Analysts are expressing concerns regarding the negative outlook for the US dollar, attributing it to uncertainties surrounding its safe-haven status. This apprehension is largely fueled by the unpredictable nature of Trump’s shifting actions related to his tariff policy, as well as the recently passed tax bill in the House of Representatives, which is set to be deliberated by the Senate this week.

Besides, Moody’s Ratings previously downgraded the US credit rating from AAA to AA1, citing a ballooning national debt that has surpassed $36 trillion, entrenched fiscal deficits, and political inability to address the issue. Meanwhile, escalating trade tensions between the US and China are fuelling concerns about the positive economic impact of Trump’s tariffs.

Accordingly, the US dollar remains under pressure, while its USDX index continues to trade in the medium- and long-term bearish trend, moving towards key support levels of 97.50 and 96.80, which separate the global bullish market from the bearish one.

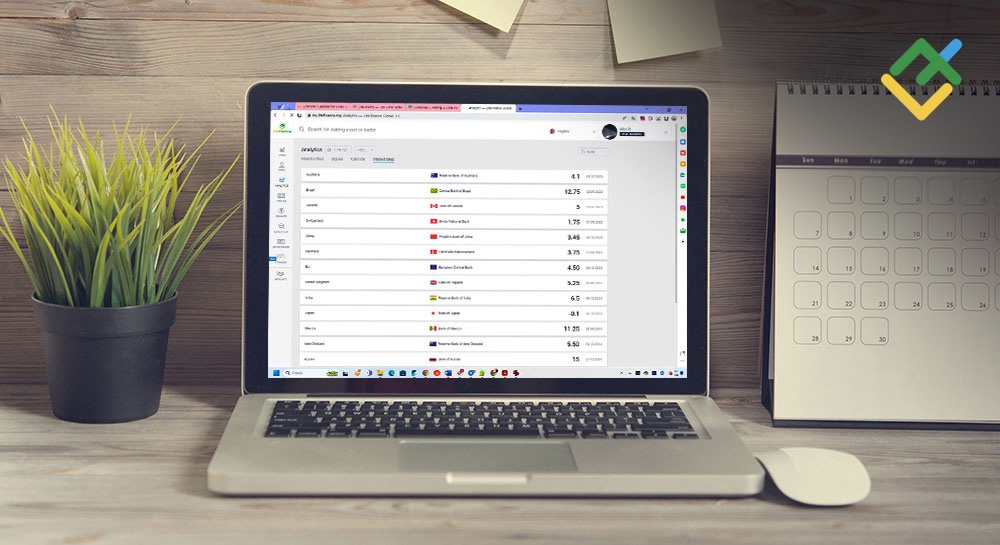

In the upcoming week of 02.06.2025–08.06.2025, market participants will focus on the release of crucial macroeconomic statistics from Switzerland, the US, China, Australia, the Eurozone, and Canada, as well as the outcomes of the Bank of Canada and European Central Bank meetings.

Note: During the coming week, new events may be added to the calendar, and/or some scheduled events may be canceled. GMT time

The article covers the following subjects:

Major Takeaways

- Monday: Swiss GDP, US ISM manufacturing PMI.

- Tuesday: Reserve Bank of Australia’s May meeting minutes, Swiss CPIs.

- Wednesday: Australian GDP, ADP report, Bank of Canada interest rate decision, US ISM services PMI.

- Thursday: Australian trade balance, Chinese Caixin services PMI, European Central Bank interest rate decision.

- Friday: Eurozone GDP, Eurozone retail sales, Canadian and US labor market data.

- Key event of the week: May US labor market report.

Monday, June 2

07:00 – CHF: Swiss GDP for Q1 2025

GDP is considered an indicator of the general state of a country’s economy, which measures its growth or decline rate. The GDP report represents the total monetary value of all final goods and services produced by Switzerland over a given period. A rising trend of the GDP indicator is considered positive for the Swiss franc, while a low result is considered negative.

