The Volume-Weighted Average Price (VWAP) indicator is a great alternative to standard moving averages. Although moving averages are popular and widely available, forming the basis of many trading platforms and indicators such as Bollinger Bands, they have certain limitations. Moving averages calculate an average price based on time frames but do not take into account trading volumes, which can reduce accuracy.

The need to improve the accuracy of the analysis has led to the development of alternatives such as exponential and weighted averages (LWMA, WMA). This article reviews the VWAP definition, its pros and cons, and its practical application.

The article covers the following subjects:

Major Takeaways

- The VWAP indicator or the Volume-Weighted Average Price is used to calculate the weighted average price of an asset, taking into account trading volume.

- The indicator helps to determine trends and identify support and resistance levels.

- Indicator advantages include trading volume consideration and real-time data relevance.

- Among the disadvantages is the fact that the indicator tends to lag and may give false signals during a sideways market.

- To understand how to use the VWAP indicator, traders may focus on price deviation from the indicator line to open and close trades.

What is the Volume Weighted Average Price (VWAP): Definition

Before explaining the definition of the Volume Weighted Average Price (VWAP) indicator, let’s revise what the Moving Average is.

A moving average is a statistical measure that obtains the average value of a given day’s market price over a set period of time. For example, if one wanted to find the twelve-week moving average for a stock, they would add up the security’s price for each trading day over the past twelve weeks and then divide that figure by twelve. The resulting number would be the stock’s twelve-week moving average. Moving averages are useful for smoothing out data points and can provide insight into overall trends. For instance, if a stock price is consistently above its moving average, it may be in an uptrend. Conversely, if a stock’s typical price is consistently below its moving average, it may be in a downtrend. Moving averages can also be used to identify support and resistance levels. There are various types of moving averages, among the most common are Simple Moving Average (SMA), Exponential Moving Average (EMA), Moving Average Convergence/Divergence (MACD).

VWAP Indicator Definition

The volume-weighted average price (VWAP) is a calculation that shows the average cost of a security over a given period, weighted by its volume. In other words, it tells you how much it would cost to buy an entire asset if you bought it in small pieces throughout the trading day. The VWAP trading indicator can be used on any time frame, but it’s most commonly used on intraday price charts.

VWAP Indicator Calculation & Formula

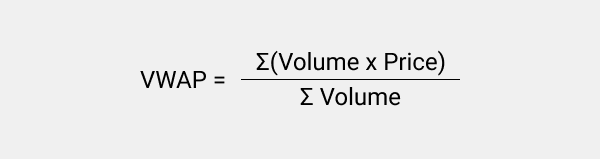

To calculate the VWAP, you simply need to multiply the price of each trade by its volume, and then divide that sum by the total trading volume. Here is the VWAP formula:

Let’s have a closer look at each formula component.

- Price stands for the average price of an asset over a given period. In calculations, it’s possible to come across three different types of average prices:

Median price – (High + Low) / 2

Typical price – (High + Low + Close) / 3

Weighted price – (High + Low + Open + Close) / 4

-

Volume represents the number of units traded during that period.

-

Total or Cumulative Volume is the total number of units traded over the entire period.

The VWAP is a lagging indicator, which means that it’s based on past data. As such, it can be used as a measure of liquidity or to identify potential support and resistance levels. What’s more, it’s important to remember that lagging indicators may not provide very accurate information about the future price performance of an asset. Thus, it’s reasonable to implement them in conjunction with other technical tools.

To illustrate how VWAP works, let’s consider the following example.

Suppose you want to make the VWAP calculation for a stock over the course of a day. The first step is to calculate the price and volume for each trade. The table below shows these values:

|

Time |

Volume (shares) |

Typical Price |

Weighted Price |

|

09:30 |

100 |

$50 |

$5000 |

|

09:45 |

200 |

$49 |

$9800 |

|

11:00 |

300 |

$48.50 |

$14,550 |

|

12:30 |

400 |

$47.75 |

$19,100 |

|

14:15 |

500 |

$46.50 |

$23,250 |

The next step is to sum the weighted prices and volumes for all trades. This gives us a total of 1500 shares traded at a weighted price of $71,700.

