The Bank of Japan’s currency interventions yielded positive outcomes. In light of the recent slowdown in the US labor market and rising inflation, it is likely that the USDJPY uptrend will soon come to an end. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

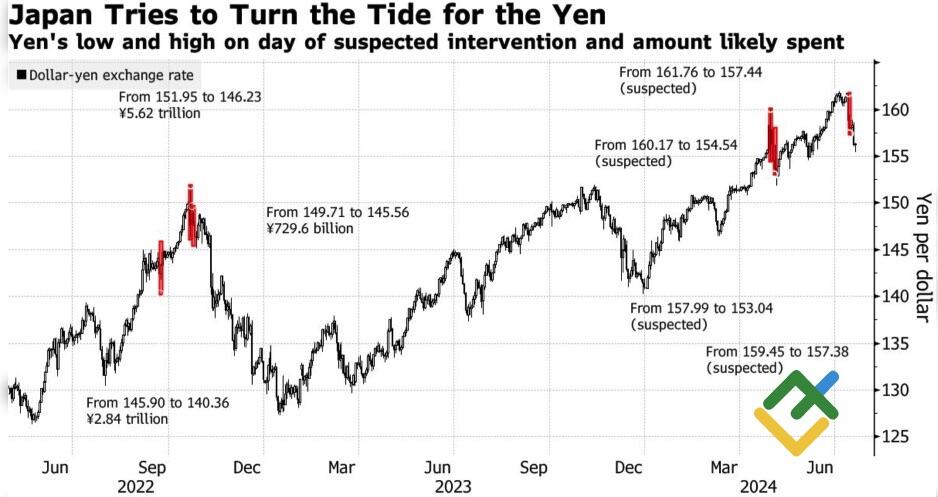

- The total volume of BoJ currency interventions in July is estimated at $35.5 billion.

- The interventions proved to be effective against a slowdown in the US economy.

- The Fed will cut rates, and the differential with Japan will shrink.

- Consider short trades once the pair rebounds from 158.85 and consolidates below 156.45.

Weekly fundamental forecast for Japanese yen

No sooner has Donald Trump come to power than he is wreaking havoc in the market. His statement that Taiwan should pay the US for its security sent tech stocks tumbling. The sell-off continued due to the threat of US intervention in foreign exchange, as Trump noted a significant currency problem. The S&P 500 correction allowed the US dollar to showcase its best daily rally since early June and forced USDJPY bears to retreat.

After news broke that the Bank of Japan had intervened on two consecutive days, injecting $22 billion and $13.5 billion into the market, investors began reconsidering their views on the USDJPY pair’s future. According to Shinkin Asset Management, the worst is over for the yen. As US inflation and the labor market slow, the interest rate differential between the US and Japan will narrow, leading to a decline in the US dollar, especially as Donald Trump’s verbal interventions hint at possible intervention.

BoJ’s currency interventions

Source: Bloomberg.

According to Capital Economics, interest rate differentials will gradually shift in favor of the yen, eventually pushing the USDJPY pair down to 145 by the end of the year.

The BoJ could accelerate this process in late July if it decides to raise the overnight call rate. Most Bloomberg experts do not expect monetary tightening as the economy continues to show signs of weakness. For example, the government lowered its GDP growth forecast for fiscal 2024 to 0.9% from 1.3% due to weak consumer demand. The IMF trimmed its estimate for the current year to 0.7% from 0.9%, citing a temporary setback in auto production and sluggish private investment in the first quarter.

Former Bank of Japan executive director Hideo Hayakawa believes that the regulator will not change the overnight rate in July as most of the data is not in line with its expectations. To prevent the yen from weakening, the BoJ will taper QE more than markets expect.

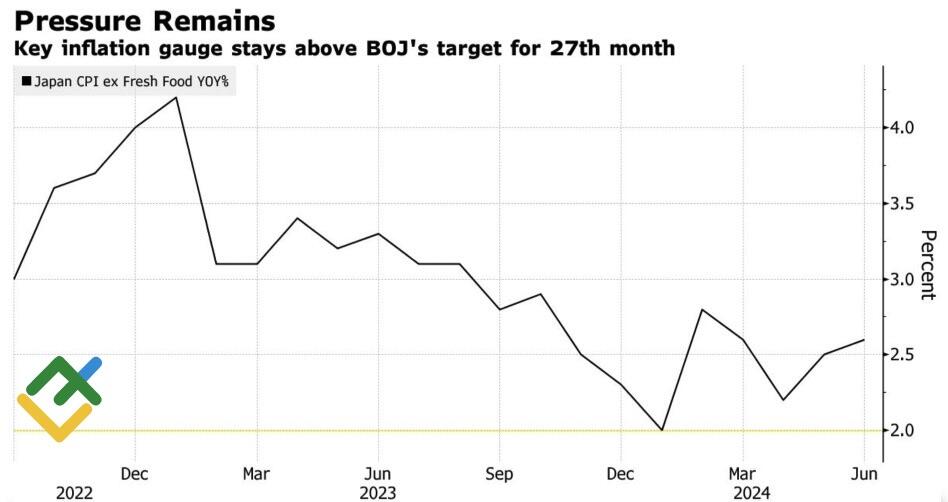

In contrast, Capital Economics predicts that Kazuo Ueda and his colleagues will resort to monetary restraint in both July and October. In 2025, they will pause the process because a Fed rate cut would weaken the US dollar, strengthen the yen and slow inflation. Japan’s consumer prices accelerated to 2.6% from 2.5% in June, above the 2% target for the 27th consecutive month.

Japan’s CPI change

Source: Bloomberg.

Weekly USDJPY trading plan

The bullish trend in the USDJPY has been broken. Consider short trades after a rebound from resistance at 158.85 or a drop below support at 156.45, adding these trades to the ones opened at 160.25. The main risk for this scenario is that Donald Trump will come to power and continue to shock the financial markets with his speeches.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.