If you plan to trade stocks, you should be able to calculate yield, i.e. profit value. In this ultimate guide for beginners, we overview the definition of stock yield, its formula and ways of calculation, and many other crucial aspects.

The article covers the following subjects:

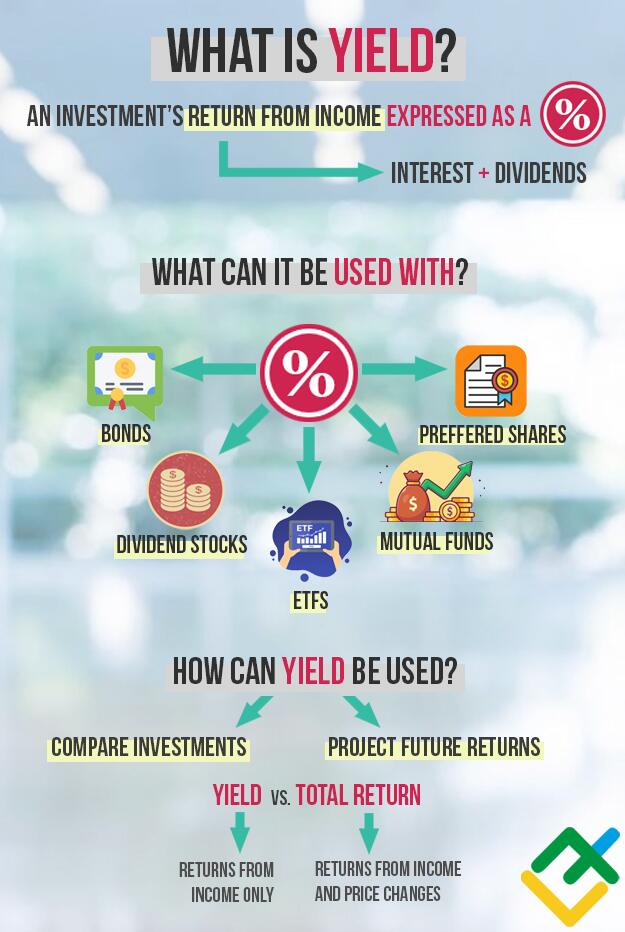

What Is a Yield?

Yield represents one of the main indicators of stock initial investments, by which one can assess their potential capital gains, feasibility and compare them with each other. Often, to assess the profitability of investing money, the risk-return ratio is used. The reason is simple: indicators such as profitability and risk themselves are not very informative.

What is the point of investing in instruments with a high level of risk and low potential return? If there is a higher risk of loss, the possible reward should be high. The yield value indicates how much money a stock brings or takes away. If you made more money on a stock yield than you spent on it, the average yield is considered positive. If you spent more than you earned, the yield is called negative. In addition, it is necessary to take into account the dividends (monthly/annual dividends) received when assessing profitability.

By purchasing stocks, an investor plans to make capital gains due to the increase in current market value (market yield). A stock bought today can be worth several times more in a few years. Or it may cost a few percent more in a few days. In any case, an increase in the stock price (current market value) allows the investor to make money by reselling assets.

How Is Yield Calculated?

To calculate yield you can use the formula:

(sale price – purchase price) / purchase price * 100%

For example, if a share was bought for 200 USD and sold for 210 USD, the market yield is as follows:

(210 – 200) / 200 * 100% = 5%

Thanks to dividend income (dividend yield) Some issuing companies regularly distribute part of the proceeds to shareholders. Such payments are called dividends or dividend yield and are applies to dividend paying stocks. Each company pays dividends due to its own policy. It determines the amount and terms of payments at its discretion. It can be quarterly and monthly yields in terms of time frames as well as annual dividends. If the financial affairs of the company are going uphill, then the size of dividends may increase over time.

The dividend yield is calculated using the formula:

dividend / share price * 100%

For example, if dividend paying stocks were bought for 200 USD, and the dividend on it was 8 USD, the dividend yield of one share is as follows:

8/200 * 100% = 4%

Total yield calculation

For a more objective picture, both yield measures are taken into account: market and dividend.

