The USDPHP currency pair represents the ratio of the US dollar to the Philippine peso. Changes in its exchange rate depend on many factors that traders should take into account when making trading decisions. To provide the most accurate forecast for 2025, 2026, 2027, and beyond, we have performed a technical analysis of this currency pair and reviewed insights from leading analysis platforms.

The article explores key levels that serve as a guide for identifying favorable entry points and target levels. Additionally, social media analysis provides insight into user sentiment regarding the USDPHP pair. Moreover, the section outlining the asset’s advantages and disadvantages highlights potential opportunities and risks associated with trading this currency pair.

The article covers the following subjects:

Major Takeaways

- The current price of the USDPHP pair is ₱57.87 as of 06.02.2025.

- The USDPHP pair reached its all-time high of ₱60.66 on 04.11.2024. The pair’s all-time low of ₱55.54 was recorded on 20.09.2024.

- The USDPHP currency pair trading is influenced by fundamental factors such as the Central Bank of the Philippines and the US Fed interest rates, inflation, employment and unemployment rates, as well as the GDP growth in both countries.

- According to technical analysis, the pair is trading in a long-term uptrend. At the beginning of 2025, the price stood at 59.20. If the asset breaks through and settles above the resistance, the quotes will likely continue to climb, targeting 62.00 and 66.00.

- Analysts offer a cautious outlook, expecting the price to rise modestly through 2025, 2026, 2027, and beyond, with an average annual growth rate of 5%.

- Forecasts beyond 2030 are limited as this currency pair is considered exotic and is primarily traded in Asian markets, which affects its appeal among traders from Europe and the US.

- In terms of global cycles, the Philippines has started to recover from the COVID-19 pandemic. However, high inflation and global economic risks are keeping the peso exchange rate in the range of 54–59.

- Investing in the asset tends to be profitable when positions are held open for a year or longer. For greater confidence in potential growth, it is advisable to wait until the price breaks through the resistance near 59.00.

USDPHP Real-Time Market Status

The USDPHP currency pair is trading at ₱57.87 as of 06.02.2025.

When trading currency pairs like USDPHP, monitoring the economic indicators of the respective countries is crucial. In this case, it is essential to focus on the economic data from the US and the Philippines.

Investors closely monitor political news in these countries, considering the impact of the US dollar within the global financial landscape while weighing the risks associated with unexpected events. Factors like the global economic crisis, alongside both natural and man-made disasters, can significantly affect the currency pair exchange rate.

| Metric (The Philippines) | Value |

| Interest rate | 5.75% |

| Inflation (YoY) | 2.9% |

| Core inflation (YoY) | 2.8% |

| Economic growth (GDP) ( YoY) | 5.2% |

| Employment | 96.8% |

| Unemployment | 3.2% |

| Balance of trade | -4.14 billion USD |

| Foreign exchange reserves | 107 billion USD |

| Capital flows | +7.09 million USD (as of September 2024) |

| Foreign direct investment | +1 billion USD (as of October 2024) |

| External debt | 123 billion USD (as of late 2024) |

USDPHP Price Forecast for 2025 Based on Technical Analysis

Let’s examine the monthly USDPHP chart to conduct a technical analysis. The key levels on the chart will help assess the price performance.

The price is trading near its all-time high, around 58.50. The previous all-time high was 57.59. Notably, the pair began climbing significantly in 1994 and later entered an accumulation phase, establishing the key support level near 40.62.

Since June 2023, the price has been trading in a global uptrend. The asset has been rising after hitting the support of 40.62. In 2022, the pair exceeded the 2004 high and attempted to surpass the previous swing high in 2024.

Let’s move to the weekly chart, adding key levels and the EMA 21 and EMA 190 indicators.

The short-term resistance sits near the 2022 high of 59.13. The nearest support level stands around 57.70, and another support level is near 55.50.

The 21-day moving average is trending upwards, indicating a short-term uptrend on the weekly chart. The EMA 190 is also pointed upwards, confirming the long-term uptrend.

Therefore, the bullish trend will likely continue in 2025. In this connection, consider long trades at the support of 57.70 with the target at 59.13. If the price consolidates above this level, the pair may soar to the target of 66.63.

|

Month |

USDPHP Projected Values | |

| Minimum, ₱ | Maximum, ₱ | |

| February | 58.30 | 59.41 |

| March | 58.50 | 60.50 |

| April | 59.13 | 60.83 |

| May | 60.50 | 61.82 |

| June | 61.00 | 63.00 |

| July | 60.00 | 62.00 |

| August | 60.34 | 63.50 |

| September | 62.00 | 64.60 |

| October | 63.00 | 65.00 |

| November | 63.50 | 65.50 |

Long-Term Trading Plan for USDPHP for 2025

Based on the analysis performed, the pair may continue to rise in 2025 if the price breaches and settles above the resistance of 59.13. In this case, the asset may break through the Triangle pattern and surge, targeting 66.63.

