Polish

online broker XTB is implementing stronger security protocols after a client

publicly claimed losing approximately 150,000 Polish zloty ($38,000) in what

appears to be a sophisticated hacking scheme that might have affected at least

a few investors across Central Europe.

XTB Faces Security

Scrutiny After Client Loses $38,000 in Alleged Hack

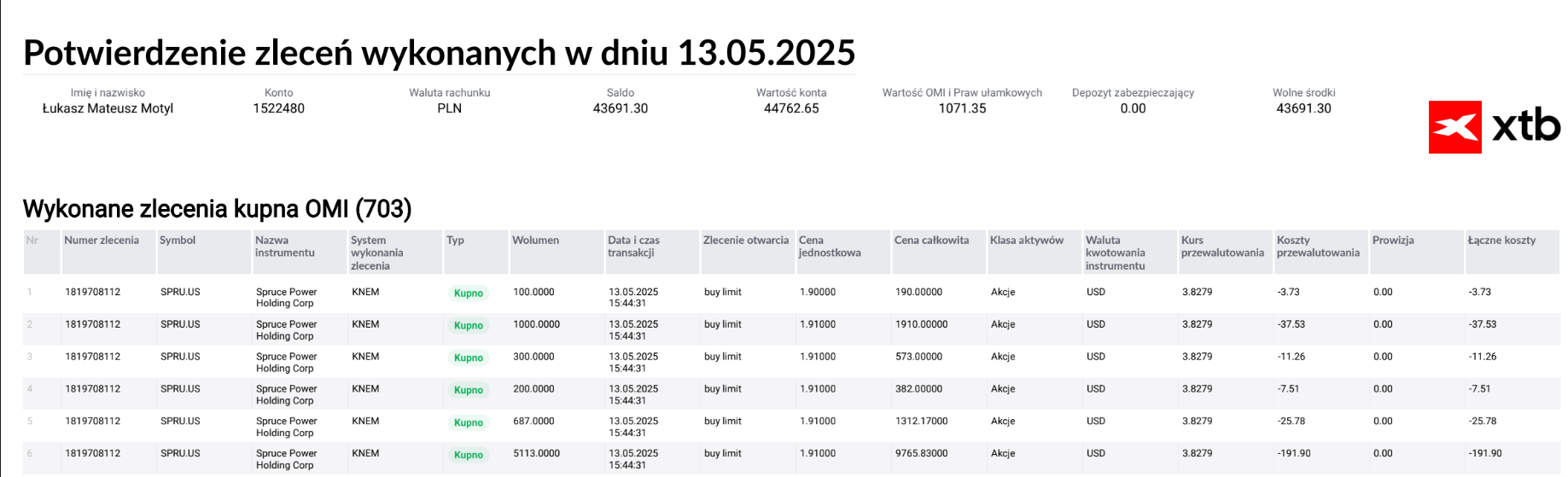

The

controversy erupted over the weekend when a five-year XTB client shared a detailed post on social media describing how hackers allegedly drained his

account through thousands

of rapid-fire trades on obscure financial instruments (including nano-caps

companies like Spruce Power). The client, who had built his portfolio to nearly

200,000 zlotys, discovered 75% of his funds had vanished in what he described as

“programmed slaughter” of his holdings.

The alleged hacker’s method was particularly clever. Rather than attempting direct

withdrawals, which XTB restricts to verified customer bank accounts, the

attacker reportedly executed simultaneous buy-sell transactions on low-liquidity

securities. The victim’s account consistently lost money on each trade while

the hacker’s separate account profited from the other side of the transactions.

“Everything

was sold in minutes: even long-held stocks, ETFs, securities that hadn’t been

touched for years,” the client wrote in his viral post.

Should Clients Protect

Themselves, or Do Firms Share the Responsibility?

It is worth noting, the client had not enabled two-factor

authentication (2FA), which the broker introduced as an optional security

feature in September last year. However, the action prompted a swift response from the fintech . Hours after the client’s story

gained traction across local financial forums and media outlets, the broker announced plans to

enhance its two-factor authentication system and make it mandatory for all

users.

“Security

of XTB client funds is our highest priority,” said Adam Dubiel, Chief

Product & Technology Officer at XTB. “We have taken action in three

areas: further improvement and development of two-factor authentication

methods, mandatory securing of client accounts through 2FA, and active

communication and education in the field of security.”

