While the Japanese government and the Bank of Japan are attempting to stabilize the USDJPY pair, the yen is awaiting the outcome of the US presidential election, as this event will influence the future of the US economy and the yield of US Treasuries. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- Political uncertainty in Japan will not affect the BoJ.

- Kazuo Ueda’s hints on rate hikes supported the yen.

- The Japanese yen’s future rate depends on the US presidential election.

- The USDJPY pair may rise to 155.5, and the EURJPY pair may fall to 161.

Weekly fundamental forecast for yen

Japan does not want to see the yen as too strong or weak. In the first instance, there is a detrimental impact on exports. In the second case, inflation accelerates, and the cost of imports increases, which presents a significant challenge for an energy-dependent country. Japan requires a stable currency. The government’s verbal interventions, coupled with the moderately hawkish rhetoric of the Bank of Japan, have prevented bulls from pushing the USDJPY pair higher.

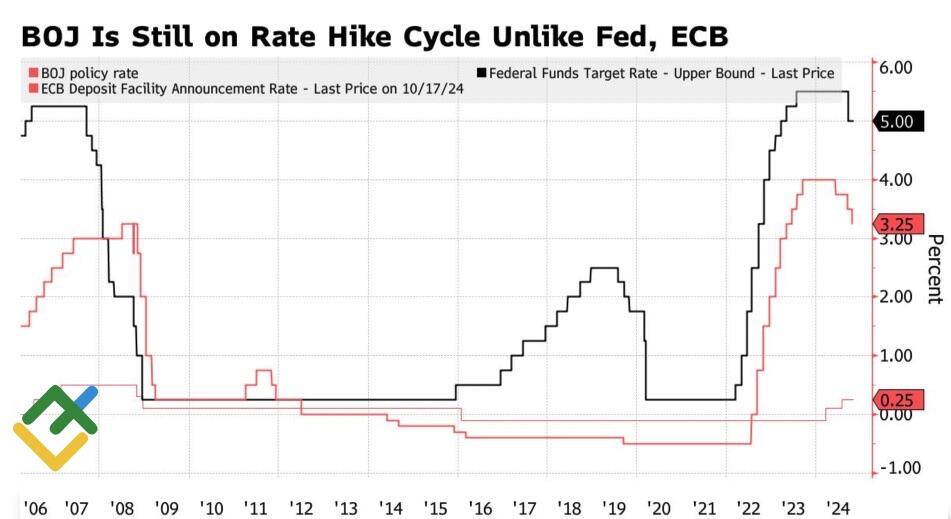

From a financial perspective, the yen is a clear leader in the foreign exchange market, as the Bank of Japan is pursuing a policy of rate increases rather than decreases, in contrast to the approach taken by most other major central banks. However, the pace at which it does so affects the USDJPY rate. If the pace is slow, the bond yield differential remains wide, and money continues to flow from Asia to North America, which weakens the yen. Political uncertainty due to the ruling Liberal Democratic Party losing its majority in parliament has pushed USDJPY quotes above 153.8.

BOJ, ECB, and Fed interest rates

Source: Bloomberg.

Kazuo Ueda promptly addressed the concerns of the speculators, assuring them that the policy would not impact the overnight rate trajectory. The Bank of Japan will base its decisions on wage levels and its forecasts. The regulator anticipates inflation to reach 2.5% in the 2024/2025 fiscal year and 1.9% in the two subsequent years. These figures indicate that the normalization of monetary policy will continue.

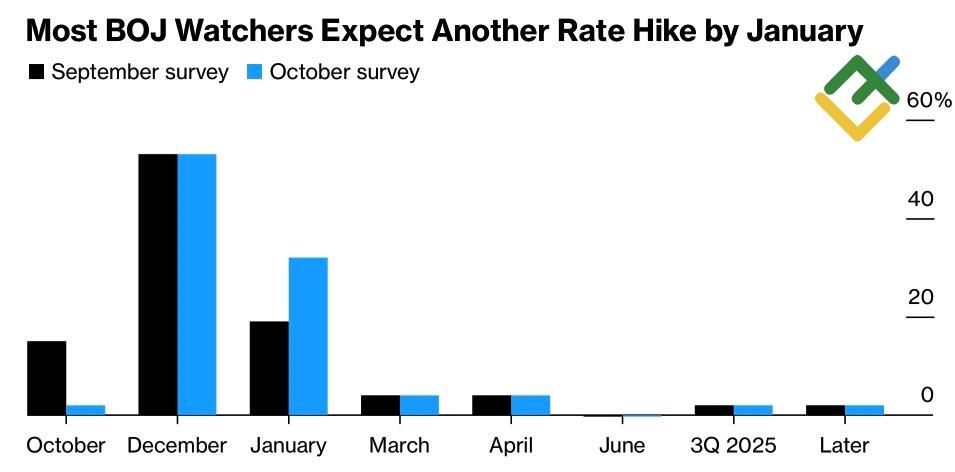

The derivatives market increased the probability of the BoJ’s next move in January to 69% from 63%. However, an increase in borrowing costs could occur as early as December. Kazuo Ueda stated that the BoJ would not require as much time as previously expected to assess the economic outlook. Notably, strong US data allows the Japanese central bank to act more quickly. Indeed, if the Fed pauses its monetary expansion in January, Japan can raise rates without concern for a strengthening yen.

BOJ rate hike expectations

Source: Bloomberg.

The government’s verbal interventions and the BoJ’s hints at the imminent tightening of monetary policy have stabilized USDJPY quotes. Japan has achieved its goal, but the success may be short-lived. Donald Trump’s victory in the US elections will likely spur US Treasury yields, boosting the US dollar against the yen.

In this regard, the growing support for Kamala Harris in the polls on the eve of the election day benefited the official Tokyo. Speculators began to lock in profits on the greenback, which prompted the USDJPY pair to stabilize.

Weekly trading plan for USDJPY and EURJPY

The outcome of the US presidential election will have a significant impact on the yen’s trajectory. Should Donald Trump win, the USDJPY pair will likely continue its upward trajectory, reaching 155.5 and creating a buying opportunity. Conversely, if Kamala Harris becomes the new president, one can consider selling the EURJPY pair with the targets of 163.2 and 161.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.