Currently, the price is trading below the resistance of 59.13, and the Triangle boundaries are narrowing. While the pattern is forming, one may consider long trades at the 57.69 and 56.29 levels with the targets near last year’s high of 59.13.

An alternative scenario suggests that if the price consolidates below 56.15, one may consider short trades. In this case, the price may break through the support of 55.49 and slide to 54.11.

Analysts’ USDPHP Price Projections for 2025

Most forecasts for the USDPHP currency pair in 2025 suggest that the price will trade between 58.00 and 62.00. Thus, one may consider initiating trades near the boundaries of this range, anticipating a potential price appreciation.

WalletInvestor

Price range in 2025: ₱58.595–₱60.894 (as of 25.01.2025).

WalletInvestor projects subdued growth, with the asset hitting a low of 58.595 in February before gradually rising to 60.849 by year-end. Corrections are expected in July and December 2025.

| Month | Open, ₱ | Close, ₱ | Minimum, ₱ | Maximum, ₱ |

| February | 58.595 | 58.751 | 58.595 | 58.763 |

| March | 58.761 | 58.886 | 58.761 | 58.964 |

| April | 58.880 | 59.050 | 58.826 | 59.050 |

| May | 59.055 | 59.458 | 59.036 | 59.458 |

| June | 59.473 | 59.978 | 59.473 | 59.978 |

| July | 59.996 | 59.916 | 59.877 | 60.065 |

| August | 59.898 | 60.338 | 59.898 | 60.355 |

| September | 60.377 | 60.722 | 60.372 | 60.722 |

| October | 60.728 | 60.822 | 60.717 | 60.844 |

| November | 60.822 | 60.843 | 60.822 | 60.894 |

| December | 60.872 | 60.849 | 60.752 | 60.872 |

PandaForecast

Price range in 2025: ₱58.529–₱61.926 (as of 25.01.2025).

PandaForecast predicts the Philippine peso will strengthen gradually, reaching 59.756 in February 2025 and trading between 58.529 and 61.926 afterward. By year-end, the asset is expected to trade at 59.921. It is advisable to trade at the boundaries of the range and avoid long-term positions.

| Month | Minimum, ₱ | Average, ₱ | Maximum, ₱ |

| February | 58.5374 | 59.7564 | 60.2763 |

| March | 59.6584 | 60.9755 | 61.8169 |

| April | 60.0060 | 60.9755 | 61.9267 |

| May | 58.5291 | 59.4023 | 60.1508 |

| June | 58.7059 | 59.5092 | 60.3305 |

| July | 59.6660 | 60.0805 | 60.9997 |

| August | 58.9086 | 60.0985 | 61.0361 |

| September | 58.8420 | 59.7199 | 60.7411 |

| October | 57.8323 | 59.2362 | 59.6982 |

| November | 59.7572 | 60.8711 | 61.2911 |

| December | 58.8789 | 59.9215 | 61.1080 |

LongForecast

Price range in 2025: ₱56.12–₱60.31 (as of 25.01.2025).

LongForecast‘s experts suggest the USDPHP pair will fluctuate between 56.12 and 60.31 in 2025, indicating a relatively narrow channel, given the potential for significant volatility. Nevertheless, trading within this channel is possible. Since an upward momentum is anticipated, one may consider long trades.

| Month | Open, ₱ | Min–Max, ₱ | Close, ₱ |

| January | 58.08 | 57.13–59.39 | 58.06 |

| February | 58.06 | 56.77–59.73 | 57.77 |

| March | 57.77 | 56.37–58.09 | 57.23 |

| April | 57.23 | 56.65–58.37 | 57.51 |

| May | 57.51 | 57.51–60.13 | 59.24 |

| June | 59.24 | 58.11–59.87 | 58.99 |

| July | 58.99 | 56.36–58.99 | 57.22 |

| August | 57.22 | 56.20–57.92 | 57.06 |

| September | 57.06 | 56.12–57.82 | 56.97 |

| October | 56.97 | 56.95–58.69 | 57.82 |

| November | 57.82 | 57.82–60.31 | 59.42 |

| December | 59.42 | 58.49–60.27 | 59.38 |

Analysts’ USDPHP Price Projections for 2026

Most experts believe the USDPHP currency pair will experience minimal swings in 2026. Analysts agree that prices are expected to grow insignificantly.

WalletInvestor

Price range in 2026: ₱60.843–₱63.317 (as of 25.01.2025).

