The yen has undergone a notable shift in performance, emerging as a prominent market leader. Regardless of the pace at which the Bank of Japan implements monetary policy adjustments, the Fed’s rate reduction has created a favorable environment for the USDJPY pair’s decline. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The Japanese government considers an overnight rate cut a mistake.

- The Bank of Japan insists on continued normalization.

- The Fed may return the US dollar under the spotlight.

- The USDJPY pair will likely reach the bearish target of 139, but one should be ready for a pullback.

Weekly fundamental forecast for Japanese yen

In a joint effort, the Bank of Japan and the government managed to significantly impact the USDJPY market. However, at the outset of the decline, the alignment of interests between the officials has been disrupted. The government is publicly discouraging any tightening of monetary policy, while members of the Governing Council are discussing the potential need to raise the overnight rate to 1%. The market has demonstrated greater confidence in the central bank, allowing the yen to strengthen to its highest level since July 2023.

The Japanese yen has overtaken the euro in the G10 best-performers race, ranking second after the British pound. This is due to the yen’s recovery, consistently high inflation, the abandonment of carry trade, and falling yields on US Treasuries. Jefferies attributes the decline in USDJPY quotes below 140 to expectations of a 50-basis-point rate cut by the Fed on September 18. Mitsubishi UFJ cites increased volatility on the eve of the FOMC and Bank of Japan meetings as the primary reason for this development.

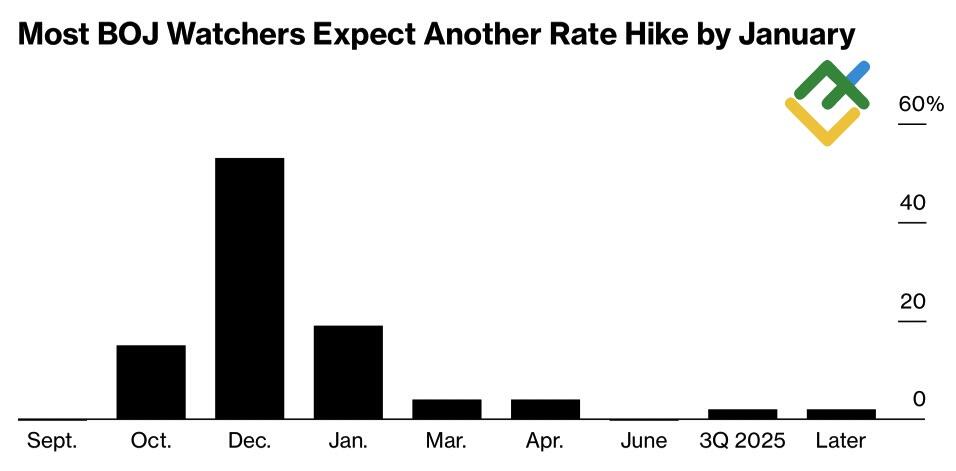

Rabobank anticipates that the pair will continue to plunge due to the Bank of Japan’s monetary policy normalization cycle. Bloomberg experts echo this sentiment. 87% of 53 experts predict a rate hike from 0.25% to 0.5% by early 2025, with December as the most probable month for such a move by the BoJ.

Predictions on the timing of the Bank of Japan’s overnight rate hike

Source: Bloomberg.

The divergence in monetary policy between the Fed and BoJ is contributing to downward pressure on USDJPY quotes, prompting concerns among officials about the potential negative impact of an overly strong yen on exports and the broader economy. Sanae Takaichi, a candidate for the Liberal Democratic Party leadership and potential future Prime Minister, has stated that the previous overnight rate hike was an error in judgment. The Bank of Japan should maintain low borrowing costs to support the fragile GDP recovery.

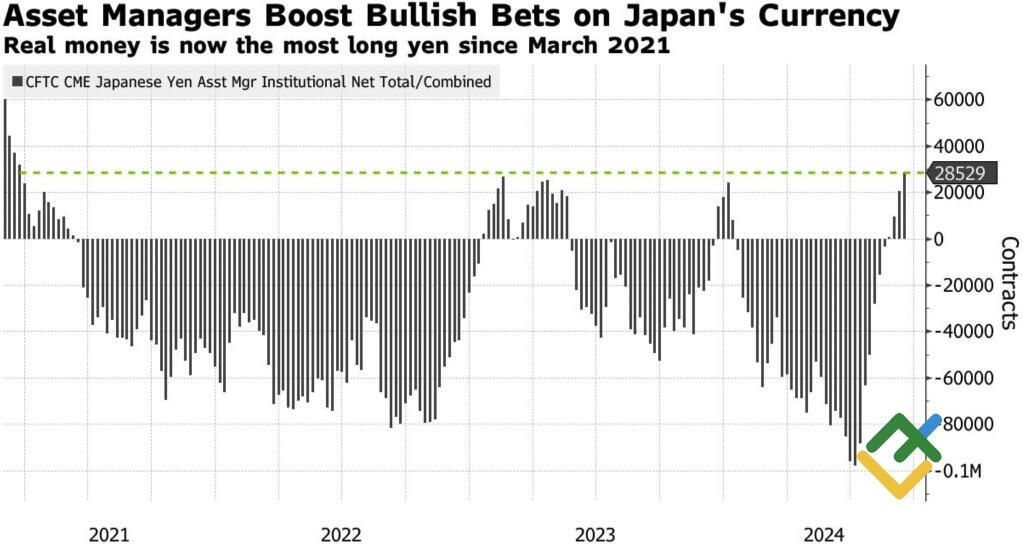

In contrast, Governing Council member Naoki Tamura stated that the rate should reach its neutral level of 1% in 2025. His remarks sparked discussions about potential monetary restrictions and prompted USDJPY selling. Asset managers increased their net JPY long positions to the highest level since March 2021.

Speculative positions on Japanese yen

Source: Bloomberg.

Despite the pressure from the government, it is unlikely that the Bank of Japan will abandon its plans to normalize monetary policy. The overnight rate is expected to continue its upward trajectory, which will strengthen the yen. In addition, the downward trajectory of the USDJPY pair is likely to become less straightforward than it has been over the past two months.

Weekly USDJPY trading plan

The updated FOMC projections for the federal funds rate could potentially trigger a correction. They indicate that the Fed is likely to implement two to three acts of monetary expansion in 2024 rather than the four to five that investors had anticipated. As a result, the US dollar may regain market favor for a few weeks. Against this backdrop, short trades can be partially closed, with targets at 139 and 133.5. After that, one can sell the USDJPY pair during an upward correction.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.