Previous values: +0.2% (+1.5% YoY) in Q4 2024, +0.4% (+2.0% YoY) in Q3, +0.7% (+1.8% YoY) in Q2, +0.5% (+0.6% YoY) in Q1, +0.3% (+0.6% YoY) in Q4 2023, +0.3% (+0.3% YoY) in Q3, 0% (+0.5% YoY) in Q2, +0.3% (+0.6% YoY) in Q1 2023.

The data indicates that the Swiss economy is recovering, albeit still at a slow pace, which is a positive factor for the Swiss franc.

If the data prove to be lower than forecast, the Swiss franc may decline in the short term. However, the currency will not fall sharply, as it is in strong demand as a defensive asset. Better-than-forecast data may strengthen the franc in the short term.

14:00 – USD: US ISM Manufacturing Purchasing Managers’ Index

The US PMI, published by the Institute for Supply Management (ISM), is an important measure of the US economy. When the index surpasses 50, it bolsters the US dollar, whereas readings below 50 have a detrimental effect on the greenback.

Previous values: 48.7, 49.0, 50.3, 50.9 in January 2025, 49.3 in December 2024, 48.4, 46.5, 47.2, 47.2, 46.8, 48.5, 48.7, 49.2, 50.3, 47.8, 49.1 in January 2024, 47.4 in December, 46.7 in November, 46.7 in October, 49.0 in September, 47.6 in August, 46.4 in July, 46.0 in June, 46.9 in May, 47.1 in April, 46.3 in March, 47.7 in February, 47.4 in January 2023.

The index has been below the 50 level for several months now, indicating a slowdown in this sector of the US economy. The growth of index values supports the US dollar. Conversely, if the index reading falls below the forecasted values or below 50, the greenback may sharply depreciate in the short term.

Tuesday, June 3

01:30 – AUD: Reserve Bank of Australia Meeting Minutes

The document is published two weeks after the meeting and the interest rate decision. If the RBA is optimistic about the country’s labor market and GDP growth rate and is hawkish on the inflation outlook, the rate may be increased at the next meeting, which is favorable for the Australian dollar. The bank’s dovish rhetoric on inflation, in particular, is putting pressure on the Australian dollar.

At the recent May 2025 meeting, the RBA decided to cut the key interest rate by 0.25% again. Until the February 2025 meeting, RBA leaders had consistently kept the interest rate unchanged at a 12-year high of 4.35% for the ninth consecutive meeting. Governor Michele Bullock stated that “inflation has fallen substantially since the peak in 2022, as higher interest rates have been working to bring aggregate demand and supply closer towards balance.” She added that this is a “cautious cut” and that ‘if we [the RBA] need to act quickly, we can.”

Investor sentiment surrounding the Australian dollar also deteriorated following another rate cut by the People’s Bank of China (PBoC), sparking worries about the economic growth of Australia’s largest trading partner.

If the released minutes contain unexpected information regarding the RBA’s monetary policy issues, the volatility in the Australian dollar will increase.

01:45 – CNY: Caixin China General Manufacturing PM

The Caixin Purchasing Managers’ Index (PMI) is a leading indicator of China’s manufacturing sector. As the world’s second-largest economy, China’s release of significant macroeconomic data may strongly influence the financial market.

Previous values: 50,4, 51.2, 50.8, 50.1 in January 2025, 50.5 in December 2024, 51.5, 50.3, 49.3, 50.4, 49.8, 51.8, 51.7, 51.4, 51.1, 50.9, 50.8, 50.8, 50.8, 50.7, 49.5, 50.6, 51.0, 49.2, 50.5, 50.9, 49.5, 50.0, 51.6, 49.2 in January 2023.

A decline in the indicator value and reading below 50 may negatively affect the renminbi, as well as commodity currencies such as the New Zealand and Australian dollar. Data that exceeds forecasted or previous values will have a positive impact on these currencies.