Lastly, it’s necessary to divide the total weighted price by the total trading volume to get the VWAP:

VWAP = 71700 / 1500 = $47.8

However, calculating the VWAP manually can be quite tedious, especially if you’re trying to do it on a large number of assets. Fortunately, most charting software packages will have a volume-weighted average price indicator built in, so you don’t have to calculate it yourself.

How to calculate VWAP on Excel Sheet

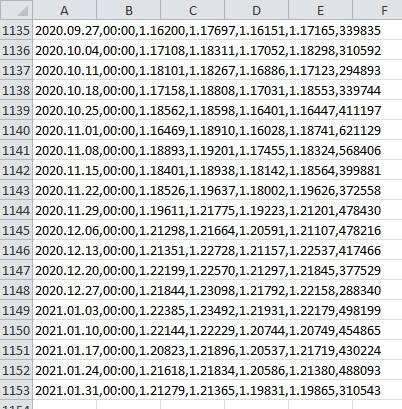

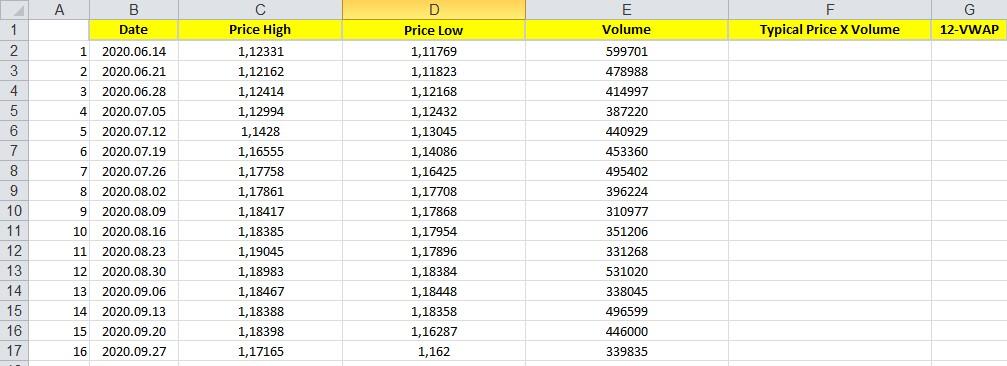

VWAP calculation in Excel is necessary to check the correctness of the indicator values on the chart. For example, if you downloaded a version of VWAP from an unknown source and did not understand the code. Make a calculation in Excel and compare the values with the real ones:

-

Download quotes from MT4. “Service/Quotes archive”. In the window that opens, select the required currency pair and timeframe.

-

Click “Export” and save the file in CSV format.

-

Open the file in Excel and edit it. The uploaded data is a single column of numbers separated by a comma. Each line corresponds to a date.

I will use the Median Price for the calculation, so I will only need two types of High/Low price and volumes. It is possible to convert the data in the source file using the LEFT and RIGHT functions. Don’t forget to convert the data to a number if a green triangle appears in the corner of the cell. Also replace the separator “dot” with “comma”.

-

Calculate the numerator of the fraction in column F. Multiply the average high and low prices by the volume. Stretch the cells.

F2: =(C2+D2)/2*E2

-

Calculate VWAP with a period of 12:

G13=F13/E13

Period 12 means that data is calculated based on the last 12 candles (cells). Therefore, insert the formula only in the 12th line of G13.

You can download the template via this link.

How to Use VWAP

Now that we know common methods of calculating VWAP, let’s take a look at some of the ways it can be used.

The measure of liquidity

Since VWAP takes into account both the price and volume of each trade it is commonly used as a measure of asset liquidity. When the VWAP is close to the current price, it means that there is high liquidity (i.e., a lot of trading activity). Conversely, when the VWAP is far from the current price, it indicates low liquidity.

