According to Kazuo Ueda, developments in the Japanese bond market reflect investors’ views on the economy, inflation, and overseas interest rate movements. The expectations are largely in line with the central bank’s outlook. Let’s discuss this topic and make a trading plan for the USDJPY pair.

The article covers the following subjects:

Major Takeaways

- The Bank of Japan is satisfied with the debt market conditions.

- The BoJ is expected to increase rates in July.

- US dollar pairs may face corrections.

- Long trades can be considered if the USDJPY pair breaches 149.15–149.25.

Weekly Fundamental Forecast for Yen

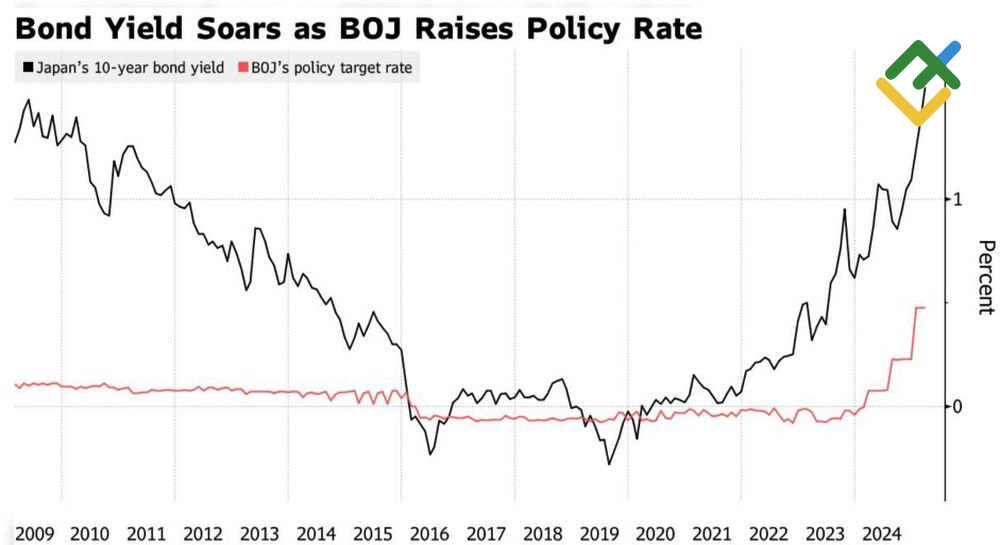

Where’s the catch? The rise in Japanese bond yields to 17-year peaks is driving up the costs of servicing the enormous government debt. They already make up a quarter of the budget, and as rates rise, costs are expected to rise by another quarter, or $230 billion, over the next four years. This poses problems for the government, whose rating continues to fall. However, the Bank of Japan believes there is nothing wrong with soaring bond yields.

BoJ Policy Rate and Japan’s Bond Yield

Source: Bloomberg.

According to Kazuo Ueda, developments in the Japanese bond market reflect his views on the economy, inflation, and interest rate changes overseas. The BoJ generally agrees with his stance. Its position is that the creation of a prolonged cycle of rising wages and spending is worth adjusting to higher borrowing costs.

According to Bloomberg, BoJ officials have no intention of intervening in the market for fear of creating yield thresholds that would damage market functioning.

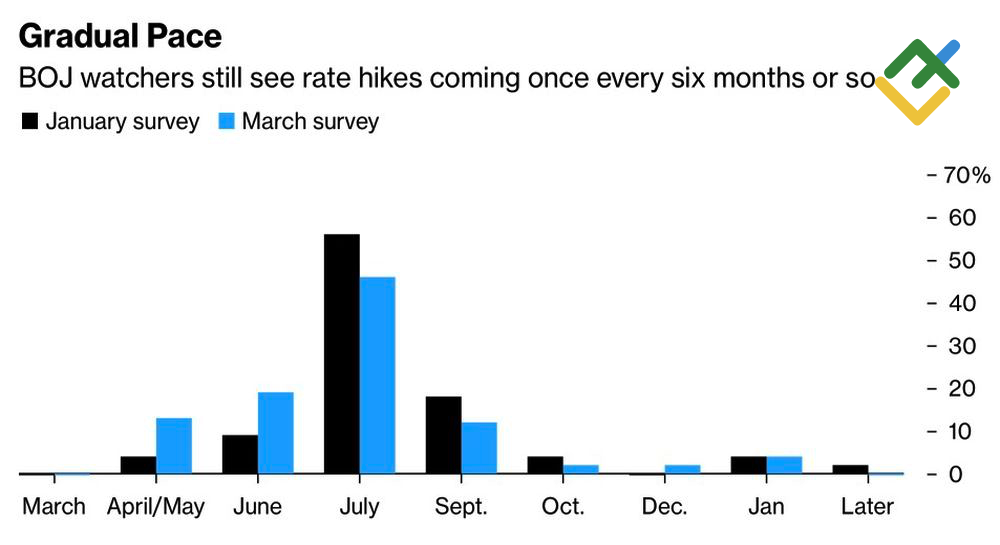

If the rally in Japanese bond yields is not bothering the central bank, why is the USDJPY pair not continuing to fall against the backdrop of a weak US dollar? The main reason is the BoJ’s sluggishness. None of the 52 experts polled by Bloomberg expects the overnight rate to increase at the BoJ meeting on March 19. July remains the most favored option, although the percentage of respondents in favor has dropped from 56% to 48%. A clear majority, 76%, expect rate hikes to take place at 6-month intervals, which curbs the yen’s rally.

BoJ Overnight Rate Expectations

Source: Bloomberg.

In any other situation, a week with the Bank of Japan and Federal Reserve meetings would be a pivotal one for the USDJPY pair. However, given the Trump factor, the pair’s trajectory has undergone a fundamental shift from those observed over the past decades.

Markets are bracing for a new batch of US tariffs scheduled for April, looking for signs that Trump’s protectionist policies are slowing US economic growth. This is exerting pressure on the US dollar, but its decline in March appears to be excessive. Meanwhile, US dollar pairs may experience corrections, creating lucrative opportunities for USDJPY bulls. The US economy remains resilient, and concerns about a recession are largely unfounded.

Weekly USDJPY Trading Plan

The pair’s trajectory will depend on a breakout of the resistance area of 149.15–149.25. If the USDJPY pair manages to pierce this area, it may perform a pullback, allowing traders to open short-term long positions. After that, traders may consider medium-term short positions on a rebound from 150.75 and 151.7. On the contrary, if the quotes fail to pierce the resistance area of 149.15–149.25, short trades can be considered.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.