The

controversy also boosted uncertainty around the company’s stock (WSE: XTB), which

fell more than 6% on Monday, testing the April lows and marking its

sharpest single-day decline of the year. On Tuesday, July 8, 2025, however, XTB

shares rebounded by nearly 3%, climbing back toward 72 zł.

Potential Security Gaps Exposed

The victim claims that when he contacted customer support, he allegedly received what he

described as a dismissive response: “I get calls like yours all day, every

day. Nothing can be done.”

According to the client, his complaints filed with XTB were rejected twice, with the company citing

terms of service that place responsibility for password security on the

customers.

“Different

passwords, different computers, different phones, different security measures.

One common denominator, XTB account and complete lack of platform

responsibility,” the client wrote.

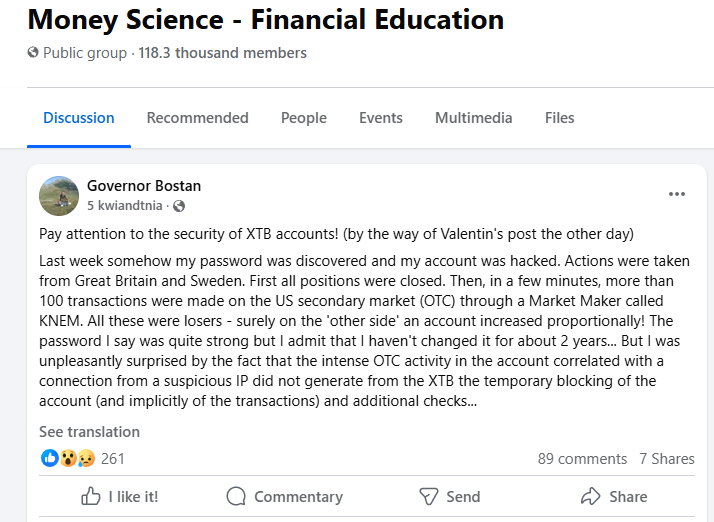

FinanceMagnates.com

found several

stories on social media, including Facebook and X, from traders who

claim they were scammed in a similar way. The oldest example found dates

back to April

5 and involves a similar situation described by a Romanian trader.

The

alleged victim we spoke with stated that he would provide contact details for

other affected individuals but had not done so by the time of publication.

XTB Responds with Security

Overhaul

In response

to the mounting criticism, XTB announced several security enhancements.

Starting July 14, customers will be able to use Time-based One-Time Password

(TOTP) authentication through apps like Google Authenticator, moving beyond the

current SMS-based system.

“As a

leader in the investment industry, we are fully aware that cybersecurity issues

are among the greatest challenges in today’s financial world and affect the

entire financial sector,” XTB commented in a statement sent to FinanceMagnates.com. “As for the post on one of the online

forums, we are currently verifying the information presented there. At the same

time, we remind our clients that official complaint procedures are available.

Each case is analyzed individually based on applicable laws and our internal

procedures.”

The broker

revealed that only about 10% of its customers currently use two-factor

authentication. XTB plans to begin automatically enabling 2FA for existing

customers in the second half of July, with all new accounts requiring it by the

fourth quarter of 2025.

The company

also cited broader cybersecurity challenges facing financial technology firms,

noting that Poland recorded 103,449 unique security incidents in 2024, a 29%

increase from the previous year.

Industry Expert Weighs In

Michał

Masłowski, Vice President of the Poland’s Individual Investors Association,

emphasized that both financial institutions and clients must collaborate to

combat hacking attempts.

“Such

‘details’ as 2FA, double authentication using either SMS passwords or one-time

passwords from applications like Google Authenticator, are simply mandatory

when logging into any accounts where we have even small amounts,”

Masłowski said.

According

to Mateusz Samołyk from Inwestomat.eu, one of the individuals who helped bring

the case to public attention in Polish media, the broker should implement

several key safeguards:

Mandatory

two-factor authentication with no option for users to disable it and real-time

monitoring of suspicious activity, such as sudden spikes in trading volume, from

a few monthly trades to hundreds in rapid succession. New device

and location verification, requiring confirmation via email or phone for logins

from unfamiliar IP addresses or geographic regions and instant

login alerts sent by email and SMS whenever an account is accessed from a new

device.

“All 4

account security methods I have already suggested to XTB and I will be waiting

for developments,” Samołyk commented on X.

XTB has not

indicated whether it will compensate affected customers or take additional

steps to assist ongoing police investigations into the alleged hacking scheme.