06:30 – CHF: Consumer Price Index

The Consumer Price Index (CPI) reflects the retail price trends for a group of goods and services comprising the consumer basket. The CPI is a key gauge of inflation. Additionally, the index has a significant impact on the value of the Swiss franc.

In April 2025, consumer inflation showed zero growth after +0.6% (+0.3% YoY) in February, -0.1% (+0.4% YoY) in January 2025, -0.1% (+0.6% YoY) in December, -0.1% (+0.7% YoY) in November, -0.1% (+0.6% YoY) in October, -0.3% (+0.8% YoY) in September, 0% (+1.1% YoY) in August, -0.2% (+1.3% YoY) in July, 0% (+1.3% YoY) in June, +0.3% (+1.4% YoY) in May, +0.3% (+1.4% YoY) in April, 0% (+1.2% YoY) in February, +0.2% (+1.3% YoY) January 2024, +1.7% in December 2023, +1.4% in November, and +1.7% YoY in October.

An index reading below the forecasted or previous value may weaken the Swiss franc, as low inflation will force the Swiss Central Bank to ease its monetary policy. Conversely, a high reading would be positive for the Swiss franc.

07:50 – JPY: Speech by Bank of Japan Governor Kazuo Ueda

In his upcoming speech, Bank of Japan Governor Kazuo Ueda is expected to comment on the bank’s monetary policy. Markets typically react strongly when the Bank of Japan governor addresses this topic, especially if he makes unexpected remarks, leading to increased volatility in yen trading as well as in Asian and global financial markets. Conversely, if he does not mention monetary policy, the market reaction will likely be subdued.

09:00 – EUR: Consumer Price Index. Core Consumer Price Index (Preliminary Releases)

The Consumer Price Index (CPI), published by Eurostat, measures the price change of a selected basket of goods and services over a given period. The CPI is a key indicator for evaluating inflation and consumer preferences. A positive indicator result strengthens the euro, while a negative one weakens it.

Previous values YOY: +2.2%, +2.2%, +2.4%, +2.5% in January 2025, +2.4% in December 2024, +2.2%, +2.0%, +1.7%, +2.2%, +2.6%, +2.5%, +2.6%, +2.4%, +2.4%, +2.6%, +2.8% in January 2024, +2.9%, +2.4%, +2.9%, +4.3%, +5.2%, +5.3%, +5.5%, +6.1%, +6.1%, +7.0%, +6.9%, +8,5%, +8.6% in January 2023, +9.2%, +10.1%, +10.6%, +9.9%, +9.1%, +8.9%, +8.6%, +8.1%, +7.4%, +7.4%, +5.9%, +5.1% in January 2022.

If the data is worse than the forecasted value, the euro may face a short-term but sharp decline. Conversely, if the data surpasses the forecast and/or the previous value, it could strengthen the euro in the short term. The ECB’s consumer inflation target is just below 2.0%, and the reading suggests that inflation continues to decline in the Eurozone.

According to the accompanying statement following the ECB’s October meeting, when its leaders decided to cut the benchmark interest rate by 25 basis points, the regulator stated that the disinflation process is underway.

The Core Consumer Price Index (Core CPI) determines the price change of a selected basket of goods and services over a given period and is a key indicator for assessing inflation and consumer preference. Food and energy are excluded from this indicator in order to provide a more accurate assessment. A high result strengthens the euro, while a low one weakens it.

Previous values YOY: +2.7%, +2.4%, +2.6%, +2.7% in January 2025, 2.7% in December 2024, +2.7%, +2.7%, +2.7%, +2.8%, +2.9%, +2.9%, +2.9%, +2.7%, +2.9%, +3.1%, +3.3% in January 2024, +3.4%, +3.6% +4.2%, +4.5%, +5.3%, +5.5%, +5.5%, +5.3%, +5.3%, +5.6%, +5.7%, +5.6%, +5.3%, +5.2%, +5.0%, +5.0%, +4.8%, +4.3%, +4.0%, +3.7%, +3.8%, +3.5%, +3.0%, +2.7%, +2.3% in January 2022.