The total return yield measures are calculated using the formula:

(dividend + (sale price – purchase price)) / purchase price * 100%

For example, we take the previous yield measures: a share was bought for 200 USD, sold for 210 USD, and the dividend on it was 8 USD.

(8 + (210 – 200)) / 200 * 100% = 9%

Calculation of annual profitability

To figure out the annual yields, you need to calculate how many days the investor owned the stock from the moment of purchase to the moment of sale.

We calculate it using the formula:

(sale price – purchase price) / purchase price * number of days in a year / number of days of ownership * 100%

Suppose that a share was bought for 200 USD, and after 90 days it was sold for 210 USD. The annual calculated yield value is:

(210 – 200) / 200 * 365/90 * 100% = 20.27%

Example of Yield

Suppose, you bought a share for 100 USD with a factor of 1.7. For the first year, dividends amounted to 15 USD. The current market return for the second year is 20%. In the third year, dividends reached 45%. The yield was paid evenly by quarters. In the third year, the investor sold the asset 90 days before the dividend was paid. The index of the ratio of the selling price to the buying price is 1.25.

When you have done so many actions, calculating the final yield can be challenging. This is where the formula comes in handy. The task is to calculate the final stock yield measures.

First, the cost of buying and selling is calculated:

Buying price = 100 USD. × 1.7 = 170 USD.

Selling price = 170 USD. × 1.25 = 212.5 USD.

Next, the current profitability is determined:

Dividends in the first year are 15 USD, the current yield in the second year is 20%. 170 USD × 0.2 = 34 USD.

Taking into account the rate of 45% during the third year, receiving dividends for only 3 quarters, the yield for the third year is equal to 100 USD × 0.45 × 0.75 = 37.5 USD.

Calculation of the average annual coupon dividend: (15 + 34 + 37.5): 2.75 = 31.45 USD.

In addition to dividends, the shareholder made a profit from the difference between the purchase and sale price of the security:

212.5 – 170 = 42.5 USD.

If you substitute all the values in the formula, you get the final profitability:

(31.45 + 42.5 / 2.75) / 170 × 100% = 26.79%.

It turns out that for every dollar spent on a share, the average annual yield was about 27 cents excluding taxes.

What Is the Highest Yield Investment?

Pretty often, higher yield values signify higher risks. This is why they attract people with a greater tendency to risky trading and investments. The list of potentially high yield investments includes:

-

Stocks. This is the first thing that comes to your mind when you consider high yield assets. By purchasing a stock, you get a tiny fraction of ownership in a public company. By investing in stock, you make a bet on how the company will perform. Hence, you can either invest in financially stable companies or choose newcomers hoping to multiply your deposit.

-

Dividend stocks are still a competitive choice even though not as profitable as others. These are cash payments from the issuer, so you can easily put money back. By the way, dividends show the risk profile of a stock

-

Mutual funds. They act like ETFs enabling purchasers to fulfill some initial investment aims. You can build a larger portfolio of stocks, bonds and other investments. In many cases, entry points are pretty low. The price of the entire stock is based on the investment value of securities included and is recalculated every trading day.

-

Real estate. Although this sort of investment requires a large initial capital and comes with a lot of document fuss, it can still generate a high yield. It’s even easier right now with various mortgage rates. If you are ready to wait for the real estate market growth, it’s worth the patience.

-

Alternative assets. It’s a nice option for retail investors because of a low entry threshold. Alternative assets unlocked the flow of cash that was previously forbidden. Such asset classes can be cryptocurrencies, digital art, commercial finance, legal finance, and so on.

If you seek more predictable stock prices, try a high yield savings account. In this case, your deposit will be protected by Federal Deposit Insurance Corporation (FDIC) insured bank accounts. In case of bank failure, you may earn up to $250,000.

Stock Market Yield

Yield on stocks

When it comes to stock investment yield, two types of yield are usually calculated. When the purchase price is taken into consideration, it’s the yield on cost (YOC).