According to WalletInvestor, the USDPHP price will open around 60.85 in 2027 and then increase smoothly without significant corrections, reaching around 63.26 by December.

| Month | Open, ₱ | Close, ₱ | Minimum, ₱ | Maximum, ₱ |

| January | 60.858 | 61.014 | 60.843 | 61.035 |

| February | 61.014 | 61.167 | 61.014 | 61.171 |

| March | 61.177 | 61.312 | 61.177 | 61.385 |

| April | 61.301 | 61.470 | 61.250 | 61.470 |

| May | 61.451 | 61.873 | 61.451 | 61.873 |

| June | 61.925 | 62.398 | 61.925 | 62.398 |

| July | 62.412 | 62.311 | 62.305 | 62.486 |

| August | 62.315 | 62.793 | 62.315 | 62.793 |

| September | 62.799 | 63.139 | 62.786 | 63.139 |

| October | 63.148 | 63.241 | 63.131 | 63.262 |

| November | 63.241 | 63.300 | 63.241 | 63.317 |

| December | 63.297 | 63.269 | 63.173 | 63.297 |

Leoprophet

Price range in 2026: ₱57.274–₱63.732 (as of 25.01.2025).

Leoprophet expects the Philippine peso to surge to 62.34 in 2026. Since the price is trading near 58.30 in early 2025, the asset will gain 7% in 2 years. This performance suggests that trading in an ascending channel will be favorable.

| Month | Close, ₱ | Minimum, ₱ | Maximum, ₱ |

| January | 58.56770 | 58.16360 | 59.78010 |

| February | 58.00550 | 57.27460 | 58.63190 |

| March | 58.04030 | 57.62240 | 58.92830 |

| April | 58.42330 | 57.79240 | 59.45740 |

| May | 59.80800 | 58.46230 | 60.20270 |

| June | 59.96940 | 59.21380 | 61.39070 |

| July | 59.68160 | 58.49990 | 60.61260 |

| August | 60.95280 | 60.05680 | 61.83050 |

| September | 61.81220 | 60.56980 | 62.27580 |

| October | 61.51550 | 60.07610 | 61.97690 |

| November | 62.06920 | 60.87750 | 62.64640 |

| December | 62.34850 | 61.03920 | 63.73260 |

LongForecast

Price range in 2026: ₱58.04–₱62.56 (as of 25.01.2025).

LongForecast predicts a moderate growth for the USDPHP exchange rate in 2026. Analysts expect the price to open around 59.62 and slowly rise, closing the year slightly higher at 60.47.

| Month | Open, ₱ | Min–Max, ₱ | Close, ₱ |

| January | 59.62 | 58.63–60.41 | 59.52 |

| February | 59.52 | 59.52–61.40 | 60.49 |

| March | 60.49 | 59.50–61.32 | 60.41 |

| April | 60.41 | 58.04–60.41 | 58.92 |

| May | 58.92 | 58.21–59.99 | 59.10 |

| June | 59.10 | 58.26–60.04 | 59.15 |

| July | 59.15 | 59.15–61.83 | 60.92 |

| August | 60.92 | 59.62–61.44 | 60.53 |

| September | 60.53 | 58.47–60.53 | 59.36 |

| October | 59.36 | 59.36–61.17 | 60.27 |

| November | 60.27 | 60.27–62.56 | 61.64 |

| December | 61.64 | 59.56–61.64 | 60.47 |

Analysts’ USDPHP Price Projections for 2027

Most experts predict that the currency pair will experience low volatility in 2027. This means the absence of a clear trend and a potential sideways channel trading. Therefore, it is essential to identify the channel’s boundaries and try to open trades within its range.

WalletInvestor

Price range in 2027: ₱62.884–₱65.339 (as of 25.01.2025).

WalletInvestor anticipates the price will trade in a long-term uptrend in 2026. The bullish scenario assumes that the price will hover near the 60.85 level at the beginning of the year, edging higher and hitting 63.26 by year-end.

| Month | Open, ₱ | Close, ₱ | Minimum, ₱ | Maximum, ₱ |

| January | 62.884 | 63.044 | 62.884 | 63.063 |

| February | 63.082 | 63.210 | 63.072 | 63.210 |

| March | 63.256 | 63.358 | 63.256 | 63.431 |

| April | 63.350 | 63.488 | 63.300 | 63.507 |

| May | 63.491 | 63.942 | 63.491 | 63.942 |

| June | 63.962 | 64.427 | 63.962 | 64.427 |

| July | 64.444 | 64.339 | 64.338 | 64.520 |

| August | 64.343 | 64.820 | 64.343 | 64.820 |

| September | 64.821 | 65.160 | 64.805 | 65.160 |

| October | 65.143 | 65.257 | 65.143 | 65.279 |

| November | 65.294 | 65.321 | 65.277 | 65.339 |

| December | 65.313 | 65.260 | 65.186 | 65.313 |

Audtoday

Price range in 2027: ₱56.16 –₱64.22 (as of 25.01.2025).