If the May 2025 figures are weaker than the previous or forecasted value, the euro may be negatively affected. If the data turns out to be better than the forecasted or previous value, the currency will likely grow.

According to recently reported data, the eurozone’s core inflation rate is still high, above the ECB’s target of 2.0%. As a result, the ECB is inclined to maintain high interest rates, which is favorable for the euro in normal economic conditions.

Wednesday, June 4

01:30 – AUD: Australian GDP for Q1

The Australian Bureau of Statistics releases its report on the country’s GDP for Q4 2024. GDP is a key indicator of the Australian economy’s health. A strong report will bolster the Australian dollar, while a weak GDP report will drag the currency down.

Previous values: +0.6% (+1.3% YoY) in Q4 2024, +0.3% (+0.8% YoY) in Q3, +0.2% (+1.0% YoY) in Q2, +0.1% (+1.1% YoY) in Q1 2024, +0.2% (+1.5% YoY) in Q4 2023, +0.2% (+2.1% YoY) in Q3, +0.4% (+2.1% YoY) in Q2, +0.2% (+2.3% YoY) in Q1 2023, +0.5% (+2,7% YoY) in Q4, +0.6% (+5.9% YoY) in Q3, +0.9% (+3.6% YoY) in Q2, +0.8% (+3.3% YoY) in Q1, +3.4% (+4.2% YoY) in Q4, -1.9% in Q3, +0.7% in Q2, +1.8% in Q1 2021. A higher reading is positive for the Australian dollar, while a lower reading is negative. If the data falls short of the forecast, the currency may decline.

12:15 – USD: ADP Private Sector Employment Report

The ADP report on private sector employment significantly impacts the market and the US dollar. An increase in this indicator value positively affects the greenback. The number of workers in the US private sector is expected to increase again in February after rising by 62k in April, 147k in March, 84k in February, 186k in January 2025, 176k in December 2024,146k in November, 184k in October, 159k in September, 103k in August, 111k in July, 155k in June, 157k in May, 188k in April, 208k in March, 155k in February, 111k in January 2024, 158k in December, 104k in November, 111k in October, 137k in September, 135k in August, 307k in July, 543k in June, 206k in May, 293k in April, 103k in March, 275k in February, 131k in January 2023.

The growth of the index values may positively affect the US dollar, while low index readings may adversely influence it. A negative market reaction and a potential decline in the dollar may occur if the data turns out to be worse than forecasted.

The ADP report is not directly correlated with the official data of the US Department of Labor, which is due on Friday. However, the ADP report often serves as a forerunner of the department’s data and significantly influences the market.

13:45 – CAD: Bank of Canada Interest Rate Decision and Accompanying Statement

At its 2022 and 2023 meetings, the Bank of Canada raised its interest rate and advocated for further increases. Since its September 2023 meeting, Canadian policymakers have held the interest rate at 5.00%, assuming that uncertainty caused by high geopolitical tensions around the world and slowing Chinese, American, and European economies will be accompanied by lower demand for oil. As oil is Canada’s primary export commodity, this situation may weaken its economic growth while grappling with high inflation.

However, at the June 5, 2024, meeting, the Bank of Canada reduced the interest rate by 0.25% to 4.75% for the first time since July 2023, making a total reduction of 1.75% (175 bp) in 2024. In March 2025, the rate was further slashed to the current 2.75%.

The central bank’s upcoming decision remains uncertain. The regulator may also take a pause at Wednesday’s meeting.

If the Bank of Canada’s accompanying statement regarding growing inflation and the prospects for further monetary policy signals further tightening, the Canadian dollar will strengthen. Conversely, if the regulator signals the need for a monetary policy easing, the Canadian currency will decline.