Its formula is:

Cost Yield = (Price Increase + Dividends Paid) / Purchase Price

However, many investors calculate yield on stocks using the current price. What they get is the current yield:

Current Yield = (Price Increase + Dividends Paid) / Current Price

Note that when the stock price rises, the current yield is decreased – there is an inverse relationship between these metrics.

Yield on bonds

A bond is a way to lend money to a government or a company. In exchange, a buyer gets coupons. Bonds are the protective part of the investment portfolio. Their potential capital gains are lower than when speculating stock prices but imply higher yield than the deposit in the bank. They are considered a reliable instrument because the price of bonds is less prone to fluctuations than all other assets and because you receive stable payments on them.

The bond’s yield is expressed in an annual interest payments. It is called ‘nominal yield’ and calculated as:

Nominal Yield = (Annual Interest Earned / Face Value of Bond)

Note that this applies to stable annual interest rates. If a bond has floating interest payments, you will have to calculate the yield over separate periods.

Here is one thing that investors often overlook when calculating the final yield – commissions. Bonds come with many fees that can seriously diminish the profitability even in a high yield bond:

-

Account management fee and under what conditions will it be necessary to pay. Many brokers will only withdraw money in the month that you made trades. If you haven’t traded in a certain month, you won’t have to pay.

-

Depositary fee. The custodian is where your securities are held. To date, most brokers have canceled this commission, But it’s still better to double-check.

-

Transaction fee. This is what you are charged for any purchase or sale of any instrument on the exchange.

Before buying a bond, you need to pay attention to the accrued interest payments. This is the part of the coupon that has accumulated for a particular bond after the previous coupon has been paid. It will also add to the bond’s yield.

What does yield depend on?

Various factors can affect stock returns – some of them are unpredictable:

-

Financial indicators and the credit rating of the company (issuer).

-

Investment yield from foreign funds.

-

An increase in major exchanges’ indices, which motivates traders to purchase more index funds (ETFs, mutual funds, etc.).

-

GDP growth.

-

Key rate of the Central Bank. When it goes down, stocks price rises.

-

Inflation rate.

-

Corporate governance.

-

Taxation.

-

Sanctions.

-

Currency stability.

To calculate how much a stock is undervalued or overvalued, traders also overview such concepts as:

-

Capitalization is the total investment value of a company’s shares. To assess the attractiveness, it is divided by the profit and a certain coefficient is obtained. The higher the number, the better. Otherwise, the stock is considered undervalued in the market.

-

Profit. For some analysts, profit alone means nothing. They believe that by dividing capitalization by the size of free cash flow, you can determine the degree of attractiveness of the paper. The lower the score, the better.

-

When it comes to free cash flow, a low ratio indicates that the company has enough free money left after all taxes have been paid. Management can direct them to pay dividends or reinvest in further development. These are the hallmarks of a healthy enterprise.

The average return over some time, say, over the past ten years, can also help you. After calculating the result of each year and the total yield, you will see a certain pattern.

Types of Yields

Running Yield

It is calculated using the formula:

Current Yield = (Sale Price – Purchase Price) / Purchase Price * 100

The result shows how much income the investor will receive when selling securities at their current price. It takes into account the coupon rate and the real current price of the bond or share price on the market.

Pro tip: If you divide the current yield by the number of days in a year (365) and multiply by the number of days that you will hold the bond, you get a completely reliable bond yield from a short-term investment expressed as a percentage.

Nominal Yield

This is the return from a bond defined as a % of the face value the bond’s yearly coupon payments equal to. For this reason, it is called ‘the coupon rate’. Depending on the kind of bond, the rate can be:

-

Fixed-rate — the nominal bond yield stays the same during the bond’s lifetime.

-

Floating rate — the nominal yield will change over the bond’s lifetime depending on the interest rate changes.

-

Indexed — the nominal yield changes depending on the movement of the underlying index.

