoJ may raise the overnight rate. However, for this to occur, there must be improvements in economic and price conditions. The USDJPY is poised to continue its rally, and it is challenging to predict what could hinder the bullish trend.

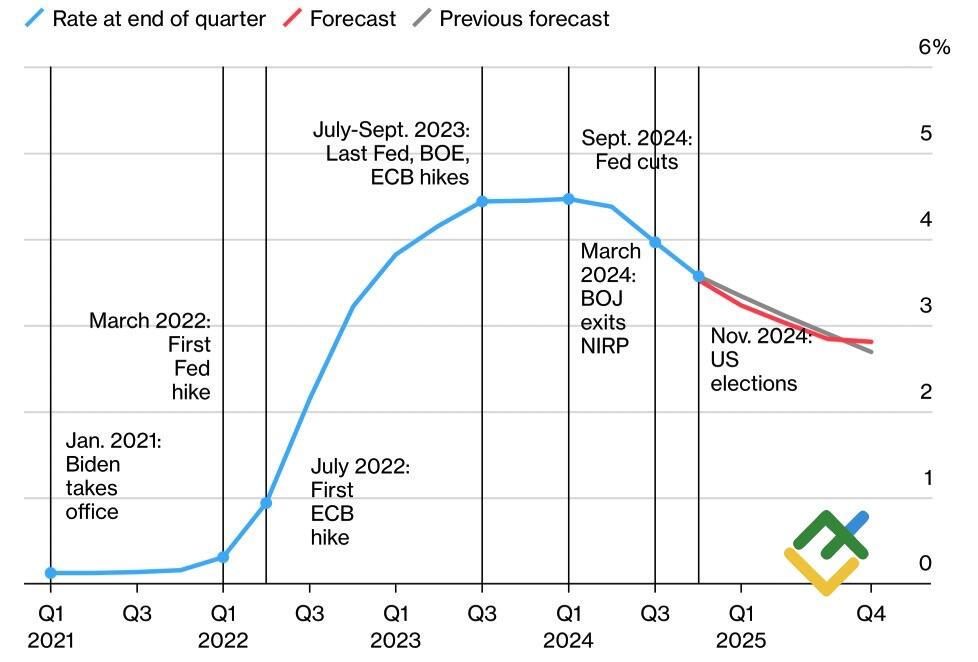

In early 2024, the yen was among the top-performing currencies. However, it became one of the year’s major disappointments on Forex. In 2025, the situation is different. At the end of 2023, the derivatives market anticipated 6-7 acts of monetary policy easing by the Fed, but the federal funds rate only fell by 75 bps. The rate differential with Japan is 425 bps, which keeps the carry trade strategy relevant and supports the USDJPY rally.

Bloomberg estimates that the pace of global monetary expansion will slow to an average of 72 bps in 2025. The Fed is expected to maintain its position at the forefront of the market, with the derivatives market projecting a 43bp reduction in borrowing costs. Despite the Bank of Japan raising the overnight rate twice to 0.75%, the spread is projected to narrow to 325 bps. Against this backdrop, carry traders will unlikely retreat. The upward trend in the USDJPY exchange rate is likely to persist.

Global Monetary Expansion Rate

Source: Bloomberg.

The impact of Donald Trump’s tariffs could potentially exert additional pressure on the yen. So far, Trump has not targeted Japan directly, but he has threatened China, Mexico, Canada, and Europe with tariffs. Meanwhile, Japan has a significant foreign trade surplus with the US, estimated at $230.9 billion, making it the second largest trade partner after China, with $334.7 billion. If Washington’s import duties are imposed on Beijing, Tokyo will likely bear the brunt of the impact.

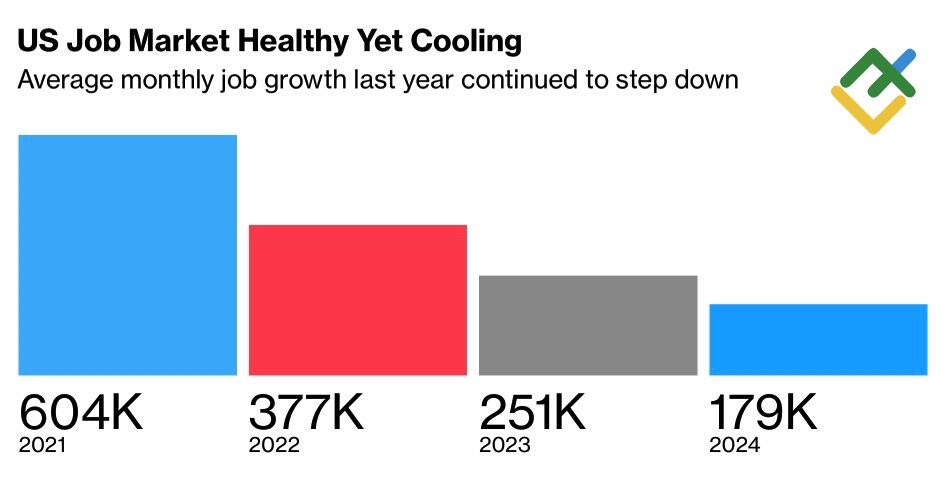

The primary threat to USDJPY bears is a renewed rally in US Treasury yields. As the US economy stabilizes, there is an increased likelihood of rising debt rates and capital flows from Asia to North America. In this regard, the forecast of Bloomberg experts on the slowdown in non-farm employment from an average of 179,000 per month in 2024 to 160,000 in 2025 confirms that the labor market is robust, albeit cooling.

US Job Market Statistics

Source: Bloomberg.

Weekly USDJPY Trading Plan

At this time, USDJPY bulls have no cause for concern. Neither verbal nor currency interventions from Japan will disrupt the uptrend without negative news from the US. On the contrary, robust US employment statistics for December will likely allow traders to open more long positions with the target at 160–160.5.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.