14:00 – USD: US ISM Services Purchasing Managers’ Index

The PMI assesses the state of the US services sector, accounting for about 80% of US GDP. The share of final goods production is about 20% of GDP, including 1% for agriculture and 18% for industrial production. Therefore, the publication of the services sector data significantly impacts the US dollar. An indicator reading above 50 is positive for the currency.

Previous values: 51.6 in April, 50.8 in March, 53.5 in February, 52.8 in January 2025, 54.1 in December 2024, 52.1 in November, 56.0 in October, 54.9 in September, 51.5 in August, 51.4 in July, 48.8 in June, 53.8 in May, 49.4 in April, 51.4 in March, 52.6 in February, 53.4 in January 2024, 50.5 in December, 52.5 in November, 51.9 in October, 53.4 in September, 54.5 in August, 52.7 in July, 53.9 in June, 50.3 in May, 51, 9 in April, 51.2 in March, 55.1 in February, 55.2 in January 2023, 49.6 in December, 56.5 in November, 54.4 in October, 56.9 in August, 56.7 in July, 55.3 in June, 55.9 in May, 57.1 in April, 58.3 in March, 56.5 in February, 59.9 in January 2022.

The growth of index values will favorably affect the US dollar. However, a relative decline in the index values and readings below 50 may negatively affect the US dollar in the short term.

14:30 – CAD: Bank of Canada Press Conference

During the press conference, Bank of Canada Governor Tiff Macklem will provide an overview of the bank’s position and assess the current economic situation in the country. If the tone of his speech is tough regarding the Bank of Canada’s monetary policy, the Canadian dollar will strengthen. If Tiff Macklem is in favor of maintaining a soft monetary policy, the Canadian currency will decline.

Besides, Tiff Macklem may share his views on the ongoing trading tension between the US and Canada, including the exchange of tariff hikes that threaten to escalate into a full-scale trade war.

Anyway, the Canadian dollar is expected to be highly volatile during his speech.

Thursday, June 5

01:30 – AUD: Balance of Trade

Balance of Trade is an indicator that measures the ratio between exports and imports. An increase in Australian exports leads to a larger trade surplus, positively affecting the Australian dollar. Previous values (in billion Australian dollars): 6.900 in March, 5.156 in January 2025, 4.924 in December, 6.792 in November, 5.670 in October, 4,5362 in September, 5.248 in August, 5.636 in July, 5.425 in June, 5.052 in May, 6.678 in April, 4.841 in March, 6.707 in February, and 9.873 in January 2024.

A decrease in the trade surplus could negatively affect the Australian dollar, while an increase in the indicator figure may bolster the currency.

01:45 – CNY: Caixin China General Services PMI

The Caixin Purchasing Managers’ Index (PMI) is a leading indicator of China’s services sector. Since China’s economy is the second largest in the world, the release of its significant macroeconomic indicators can profoundly influence the overall financial market.

Previous values: 50.7, 51.9, 51.4, 51.0 in January 2024, 52.2 in December 2024, 51,5, 52.0, 50.3, 51.6, 52.1, 51.2, 54.0, 52.5, 52.7, 52.5, 52.7 in January 2024, 52.9, 51.5, 50.4, 50.2, 51.8, 54.1, 53.9, 57.1, 56.4, 57.8, 55.0, 52.9 in January 2023.

Although an index value above 50 indicates growth, a relative decline in the indicator may adversely affect the yuan. Since China is the most important trade and economic partner of Australia and New Zealand, a deterioration in Chinese macro data may negatively impact the Australian and New Zealand dollars. Conversely, an increase in Chinese macro figures is usually positive for these currencies.

12:15 – EUR: European Central Bank’s Interest Rate Decision. ECB Monetary Policy Statement

The European Central Bank will publish its decision on the main refinancing operations and the deposit facility rates, which currently stand at 2.40% and 2.25%, respectively.