Audtoday expects the pair to trade in a relatively narrow price range of 56.16–64.22 in 2027. Monthly volatility is forecast not to exceed 3.0%, indicating the absence of a pronounced trend.

| Month | Open, ₱ | Min–Max, ₱ | Close, ₱ |

| January | 60.54 | 60.30–62.14 | 61.22 |

| February | 61.22 | 59.29–61.22 | 60.19 |

| March | 60.19 | 58.43–60.21 | 59.32 |

| April | 59.32 | 56.81–59.32 | 57.68 |

| May | 57.68 | 56.16–57.88 | 57.02 |

| June | 57.02 | 57.02–59.61 | 58.73 |

| July | 58.73 | 58.73–60.59 | 59.69 |

| August | 59.69 | 59.19–60.99 | 60.09 |

| September | 60.09 | 60.09–62.82 | 61.89 |

| October | 61.89 | 60.96–62.82 | 61.89 |

| November | 61.89 | 61.67–63.55 | 62.61 |

| December | 62.61 | 62.32–64.22 | 63.27 |

LongForecast

Price range in 2027: ₱56.59 –₱64.70 (as of 25.01.2025).

LongForecast predicts that the USDPHP exchange rate will start at 61.01 in early 2027, drop to 59.17 by July, and then rebound to 63.74 by the end of December.

| Month | Open, ₱ | Min–Max, ₱ | Close, ₱ |

| January | 61.01 | 60.76–62.62 | 61.69 |

| February | 61.69 | 59.74–61.69 | 60.65 |

| March | 60.65 | 58.87–60.67 | 59.77 |

| April | 59.77 | 57.24–59.77 | 58.11 |

| May | 58.11 | 56.59–58.31 | 57.45 |

| June | 57.45 | 57.45–60.06 | 59.17 |

| July | 59.17 | 59.17–61.03 | 60.13 |

| August | 60.13 | 59.62–61.44 | 60.53 |

| September | 60.53 | 60.53–63.29 | 62.35 |

| October | 62.35 | 61.41–63.29 | 62.35 |

| November | 62.35 | 62.12–64.02 | 63.07 |

| December | 63.07 | 62.78–64.70 | 63.74 |

Analysts’ USDPHP Price Projections for 2028

According to most forecasts, the USDPHP price will continue to advance slowly in 2028, meaning that long trades will be prioritized. Moreover, volatility will be low during this period.

WalletInvestor

Price range in 2028: ₱65.26–₱67.72 (as of 25.01.2025).

WalletInvestor predicts a bullish scenario for the USDPHP in 2028, forecasting the highest price of 67.727. While this gain may not be significant compared to early 2020s momentum, it presents opportunities for short-term trading if the price movement aligns with the forecast.

| Month | Open, ₱ | Close, ₱ | Minimum, ₱ | Maximum, ₱ |

| January | 65.266 | 65.464 | 65.266 | 65.464 |

| February | 65.469 | 65.642 | 65.454 | 65.642 |

| March | 65.651 | 65.714 | 65.651 | 65.819 |

| April | 65.704 | 65.874 | 65.685 | 65.886 |

| May | 65.913 | 66.342 | 65.907 | 66.342 |

| June | 66.360 | 66.802 | 66.352 | 66.810 |

| July | 66.815 | 66.762 | 66.722 | 66.911 |

| August | 66.772 | 67.208 | 66.772 | 67.208 |

| September | 67.187 | 67.525 | 67.187 | 67.535 |

| October | 67.531 | 67.682 | 67.531 | 67.682 |

| November | 67.682 | 67.702 | 67.661 | 67.727 |

| December | 67.671 | 67.648 | 67.575 | 67.680 |

Audtoday

Price range in 2028: ₱62.44–₱68.93 (as of 25.01.2025).

Audtoday forecasts the rate to soar from 63.27 to 66.43 by the end of 2028. Monthly volatility will not exceed 2.9%, indicating low seller and buyer activity. At the same time, minor price fluctuations will help avoid significant drawdowns.

| Month | Open, ₱ | Min–Max, ₱ | Close, ₱ |

| January | 63.27 | 62.44–64.34 | 63.39 |

| February | 63.39 | 62.54–64.44 | 63.49 |

| March | 63.49 | 63.18–65.10 | 64.14 |

| April | 64.14 | 63.18–65.10 | 64.14 |

| May | 64.14 | 62.42–64.32 | 63.37 |

| June | 63.37 | 63.37–66.20 | 65.22 |

| July | 65.22 | 63.79–65.73 | 64.76 |

| August | 64.76 | 64.76–67.30 | 66.31 |

| September | 66.31 | 66.31–68.93 | 67.91 |

| October | 67.91 | 66.11–68.13 | 67.12 |

| November | 67.12 | 65.72–67.72 | 66.72 |

| December | 66.72 | 65.43–67.43 | 66.43 |

LongForecast

Price range in 2028: ₱62.89–₱69.45 (as of 25.01.2025).