Support and resistance levels

Another common use for VWAP is to identify potential support and resistance levels. These are prices where there is likely to be an influx of buying or selling activity, which can cause the price to reverse course.

One way to use VWAP to identify these levels is by looking for periods where the price is trading above or below the VWAP. When the price is above the VWAP, it indicates that there is strong buying pressure. Similarly, when the price is below the VWAP, it suggests that there is significant selling pressure.

Another way to use VWAP to find support and resistance levels is by looking for deviations. This occurs when the price deviates significantly from the VWAP. For example, if the stock has been trading at a VWAP of $50 for most of the day but suddenly spikes up to $60, this could be an indication that there is strong buying pressure and the stock is likely to continue moving higher. Conversely, if the price plummets from $50 to $40, this could be a sign that the stock is going to continue falling.

While VWAP can be a useful indicator, it’s important to remember that it may not always accurately predict future price movements. Therefore, to get a more complete picture of what’s happening in the market it’s recommended to use it with other technical tools, such as Bollinger bands, Relative Strength Index (RSI), and others.

VWAP Trading Strategies

Let’s take a look at some trading strategies that make use of the Volume Weighted Average Price indicator.

Intraday trading

VWAP indicator can be used in intraday trading to identify buy and sell signals. If the asset is traded over VWAP, some traders may interpret it as a good sign to sell. Conversely, if the asset price is traded below VWAP, it could be a good price to buy.

Pairs trade

This involves taking a long position in a stock that is trading below its VWAP and simultaneously taking a short position in another stock that is trading above its VWAP. The idea behind this strategy is that the two stocks will eventually converge towards their respective VWAPs.

Trailing stop

This strategy means that a trader would buy or sell when the price moves a certain percentage above or below the VWAP. For example, an investor might set a trailing stop of plus or minus five percent.

The VWAP Pullback

It is a simple yet effective way to trade using the VWAP indicator. This technique is based on the premise that after a stock has made a large move, it will often retrace back to the VWAP before resuming its original trend. To trade this VWAP strategy, a trader would first need to identify a stock that has made a large move. Then it’s necessary to calculate the volume-weighted average price and wait for the stock to pull back to this level. Once it does, a trader would enter a long or short position, depending on the direction of the original move. The stop loss for this pullback strategy should be placed just below or above the VWAP, depending on the position.

VWAP Bands

Another way to trade with the Volume Weighted Average Price (VWAP) indicator is by using VWAP bands. This involves drawing a band around the indicator and waiting for the price to move towards the upper or lower band. The width of the band can be based on a number of different factors, but a common setting is to use plus or minus two standard deviations. This will create a fairly wide band that will capture most of the price action. Once the price reaches the upper or lower band, a trader would then enter a long or short position, depending on the direction of the move. The stop loss for this strategy should be placed just outside of the VWAP band.

Support and Resistance with the VWAP

As previously mentioned, the Volume Weighted Average Price (VWAP) indicator can be used as a support and resistance level. By taking the average price of a security over a period of time, this tool can be implemented to identify potential entry and exit points. For example, if the asset price is trading below the VWAP, it may be an indication that it is undervalued and could be ripe for purchase. Similarly, if the asset price is trading above the VWAP line, it may be an indication that the security is overvalued and could be ripe for selling. In case the asset price is approaching the VWAP line, the current market tends to be balanced. This is a potential signal where the trend is likely to continue or reverse.

What’s more, VWAP can be used in conjunction with support and resistance levels to help make better-informed trading decisions. For example, if the current price is below VWAP and approaching a significant support level, that may be seen as a buying opportunity. Conversely, if the current price is above VWAP and approaching a significant resistance level, that may be seen as a selling opportunity.

VWAP vs. MVWAP

There is a similar to VWAP indicator known as Moving VWAP (MVWAP). It is simply the VWAP that’s been shifted forward in time. It’s often used as a reference point for making trading decisions. For example, a trader might buy a security if it’s trading below the MVWAP and sell it if it’s trading above the MVWAP.