Polish

online broker XTB is implementing stronger security protocols after a client

publicly claimed losing approximately 150,000 Polish zloty ($38,000) in what

appears to be a sophisticated hacking scheme that might have affected at least

a few investors across Central Europe.

XTB Faces Security

Scrutiny After Client Loses $38,000 in Alleged Hack

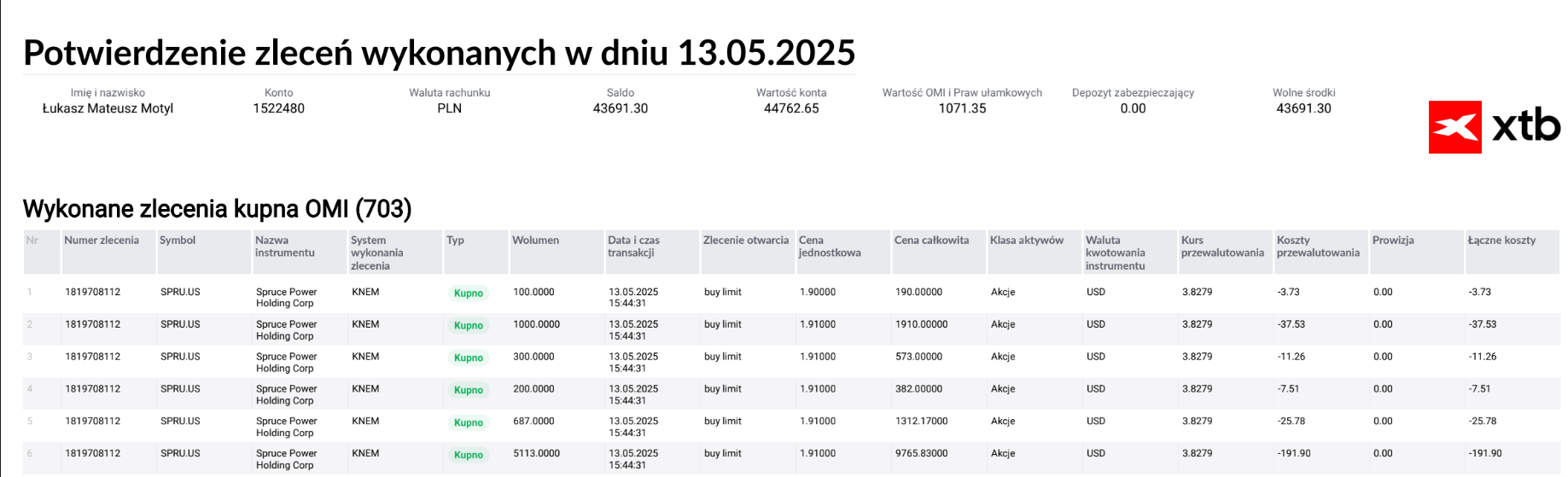

The

controversy erupted over the weekend when a five-year XTB client shared a detailed post on social media describing how hackers allegedly drained his

account through thousands

of rapid-fire trades on obscure financial instruments (including nano-caps

companies like Spruce Power). The client, who had built his portfolio to nearly

200,000 zlotys, discovered 75% of his funds had vanished in what he described as

“programmed slaughter” of his holdings.

The alleged hacker’s method was particularly clever. Rather than attempting direct

withdrawals, which XTB restricts to verified customer bank accounts, the

attacker reportedly executed simultaneous buy-sell transactions on low-liquidity

securities. The victim’s account consistently lost money on each trade while

the hacker’s separate account profited from the other side of the transactions.

“Everything

was sold in minutes: even long-held stocks, ETFs, securities that hadn’t been

touched for years,” the client wrote in his viral post.

Should Clients Protect

Themselves, or Do Firms Share the Responsibility?

It is worth noting, the client had not enabled two-factor

authentication (2FA), which the broker introduced as an optional security

feature in September last year. However, the action prompted a swift response from the fintech . Hours after the client’s story

gained traction across local financial forums and media outlets, the broker announced plans to

enhance its two-factor authentication system and make it mandatory for all

users.

“Security

of XTB client funds is our highest priority,” said Adam Dubiel, Chief

Product & Technology Officer at XTB. “We have taken action in three

areas: further improvement and development of two-factor authentication

methods, mandatory securing of client accounts through 2FA, and active

communication and education in the field of security.”