LongForecast projects that the USDPHP exchange rate will jump from 63.74 to 66.94 in 2028. Thus, long trades can be considered in the long term.

| Month | Open, ₱ | Min–Max, ₱ | Close, ₱ |

| January | 63.74 | 62.90–64.82 | 63.86 |

| February | 63.86 | 63.00–64.92 | 63.96 |

| March | 63.96 | 63.65–65.59 | 64.62 |

| April | 64.62 | 63.65–65.59 | 64.62 |

| May | 64.62 | 62.89–64.81 | 63.85 |

| June | 63.85 | 63.85–66.71 | 65.72 |

| July | 65.72 | 64.27–66.23 | 65.25 |

| August | 65.25 | 65.25–67.81 | 66.81 |

| September | 66.81 | 66.81–69.45 | 68.42 |

| October | 68.42 | 66.62–68.64 | 67.63 |

| November | 67.63 | 66.22–68.24 | 67.23 |

| December | 67.23 | 65.94–67.94 | 66.94 |

Analysts’ USDPHP Price Projections for 2029

Since the USDPHP currency pair is an exotic asset, very few analysis resources provide forecasts for 2029. Those that are available indicate a continuation of the uptrend.

WalletInvestor

Price range in 2029: ₱67.69–₱70.11 (as of 25.01.2025).

WalletInvestor suggests the Philippine peso will continue to advance in 2029. The price is expected to open near 67.69, reaching 69.19 mid-year and ending at 70.07.

| Month | Open, ₱ | Close, ₱ | Minimum, ₱ | Maximum, ₱ |

| January | 67.691 | 67.853 | 67.691 | 67.853 |

| February | 67.857 | 68.023 | 67.836 | 68.023 |

| March | 68.036 | 68.100 | 68.023 | 68.209 |

| April | 68.090 | 68.294 | 68.069 | 68.294 |

| May | 68.301 | 68.724 | 68.288 | 68.724 |

| June | 68.717 | 69.182 | 68.717 | 69.182 |

| July | 69.196 | 69.149 | 69.106 | 69.300 |

| August | 69.154 | 69.568 | 69.151 | 69.589 |

| September | 69.570 | 69.908 | 69.570 | 69.909 |

| October | 69.950 | 70.066 | 69.950 | 70.066 |

| November | 70.069 | 70.065 | 70.045 | 70.114 |

| December | 70.057 | 70.067 | 69.965 | 70.076 |

Audtoday

Price range in 2029: ₱66.33–₱68.43 (as of 25.01.2025).

Audtoday offers a forecast only for January and February 2029. According to the analysts, the price will trade at 66.43 at the beginning of the year and 67.42 at the end of February.

| Month | Open, ₱ | Min–Max, ₱ | Close, ₱ |

| January | 66.43 | 66.33–68.35 | 67.34 |

| February | 67.34 | 66.41–68.43 | 67.42 |

LongForecast

Price range in 2029: ₱66.84–₱68.96 (as of 25.01.2025).

LongForecast also provides a forecast only for January and February 2029, with the lowest and the highest prices hitting 66.84 and 68.96, respectively. Therefore, the asset is expected to grow slightly.

| Month | Open, ₱ | Min–Max, ₱ | Close, ₱ |

| January | 66.94 | 66.84–68.88 | 67.86 |

| February | 67.86 | 66.92–68.96 | 67.94 |

Analysts’ USDPHP Price Projections for 2030

Forecasts for the Philippine peso rate in 2030 are scarce and vary widely. The most pessimistic projection predicts a slump to 48.96, while the neutral outlook expects the pair to trade around 61.51. WalletInvestor’s optimistic forecast sets a target near 70.19.

Capital.com

Capital.com expects the USDPHP price to plummet to 48.96 in 2030. However, this forecast may be revised upward in the future, as the article was published in April 2023.

CoinCodex

Experts at CoinCodex predict the US dollar will appreciate against the Philippine peso, reaching around 61.51 by 2030. Given the current price of 58.30, this growth appears too modest for a five-year forecast. Therefore, this projection should be approached with caution.

WalletInvestor

According to WalletInvestor, the USDPHP price will reach 70.19 in 2030. This forecast may materialize if the price maintains its current uptrend and will continue to rise in small impulses.

Analysts’ USDPHP Price Projections until 2050

Forecasting exchange rates for long-term periods such as 2050 is an extremely challenging task. Exchange rates depend on many factors, including economic performance, political situation, global events, and unpredictable crises or innovations.

The USDPHP currency pair is considered to have relatively low liquidity compared to the EURUSD, GBPUSD, or USDJPY pairs. This low liquidity results in significantly reduced trading volumes, making it less appealing for analysts and traders. Additionally, the lack of interest from larger investors and speculators further diminishes the availability of data and research, which can be crucial for long-term forecasting.