The ECB’s tight stance on inflation and the level of key interest rates favor the euro, while a softer stance and lower rates weaken it. Given the high inflation in the Eurozone, according to the ECB leadership, the risk balance for the eurozone’s economic outlook remains negative.

The ECB warns that GDP growth may slow due to several challenges, including the EU’s energy crisis, heightened economic uncertainties, a global economic slowdown, and tightening financial conditions. Additionally, President Trump’s tariffs complicate an already delicate economic situation, raising the US average tariff rate to 22%, the highest since 1910. For the Eurozone, already facing weakening industrial production and the services sector, these tariffs are a significant concern. Analysts indicate that all European exporters will feel the strain, particularly the automobile industry, where tariffs have escalated to 25%.

In light of the current situation, the ECB may lower its deposit rate to below 2.0% and resume quantitative easing, given the high risks of recession in the Eurozone. However, the possibility of taking a pause is not ruled out.

A dovish tone in the statements will negatively impact the euro. Conversely, a hawkish tone regarding the central bank’s monetary policy will bolster the euro.

12:45 – EUR: European Central Bank’s Press Conference

This press conference will draw significant attention from market participants. Volatility may increase not only in euro quotes but also across the entire financial market if the ECB leaders make unexpected statements. ECB executives will evaluate the current economic situation in the Eurozone and provide insights on the bank’s rate decision. Historically, after some ECB meetings and subsequent press conferences, the euro exchange rate experienced fluctuations of 3%–5% in a short time frame.

A dovish tone in the speech will negatively impact the euro. Conversely, a hawkish tone regarding the central bank’s monetary policy will bolster the euro.

Friday, June 6

09:00 – EUR: Eurozone GDP for Q1 (Final Estimate). Eurozone Retail Sales

GDP is considered to be an indicator of the overall economic health. A rising trend of the GDP indicator is positive for the euro, while a low reading weakens the currency.

Recent Eurozone macro data has shown a gradual recovery in the growth rate of the European economy after a sharp decline in early 2020.

Previous values: +0.2% (+1.2% YoY) in Q4 2024, +0.4% (+0.9% YoY) in Q3, +0.2% (+0.6% YoY) in Q2, +0.3% (+0.4% YoY) in Q1 2024, 0% (+0.1% YoY) in Q4 2023, -0.1% (0% YoY) in Q3, +0.1% (+0.5% YoY) in Q2, -0.1% (+1.0% YoY) in Q1 2023, 0% (+1.9% YoY) in Q4 2022, +0.7% (+4,0% YoY) in Q3, +0.8% (+4.1% YoY) in Q4 2022, +0.7% (+4,6% YoY) in Q3, +2.2% (+3.9% YoY) in Q3, +2.2% (+14.3% YoY) in Q2, and -0.3% (-1.3% YoY) in Q1 2021.

If the data is below the forecasted and/or previous values, the euro may decline. Conversely, readings exceeding the predicted values may strengthen the euro in the short term. However, the European economy is still far from fully recovering to pre-crisis levels.

The preliminary estimate stood at +0.4% (+0.2% YoY) in Q1 2025.

Retail sales data is the main measure of consumer spending, indicating the change in sales volume. A high indicator result strengthens the euro, while a low one weakens it.

