With stocks confident of a soft landing for the US economy and bonds screaming about the return of inflation, the EURUSD pair is having a hard time deciding which trajectory to embark on. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The US economy is stronger than expected.

- Robust macro statistics supported stock indices.

- The US dollar is confused by stock and bond signals.

- The EURUSD pair may fall into a consolidation range of 1.108-1.124.

Weekly US dollar fundamental forecast

The market discounts everything. However, the current market conditions are challenging to navigate, with equities embracing the Goldilocks scenario and bonds facing concerns about the potential resurgence of high inflation. Consequently, the EURUSD pair is experiencing significant volatility, with the pair struggling to determine the direction of further movement. In order to make an informed decision, further guidance is required, particularly in light of the imminent release of US employment statistics.

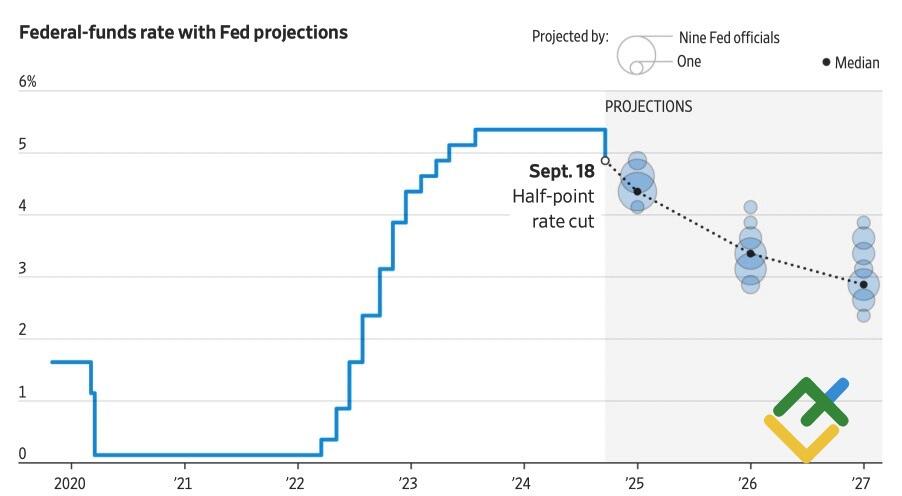

The effectiveness of the Fed’s monetary expansion will depend on the underlying weakness of the US economy. Given the central bank’s objective of a soft landing, it was a calculated risk to be proactive. The decision to lower the federal funds rate by 50 bps was taken to keep the economy at current levels and to prevent a cooling of the labor market. As anticipated, the updated FOMC forecasts include two further acts of monetary easing in 2024 and a slight increase in the unemployment rate.

Federal funds rate and FOMC forecasts

Source: Wall Street Journal.

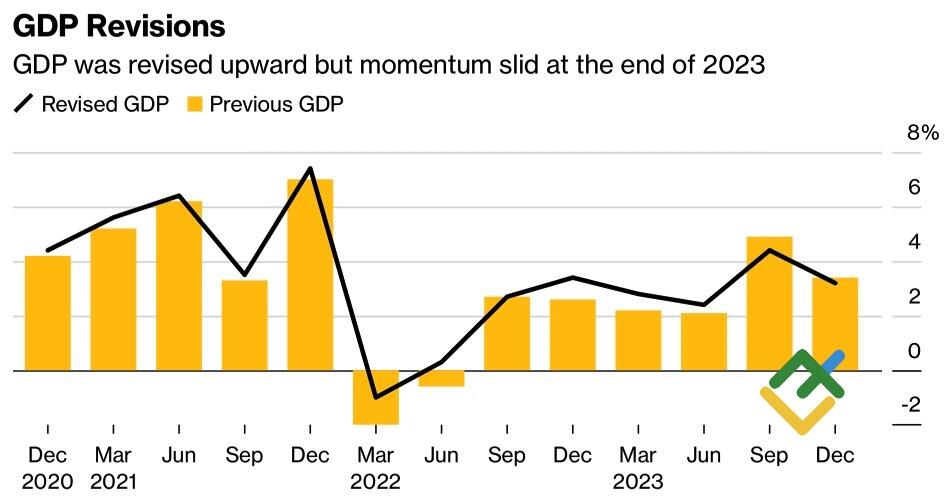

However, recent data indicates that the economy is not as weak as previously thought. There has been a notable decline in jobless claims, reaching a four-month low. Additionally, durable goods orders have exceeded expectations, and GDP has been revised upwards from 1.4% to 1.6% in the first quarter and from 4.9% to 5.2% in the five years to March 2024, representing a total of $294.2 billion.

US GDP

Source: Bloomberg.

In the wake of the Fed’s aggressive tightening of monetary policy between 2022 and 2023, industry experts were left pondering the resilience of the US economy. As it transpired, the economy proved to be even more robust than anticipated. Consumers have secured favorable mortgage rates, and the substantial fiscal stimulus and related surplus savings have been propelling domestic demand.

There is a concern that a new cycle of monetary expansion will not quickly revive lending. It is anticipated that even a 100-basis point reduction in rates will not result in a significant decline. However, the decline in mortgage interest rates to a two-year low indicates otherwise. Many Americans are actively refinancing existing debt at lower rates. There is a growing trend in lending, which has the potential to accelerate GDP and inflation. This scenario poses a risk to US Treasuries and supports EURUSD bears.

Conversely, stock indices are optimistic about a soft landing and believe the Fed will avoid recession and maintain inflation under control. The stock market is responding favorably to the positive economic news from the US, with the S&P 500 continuing to set record highs. Global risk appetite is growing, which is also positive for the EURUSD pair.

Weekly EURUSD trading plan

When bonds and stocks provide conflicting signals, it becomes challenging to navigate the major currency pair. This is likely to persist until the release of US labor market statistics for September. The optimal strategy is to sell the EURUSD pair when it reaches 1.121-1.124 and buy when it declines to 1.108-1.111.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.