The Philippine peso (PHP) is often categorized as an exotic currency, particularly in a global context. Exotic currencies tend to be traded less frequently than major currencies and their rates are more influenced by local economic and political factors. Consequently, experts rarely pay attention to such instruments, preferring to analyze more prominent currencies such as the US Dollar, the euro, or the Japanese yen. This makes predicting the USDPHP exchange rate until 2050 challenging and less effective.

Market Sentiment for USDPHP on Social Media

Media sentiment plays a significant role in the USDPHP (US dollar to Philippine peso) pair trading, especially in the short term. Media sentiment reflects the general mood and tone of analytical reviews and news on social media, which can influence trader and investor behavior.

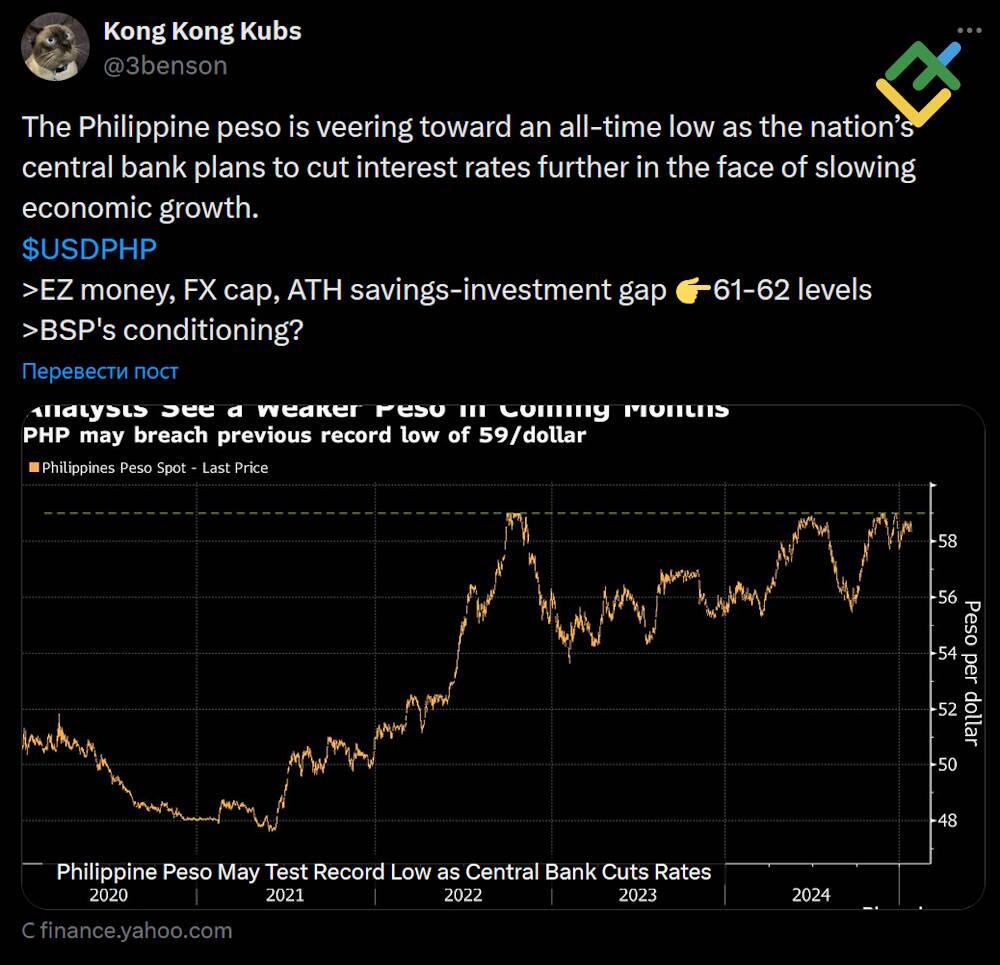

For example, the user of the X (former Twitter) network @3benson points out that the Philippine peso is approaching an all-time low as the country’s central bank plans to cut interest rates further amid slowing economic growth. The user offers the 61.00–62.00 levels as bullish targets.

@ravelasj expects the currency to fluctuate between the 58.500 and 58.750 levels in the near term.