The

controversy also boosted uncertainty around the company’s stock (WSE: XTB), which

fell more than 6% on Monday, testing the April lows and marking its

sharpest single-day decline of the year. On Tuesday, July 8, 2025, however, XTB

shares rebounded by nearly 3%, climbing back toward 72 zł.

Potential Security Gaps Exposed

The victim claims that when he contacted customer support, he allegedly received what he

described as a dismissive response: “I get calls like yours all day, every

day. Nothing can be done.”

According to the client, his complaints filed with XTB were rejected twice, with the company citing

terms of service that place responsibility for password security on the

customers.

“Different

passwords, different computers, different phones, different security measures.

One common denominator, XTB account and complete lack of platform

responsibility,” the client wrote.

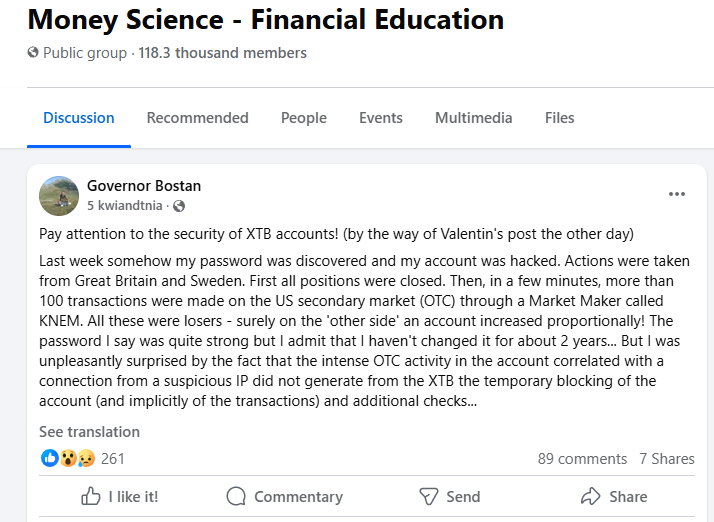

FinanceMagnates.com

found several

stories on social media, including Facebook and X, from traders who

claim they were scammed in a similar way. The oldest example found dates

back to April

5 and involves a similar situation described by a Romanian trader.

The

alleged victim we spoke with stated that he would provide contact details for

other affected individuals but had not done so by the time of publication.

XTB Responds with Security

Overhaul

In response

to the mounting criticism, XTB announced several security enhancements.

Starting July 14, customers will be able to use Time-based One-Time Password

(TOTP) authentication through apps like Google Authenticator, moving beyond the

current SMS-based system.

“As a

leader in the investment industry, we are fully aware that cybersecurity issues

are among the greatest challenges in today’s financial world and affect the

entire financial sector,” XTB commented in a statement sent to FinanceMagnates.com. “As for the post on one of the online

forums, we are currently verifying the information presented there. At the same

time, we remind our clients that official complaint procedures are available.

Each case is analyzed individually based on applicable laws and our internal

procedures.”

The broker

revealed that only about 10% of its customers currently use two-factor

authentication. XTB plans to begin automatically enabling 2FA for existing

customers in the second half of July, with all new accounts requiring it by the

fourth quarter of 2025.

The company

also cited broader cybersecurity challenges facing financial technology firms,

noting that Poland recorded 103,449 unique security incidents in 2024, a 29%

increase from the previous year.

Industry Expert Weighs In

Michał

Masłowski, Vice President of the Poland’s Individual Investors Association,

emphasized that both financial institutions and clients must collaborate to

combat hacking attempts.

“Such

‘details’ as 2FA, double authentication using either SMS passwords or one-time

passwords from applications like Google Authenticator, are simply mandatory

when logging into any accounts where we have even small amounts,”

Masłowski said.

According

to Mateusz Samołyk from Inwestomat.eu, one of the individuals who helped bring

the case to public attention in Polish media, the broker should implement

several key safeguards:

Mandatory

two-factor authentication with no option for users to disable it and real-time

monitoring of suspicious activity, such as sudden spikes in trading volume, from

a few monthly trades to hundreds in rapid succession. New device

and location verification, requiring confirmation via email or phone for logins

from unfamiliar IP addresses or geographic regions and instant

login alerts sent by email and SMS whenever an account is accessed from a new

device.

“All 4

account security methods I have already suggested to XTB and I will be waiting

for developments,” Samołyk commented on X.

XTB has not

indicated whether it will compensate affected customers or take additional

steps to assist ongoing police investigations into the alleged hacking scheme.

This post is originally published on FINANCEMAGNATES.