The effective annual bond’s yield is the return from a bond that pays annual interest rates being reinvested. Contrary to nominal yield, effective one calculates the compounding on investment returns.

Yield to Maturity (YTM)

YTM takes into account not only the coupon yield and actual purchase price but also the planned redemption price. You need to know it if you plan to hold the bond for a long time and withdraw the coupon yield and spend on your own needs.

Effective Yield to Maturity value represents the total income of the bondholder including coupon reinvestment. You will get this yield if you leave all coupon payments on your brokerage account and buy bonds with a similar coupon on them. You need it if you plan to hold the bond for a long time and reinvest coupons.

Tax-Equivalent Yield (TEY)

Bonds issued by a state, a municipal authority or a country are called ‘municipal’. They are tax-exempt and also come with a tax-equivalent yield (TEY). This is a pre-tax yield that should have to be the same as a tax-free municipal bond.

Yield to Worst (YTW)

As suggested by the name, this metric shows the lowest possible yield without the bond’s issue failing. This indicator is calculated taking into account the worst-case scenarios for the bond (a call, fund sinking, and so on). By measuring the YTW, investors can predict how their income might be impacted, and whether the bond is worth buying at all.

YTW calculations are designed for all possible call dates to provide a lot of valuable information. They also assume that no recalculations will be done in favor of the investor.

SEC Yield

Some companies, mutual funds and issuers come up with their own formulas for yield calculations. Regulators like the Securities and Exchange Commission (SEC) have introduced a standard measure for yield calculation, called the SEC yield. It was created for a fair comparison of standard bond yields. The SEC’s formula takes into account the fees associated with the purchase.

Yield vs. return

Yield and return are two measures used to evaluate the performance of an investment, but they have important differences. Yield shows the expected future return on an investment and is usually expressed as a percentage of an investment’s value. It reflects the earned interest on the invested funds and helps to assess future net income.

Return is the realized profit that an investor receives over a period. It includes capital gains, interest and dividends, and is expressed in monetary terms and shows the actual return on an investment over a given period of time.

Conclusion

As a smart and careful investor, you should assess the stock’s profitability before spending hard-earned money on it. By knowing different types of yield, you can calculate the current and overall profitability of an asset to make informed decisions and minimize risks. When measuring yield, don’t forget to estimate taxes and transaction fees – they can be painful when you deal with bonds and share prices in the long term.

Yield FAQ

Yield refers to the pure profit you get from investing in a stock. It’s expressed as a percentage of the stocks’ price. When it comes to dividends, each company has its own regulations and can pay out annually, quarterly, or monthly yield. Higher yield implies higher risks.

Consider an investor who buys a bond with a 1-year expiration date. He will calculate the Yield to Maturity to figure out how much profit it will generate during this year plus the final price the bond will be sold for.

This is the percentage of the share price that an investor earns. For example, if he bought a stock for $100 and it generated a $20 profit, the stock’s yield is 20%. Higher yield comes with higher risks.

It means that during one year, the stock will generate income worth 1% of its cost. It’s a pretty low rate and might be a sign of economic difficulties with the stock issuer.

Bond yield is the interest rate calculated from its current market price. For instance, if a bond is sold for $100 and brings 5% per year, its yield is 5%. But if the bond’s price increases say, to $110, the yield will be 4.54% (5/110). When the bond experiences falling market value, you can expect a rise in yield.

The yield rate is calculated as the ratio of income to the amount invested, expressed as a percentage using the following formula: Yield rate = (Income / Initial value) x 100%

The yield on a stock can be calculated by dividing the sum of its price appreciation and dividends by its purchase price and multiplying by 100%. Yield = (Price Increase + Dividends) Purchase Price x 100%

Dividend yield is the ratio of annual dividends to the current stock price multiplied by 100%. Formula: Dividend Yield = Annual Dividends Current Stock Price x 100%

A good yield is one that exceeds the inflation rate and generates income. Generally, an annual yield above 7-10% is considered good. However, it depends on an investor’s financial goals and risk tolerance.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.