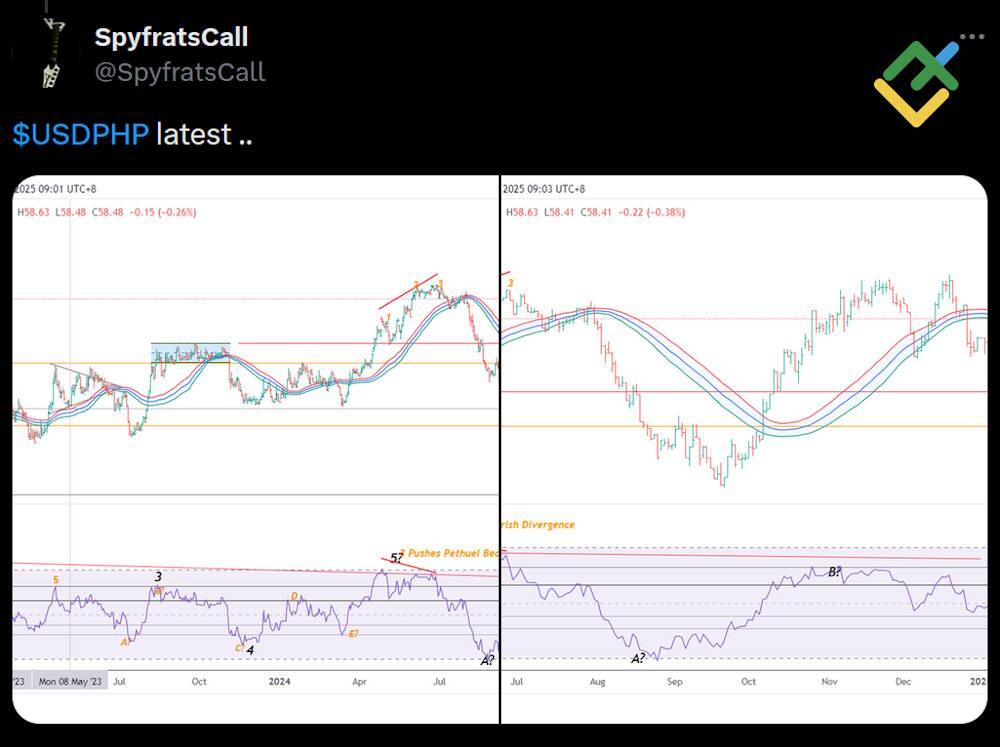

Another analyst @SpyfratsCall assumes that a correction to 57.14–56.54 levels may start within the A-B-C pattern, and then the price will likely continue to climb.

In general, traders expect the USDPHP pair to continue its uptrend once the corrective patterns are completed. The 61.00 and 62.00 levels are considered the nearest targets.

USDPHP Price History

The USDPHP pair reached its all-time high of 60.66 PHP on 04.11.2024.

The lowest price of the USDPHP pair was recorded on 20.09.2024 and reached 55.54 PHP.

It is important to evaluate historical data to make predictions as accurate as possible.

The history of the USDPHP currency pair reflects economic and political changes both in the Philippines and in the global context. Initially, the Philippine peso was pegged to the US dollar under a fixed exchange rate until the 1960s. In the 1970s, the Philippines shifted to a floating exchange rate, which led to a gradual devaluation of the peso due to economic difficulties, including external debt and political instability. In 1997, the Asian financial crisis hit the Philippines hard, causing the peso to depreciate sharply from 26 to 40–45 per dollar.

In the 2000s, the Philippines recovered from the crisis, and the economy began to expand due to reforms, increased exports, and remittance inflows from overseas Filipino workers. During that period, the USDPHP price stabilized in the 40–50 range, although encountering occasional fluctuations due to global events such as the 2008 financial crisis.

The Philippines started to recover from the COVID-19 pandemic in 2021–2024. However, high inflation and global economic risks have kept the peso exchange rate at 54–59.

USDPHP Price Fundamental Analysis

Fundamental analysis helps to understand the long-term and short-term movements of the currency pair based on economic, political, and global factors, including the Philippines and US macroeconomic indicators, monetary policy, cash flows, investments, inflation, and external risks.

What Factors Affect the USDPHP Price?

The USDPHP price is influenced by the following fundamental factors:

- Interest rates. Interest rates in the US and the Philippines significantly affect the exchange rate. The difference between the interest rates of the two countries may attract investors to currencies with higher yields.

- Inflation. Inflation reduces the purchasing power of a currency. If one country’s inflation rate is significantly higher than that of another one, it can lead to a weakening of that country’s currency.

- GDP growth rate. Economic growth is an important factor affecting the strength of a currency. Countries with faster economic growth tend to have stronger currencies.

- Balance of trade. The balance of trade reflects the difference between a country’s exports and imports. A positive balance of trade, when exports exceed imports, usually bolsters the currency.

- Political situation. Political instability can significantly impact a currency. For example, political crises, elections, and government changes can cause uncertainty and may undermine the currency.

Moreover, foreign exchange reserves, employment and unemployment rates, international investments and capital inflows, and consumer confidence indexes should be taken into account.

More Facts About USDPHP

The USDPHP currency pair is the ratio of the US dollar (USD) to the Philippine peso (PHP). It became available for trading on the open market in the 1970s when the Philippines switched from a fixed to a floating exchange rate system. The USDPHP pair is widely used in international trade, money transfers, and investments, especially since the Philippines is a significant recipient of remittances from overseas Filipino workers. Besides, the pair is valuable for businesses operating in the region and serves as an effective tool for hedging currency risks.

The instrument is popular among traders focused on Asian markets. However, it is less liquid and more volatile than major currency pairs such as the EURUSD or USDJPY.

