The US Federal Reserve has started the monetary expansion cycle quite aggressively and is now prepared to adopt a more measured approach if the US economy remains as robust as anticipated. In light of the ongoing challenges in the eurozone, there is an elevated risk of a pullback in the EURUSD pair. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The Fed is in no hurry to cut interest rates.

- Synchronized monetary expansion will not weaken the US dollar much.

- The ECB will consider a rate cut in October.

- Short trades on the EURUSD formed on the rise to 1.121 should be kept open.

Weekly fundamental forecast for euro

In the context of the fast-paced financial market, Jerome Powell’s assertion that the Fed is not an urgency-driven central bank is perceived as a significant concession. Following the release of the Fed Chairman’s speech, yields on Treasuries rose while the EURUSD currency pair experienced a significant decline. Powell stated that the US economy was in a favorable position and that there was no rationale for accelerating the monetary expansion cycle. If current projections hold, the Fed will cut the fed funds rate twice more in 2024, with a total reduction of 50 basis points.

It is unusual for the US regulator to begin loosening monetary policy in this way. It is particularly noteworthy that this occurred against the backdrop of an economy that is performing well. The primary reasons cited were the prevalence of elevated real interest rates and the necessity to avert a recession and combat inflation. However, this is about returning to a regime of continuous support for the financial markets. Against this backdrop, the S&P 500 index continues to hit record highs. The economy is strong, so the size of the Fed’s move at the next meeting is likely to have minimal impact on the overall picture.

However, it will have an effect on US Treasury yields and the greenback. The USD index has declined for three months, the longest losing streak since January 2023. Speculators continue to divest from the US dollar on expectations of a prolonged cycle of monetary expansion.

Non-commercial traders’ positions on US dollar

Source: Bloomberg.

Concurrently, the Fed maintains its position as the de facto leader. All other central banks follow the US financial regulator. Bloomberg research indicates that borrowing costs in advanced economies will exceed 50% by the end of 2025. We are witnessing a significant degree of alignment in the timing of monetary easing cycles across multiple economies. Historically, when this has occurred, the US dollar has not depreciated significantly against major world currencies.

Conversely, significant monetary expansion is beneficial for the global economy and procyclical currencies like the euro. However, the impact is delayed, which, when coupled with the vulnerability of the eurozone, suggests that EURUSD bears will continue to face challenges in the near term.

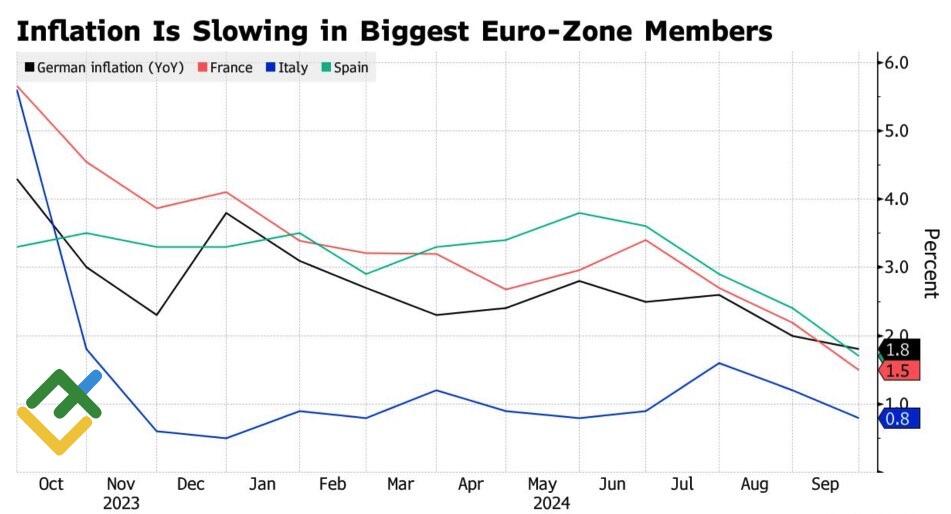

European inflation statistics contributed to the decline of the euro. The deceleration in consumer prices reinforces the risks of the currency bloc’s CPI declining below 2%, thereby heightening the probability of a deposit rate reduction in October to 80%. In light of Christine Lagarde’s remarks, it seems likely that the ECB will consider the latest statistics.

Inflation rate in EU countries

Source: Bloomberg.

Weekly trading plan for EURUSD

In this context, the US labor market report is the key indicator for the EURUSD pair. Strong employment figures will support the pair’s breakout of the lower boundary of the 1.108-1.121 consolidation range, while weak employment data will reinforce the risks of an uptrend recovery. For now, it is better to keep short positions formed at 1.121 open.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.