The EU GDP has shown zero growth, the US GDP has expanded by 2.3%, the Fed has taken a pause, and the ECB has cut the interest rate. All these factors have failed to support the greenback. Nevertheless, the White House will take action to boost the US dollar. Another reminder from the Trump administration regarding tariffs has severely hurt the euro. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Major Takeaways

- The ECB will continue to cut rates.

- The decision to cut by 50bp is off the agenda for now.

- Trump will impose tariffs on February 1.

- Short trades can be opened as long as the EURUSD pair is trading below 1.0415.

Weekly US Dollar Fundamental Forecast

Tariffs are a key factor in the US dollar’s performance, and their absence has hindered its growth. The traditional drivers of the EURUSD‘s downtrend, such as divergences in monetary policy and economic growth, remain in play. However, these factors alone are insufficient to drag the two currencies to parity. The imposition of import duties by the United States is another crucial factor. President Donald Trump’s recent announcement of his intention to impose tariffs on Canada and Mexico, effective February 1, has severely slammed the euro.

Following the Fed’s decision to keep the rate unchanged, the ECB’s decision to loosen monetary policy was anticipated to trigger a sweeping wave of sell-offs in the EURUSD pair. This was further exacerbated by Christine Lagarde’s remarks on the Eurozone economy’s weakness, the unanimous decision to reduce the deposit rate from 3% to 2.5%, and the recognition that it would be premature to predict the end of the current monetary expansion cycle.

As a result, German bund yields decreased, and the derivatives market increased the implied magnitude of the ECB’s remaining steps from 65 basis points to 73 basis points before the end of the year. The market expects three additional cuts in borrowing costs and expresses skepticism regarding two cuts for the Fed. On paper, this bodes well for EURUSD bears.

Market Expectations on Fed and ECB Policy Rates

Source: Financial Times.

In practice, the euro has managed to remain resilient thanks to Christine Lagarde’s statement that a 50 basis point cut in the deposit rate was out of discussion, as well as Bloomberg insider reports. According to informed sources, the remark that rates are limiting economic growth will be removed from the text of the accompanying statement at the next ECB meeting. If so, the potential for their further reduction is not as great as the markets assume.

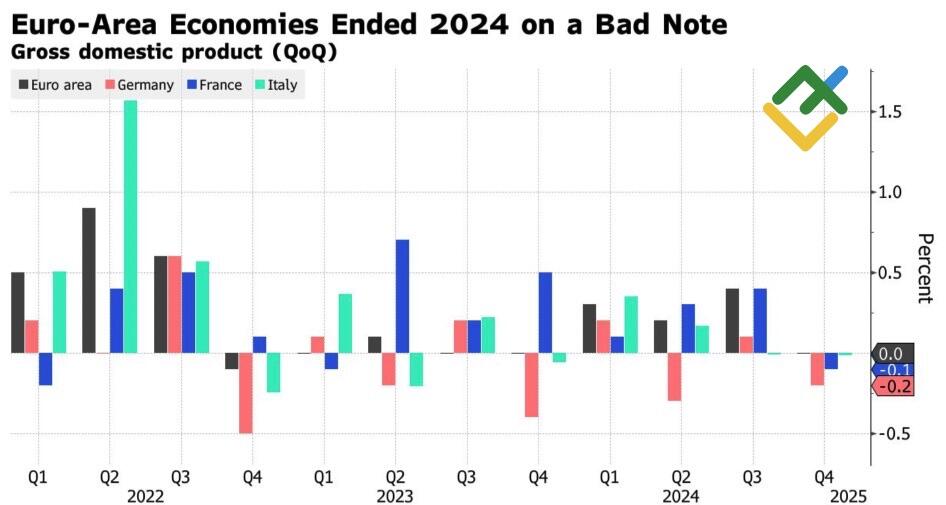

However, a new factor may emerge in the near future: according to Berenberg Bank, Donald Trump’s tariffs against the EU will reduce Eurozone GDP from zero to -0.5% and accelerate the European Central Bank’s monetary expansion cycle.

Euro Area GDP Growth

Source: Bloomberg.

First of all, the US president has pledged to impose 25% tariffs on imports from Canada and Mexico, effective February 1. He cited three reasons for this decision: the surging influx of people into US territory, drug trafficking, and substantial subsidies ballooning the budget deficit.

The exact scope of the tariffs remains to be clarified, as does the question of which sectors will be excluded. It is not yet known if a grace period will be granted, and the duration of the restrictions is also uncertain. Notably, the initial figure is expected to be 25% or less. It is clear that tariffs are looming. Against this backdrop, EURUSD quotes are plummeting.

Weekly EURUSD Trading Plan

The previously outlined strategy implying opening short trades on the major currency pair at 1.047 and then building up short positions at 1.0415 was successful. However, the last level continues to act as a line in the sand. As long as EURUSD quotes stay below this line, one should remain in the bears’ camp.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.