Previous values: -0.1% (+1.5% YoY), -0.3% (+2.3 YoY), -0.3% (+1.5% YoY), -0.2% (+1.9% YoY) in January 2025, +0.1% (+1.2% YoY) in December 2024, -0.5% (+1.9% YoY), +0.5% (+2.9% YoY), +0.2% (+0.8% YoY), +0.1% (-0.1% YoY), -0.3% (-0.3% YoY), +0.1% (+0.3% YoY), -0.5% (0% YoY), +0.8% (+0.7% YoY), -0.5% (-0.7% YoY), +0.1% (-1.0% YoY) in January 2024, -1.1% (-0.8% YoY) in December, -0.3% (-1.1% YoY) in November, +0.1% (-1.2% YoY) in October, -0.3% (-2.9% YoY) in Sept, 1.2% (-2.1% YoY) in August, -0.2% (-1.0% YoY) in July, -0.3% (-1.4% YoY) in June, 0% (-2.4% YoY) in May, -1.2% (-2.9% YoY) in April, -0.8% (-3.3% YoY) in March, +0.3% (-2.4% YoY) in February, -2.7% (-1.8% YoY) in January, +0.8% (-2.8% YoY) in December 2022.

The data suggests that retail sales have not returned to pre-pandemic levels after a severe drop in March–April 2020, when Europe was under strict quarantine measures, and are periodically declining again. Nevertheless, values exceeding the forecast will strengthen the euro.

12:30 – CAD: Canada Unemployment Rate

Statistics Canada will release the country’s November labor market data. Massive business closures due to the coronavirus and layoffs have also contributed to the unemployment rate, increasing from the usual 5.6–5.7% to 7.8% in March and 13.7% in May 2020.

In April 2025, unemployment stood at 6.9% against 6.7% in March, 6.6% in February and January 2025, 6.7% in December 2024, 6.8% in November, 6.5% in October and September, 6.6% in August, 6.4% in July and June, 6.2% in May, 6.1% in April and March, 5.8% in February, 5.7% in January 2024, 5.8% in December and November 2023, 5.7% in October, 5.5% in September, August, and July, 5.4% in June, 5.2% in May, 5.0% in April, March, February, January, December, 5.1% in November, 5.2% in October and September, 5.4% in August, 4.9% in July and June, 5.1% in May, 5.2% in April, 5.3% in March, 5.5% in February, 6.5% in January 2022.

If the unemployment rate continues to rise, the Canadian dollar will depreciate. If the data exceeds the previous value, the Canadian dollar will strengthen. A decrease in the unemployment rate is a positive factor for the Canadian dollar, while an increase is a negative factor.

12:30 – USD: Average Hourly Earnings. Private Nonfarm Payrolls. Unemployment Rate

The most significant US labor market indicators for May.

Previous values: +0.2% in April, +0.3% in March and February, +0.5% in January 2025, +0.3% in December 2024, +0.4% in November, October, September, and August, +0.2% in July, +0.3% in June, +0.4% in May, +0.2% in April, +0.3% in March, +0.1% in February, +0.6% in January 2024, +0.4% in December and November 2023, +0.2% in October, September, and August, +0.4% in July and June, +0.3% in May, +0.5% in April, +0.3% in March, +0.2% in February, +0.3% in January 2023 / 227k in November, 36k in October, +255k in September, +78k in August, +114k in July, +118k in June, 216k in May, +108k in April, +310k in March, +236k in February, +256k in January 2024, +290k in December 2023, +182k in November, +165k in October, +246k in September, +210k in August 2023, +210k in August 2023 / 4.2% in November, 4.1% in October and September, 4.2% in August, 4.3% in July, 4.1% in June, 4.0% in May, 3.9% in April, 3.8% in March, 3.9% in February, 3.7% in January 2024, December and November 2023, 3.9% in October, 3.8% in September and August, 3.5% in July, 3.6% in June, 3.7% in May, 3.4% in April, 3.5% in March, 3.6% in February, 3.4% in January 2023.

Overall, the values are positive. Nevertheless, it is often difficult to predict the market’s reaction to the data release, given that many previous figures can be revised. This task becomes even more challenging now due to the contradictory economic situation in the US and many other large economies, with the looming risk of recession alongside persistently high inflation.

Regardless, the release of the US labor market data is anticipated to prompt increased volatility not just in the US dollar but also in the entire financial market. Most risk-averse investors will probably prefer to stay out of the market during this period.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.