There are several key differences between the VWAP and MVWAP that need to be understood.

-

The VWAP is based on cumulative volume over a given period, while the MVWAP is based on a subset of that volume.

-

The VWAP is static, while the MVWAP is dynamic.

-

The VWAP is typically used as a benchmark for intraday trading, while the MVWAP is often used as a reference point for making trading decisions over multiple days or even weeks.

Anchored VWAP

Another variation of the VWAP is the anchored VWAP. This is a VWAP that is calculated using a specific time period. For example, you could calculate the anchored VWAP using the last two hours of trading. This would give you a good idea of where the stock is likely to trade during this period. Anchored VWAPS can be useful for day traders who want to get a feel for where the stock is likely to trade during a specific time period.

VWAP indicator for MT4

If you’re using the MetaTrader platform, there’s also a possibility to add VWAP to your trading chart. To download the free version of this indicator, click on the following link (VWAP Indicator for MT4). Once you have downloaded and installed the indicator, you simply need to attach it to your chart. Everything it’s necessary to do is to go to the MT4 menu panel, click on “File / Open Data Catalog,” proceed to the Indicators folder, and put the VWAP indicator file there. As soon as you restart the platform, VWAP will appear as any other tool in the section “Insert / Indicator” on the chart.

Limitations of Using VWAP

While the VWAP is an efficient tool, it’s important to keep in mind that it’s not perfect. Here are some of its most significant drawbacks.

-

It’s a lagging indicator. This means that it’s based on past price action and may not always reflect what’s happening in the present market. This isn’t necessarily a bad thing, but it’s something to keep in mind.

-

It doesn’t take order size into account. For example, if there are two orders placed for 100 shares each, the VWAP will be the same as if there was just one order for 200 shares. This can sometimes lead to false signals and you should be aware of this before using the VWAP.

-

VWAP is more suitable for short- and middle-term strategies. It is prone to false signals in the long run.

-

There are many versions of VWAP that take slightly different input data. Therefore, the results of the calculation may differ, this way causing confusion for traders.

Despite these limitations, the VWAP is a robust indicator that can be helpful in trading. However, traders are recommended to use it with other indicators to get the best results.

Pros and Cons

Let’s sum up the advantages and disadvantages of using VWAP in the table below.

|

Pros |

Cons |

|

Helps to identify support and resistance levels |

Lagging indicator |

|

Trend-following indicator |

Not accurate for large orders |

|

Relatively easy to calculate |

Doesn’t take into account order size |

|

Accurate for short-term strategies (М1-М5-М15) |

Has many versions which causes confusion among traders |

|

The full version is paid |

Conclusion

The VWAP indicator is a helpful tool for traders of all levels of experience. It can be used to find potential entry and exit points, as well as to identify support and resistance levels. There are also a number of different settings and time periods that can be implemented to suit the needs of any trader. Give it a try and see how it works for you. Experiment with different settings to find what works best for your trading style. However, to mitigate potential risks and get better results, it’s advisable to use VWAP in combination with other technical analysis tools, such as Bollinger bands, RSI, SMA, and others.

VWAP FAQ

The VWAP indicator is a measure of the volume-weighted average price of a security over a specific period of time. The indicator is calculated by adding up all of the prices at which transactions occur during the period and then dividing by the total number of transactions. The VWAP indicator can be used by traders to identify potential buy and sell points, as well as to assess the overall market direction.

There are a number of different ways that traders can use VWAP, but some common approaches include using it as a target for taking profits or as a support/resistance level. VWAP can also be used as a trailing stop-loss order, which will automatically sell a security if it falls below the VWAP level. Overall, VWAP is a versatile tool that can be used in a variety of different ways to help traders make better-informed decisions.