The asset is appealing because of its sensitivity to key Philippine macroeconomic indicators, such as GDP, inflation, interest rates, and global events that impact emerging markets. However, due to relatively low liquidity and unique market characteristics, the USDPHP pair is primarily utilized by experienced traders and investors specializing in Asian assets.

Advantages and Disadvantages of Investing in USDPHP

Trading and investing in currencies come with pros and cons. Investors need to gain basic knowledge of the currency market to consider including a particular asset in their portfolio.

Advantages

- High volatility. The USDPHP pair often demonstrates significant fluctuations, creating opportunities to profit from short- and medium-term trends.

- Sensitivity to macroeconomic data. The exchange rate reacts heavily to key indicators such as GDP, inflation, interest rates, and remittances, allowing traders to use fundamental analysis for forecasting.

- Global events impact. The pair is vulnerable to the US Fed monetary policy changes and global risks.

- Remittances. The Philippines is one of the largest remittance recipients in the world, which fuels demand for the peso and creates seasonal trends.

- Diversification. The pair allows investors to diversify their portfolio by investing in emerging markets.

Disadvantages

- Low liquidity. Compared to major currency pairs such as the EURUSD or USDJPY, the USDPHP pair is less liquid, leading to wider spreads and making it more challenging to identify optimal entry and exit points.

- High risks. The Philippine economy is prone to external shocks such as natural disasters, political instability, or global crises, magnifying risks for investors.

- Speculators’ influence. Due to the relatively small trading volume, the USDPHP exchange rate may be subject to sharp movements driven by speculation or news.

- Availability. Not all brokers offer the USDPHP pair for trading, especially on retail platforms, which can limit investment opportunities.

Investing in the USDPHP pair can be profitable for experienced traders ready to handle high volatility and risks. However, beginners may find this pair challenging due to low liquidity and sensitivity to external factors. Thus, it is essential to carefully analyze fundamental and technical factors before making decisions.

How We Make Forecasts

When making forecasts, we use technical and fundamental analyses. Technical analysis includes examining the price chart, identifying key support and resistance levels, and pinpointing long-term trends. Indicators such as moving averages (SMA, EMA), oscillators (RSI, MACD), pivot points, and the Ichimoku indicator help identify trends, overbought or oversold conditions, and entry/exit points.

Fundamental analysis involves evaluating macroeconomic data such as central bank interest rates, economic growth rates, employment figures, and the geopolitical landscape both globally and in specific countries being analyzed. It also considers the insights of well-known analysts and reputable analysis platforms. Additionally, media sentiment plays a crucial role in capturing the mood of investors. Combining these tools makes it possible to make forecasts for different time frames and make informed investment decisions.

Conclusion: Is USDPHP a Good Investment?

Technical and fundamental analysis and the opinions of various analysts indicate that the USDPHP pair is a good long-term investment.

The Philippine peso has been weakening against the US dollar since it was introduced to the open market. Several factors contribute to this decline, including the country’s economic challenges, political uncertainties, competition from other Asian countries, and the impact of global crises. However, the primary driver of the peso’s depreciation is the overall strength of the US dollar.

Additionally, analysts believe that the USDPHP pair will increase in the long term if it breaks through the range of 59.00–54.00. In this case, the pair may hit the targets near 62.00 and then 66.00.

USDPHP Price Prediction FAQs

The current USDPHP price stands at ₱57.87 as of 06.02.2025.

Most analysts expect the asset to trade in the range of 58.00–62.00. A slight upward trend will be maintained. If the price consolidates above 62.00, the pair may continue to rise to 66.00.

The highest USDPHP price of PHP was recorded on .

The weakening of the Philippine peso can be attributed to several factors, including economic challenges in the country, the current political landscape, regional uncertainties, and the strengthening of the US dollar in the global market. For instance, the Philippines is dealing with relatively high inflation at 2.9% and an elevated interest rate of 5.75%.

Several key factors influence the current USDPHP exchange rate, notably the recent interest rate decisions made by the Philippines central bank and the domestic political climate. The central bank raises interest rates, while disagreements among key authorities cause currency sell-offs. Additionally, the strength of the US dollar significantly impacts the quotes.

High inflation can strengthen the Philippine peso if managed effectively by the central bank. However, if inflation becomes uncontrollable, the peso tends to weaken. Employment and GDP growth support the currency, while declines affect it negatively.

Changes in the USDPHP exchange rate movement are possible. Thus, monitor the main economic and political news worldwide and in the Philippines. US dollar weakening or strengthening, changes in government, and force majeure events can significantly affect the exchange rate.

Firstly, the Central Bank of the Philippines and the US Fed interest rate decisions help to forecast the exchange rate. Secondly, one should pay attention to inflation indicators in both countries and assess the labor market data, money flows, and business confidence indices.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.