VWAP is primarily used by traders as a benchmark or tool for making trading decisions, some investors also use it as a measure of value. For example, if a stock has consistently traded below its VWAP over a long period of time, an investor might view it as undervalued and be more likely to buy it. Conversely, if a stock has consistently traded above its VWAP over a long period of time, an investor might view it as overvalued and be less likely to buy it.

To calculate VWAP, you first need to determine the total asset value of all trades made during the period in question. This can be done by multiplying the number of securities traded by the price of each trade. Once you have determined the total value, it’s necessary to divide it by the total number of assets traded.

To set up VWAP on Thinkorswim, first go to the “Charts” tab. Then, click on the “Style” dropdown menu and select “Area.” Next, choose the “Studies” in the dropdown menu and click “Edit Studies.” In the Edit Studies window, click on the “Add Study” button. A new window will pop up. In this window, select “Volume Weighted Average Price” from the list of studies. Then, click on the “OK” button. The VWAP will now be seen on your chart.

The VWAP is a useful metric for traders because it takes into account both price and volume, giving a more accurate picture of market activity than either measure alone. There are various ways how to use VWAP indicator. Most commonly traders implement it as a support and resistance. In this case, if the asset price is located below the VWAP, investors consider it an indication that the market is undervalued so it could be a good opportunity to open a buying position. Conversely, if the asset price is trading above the VWAP, it may be an indication that it is overvalued so it could be profitable to open a selling trade.

The volume-weighted average price is often used as a benchmark by traders in various ways. For example, some investors may implement VWAP as a buy or sell signal – if the price of a security falls below VWAP, they may buy it, and if it rises above VWAP, they may sell it. Other traders may use VWAP as a guide for where to place their stop-loss orders.

To calculate VWAP indicator on Exel, first, it’s necessary to open the MT4 trading platform, go to the Tools menu, and find the History Center tab. There you need to choose the suitable asset and set the timeframe. Then, export the data in the csv format. Once you open the downloaded file in Excel, make changes and calculate the VWAP following the formula: VWAP = Sum of (Price * Volume) / Total Volume.

A VWAP strategy is a trading approach that seeks to minimize transaction costs by trading at or near the volume-weighted average price of a security. In order to do this, investors often establish a VWAP benchmark at the start of the day and then look to trade around that price. Some traders may use VWAP as an intraday target, while others may use it as a stop-loss order. In any case, the goal of VWAP strategies is to take advantage of lower prices during times of high volume and better prices during times of low volume.

VWAP is a popular indicator that is used by traders to assess the market value of a security. Just as any indicator, it comes with its pros and cons. Volume Weighted Average Price is a trend-following indicator that helps traders to spot suitable entry and exit points as well as set the levels of support and resistance. It has proven to be accurate for short-term trading strategies. However, it’s necessary to remember that it’s a lagging tool, thus it’s not very efficient in predicting future price action. Moreover, it shows much noise and can give false signals for large orders.

VWAP (volume-weighted average price) and VWMA (volume-weighted moving average) are technical indicators that use volume data to measure the average price of a security over a given period of time. While both indicators provide similar information, there are some key differences between them. VWAP is a static indicator that is calculated using the closing price, while VWMA is a dynamic indicator that is constantly updated as new information becomes available. VWAP is also typically calculated using a shorter time frame than VWMA, making it more suitable for day trading.

There are a few different ways that you can set up your VWAP, depending on your trading style and what kind of information you want to be displayed. The first step is to find a VWAP indicator for your chosen trading platform – most platforms will have at least one VWAP tool available. Once you’ve found an indicator, you’ll need to add it to your chart. To do this, simply click on the “Indicators” tab in the toolbar and select the VWAP indicator from the list. Once the indicator is added to your chart, you can customize the parameters to suit your needs.

The VWAP indicator was invented by Peter Steidlmayer, a pioneer in market analysis and founder of the Market Profile theory. Steidlmayer designed VWAP as a way to measure institutional activity and identify potential support and resistance levels. Although it is primarily used by traders, VWAP is also a popular tool among investors and portfolio managers.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.