The US Federal Reserve will take all necessary steps to support the labor market. Therefore, an aggressive reduction in the federal funds rate is still possible. The outcome will be largely determined by US employment data for August. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Highlights and key points

- The S&P 500 index’s collapse dragged the EURUSD to a 2-week low.

- The Fed’s outlook has changed dramatically in 2.5 months.

- The Fed should try hard to achieve a soft landing.

- The euro’s rise to the upper boundary of the 1.102-1.11 range will create a selling opportunity.

Weekly US dollar fundamental forecast

The stock market is experiencing a resurgence of unfavorable news. Recently, negative news was viewed as an indication of an imminent start to the Fed’s monetary expansion cycle, which boosted the S&P 500 index. In early fall, disappointing data on business activity in the US manufacturing sector prompted a sharp decline in stock indices, marking the fastest sell-off since the Black Monday market crash. A decrease in global risk appetite supported the US dollar as a safe-haven currency, leading to a collapse in EURUSD quotes to a two-week low.

In the market, nothing is guaranteed. Two and a half months ago, the Federal Open Market Committee (FOMC) members did not anticipate reducing the federal funds rate in September. However, at the end of the summer in Jackson Hole, Jerome Powell stated that the time to adjust monetary policy was now. Just as Mario Draghi once promised to do everything he could to save the euro, the Fed chief vowed to do whatever was necessary to support the labor market. The reason for the dovish reversal should be sought in the constant stream of disappointing statistics on the US economy, which simultaneously weakened the US dollar.

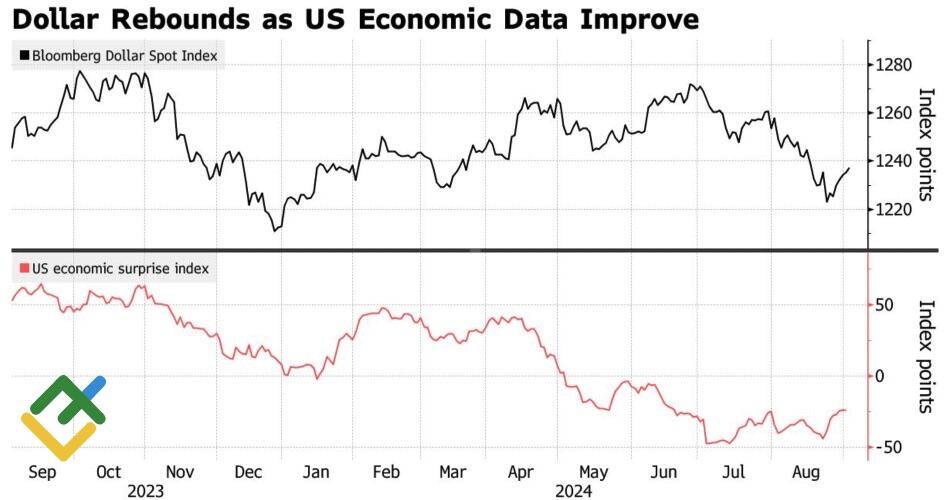

US dollar index and US economic surprise index

Source: Bloomberg.

Nevertheless, EURUSD bears have lost the opportunity to leverage the US exceptionalism. In this instance, the “weak economy – weak currency” principle proved less influential than the concept of exceptionalism. While the US GDP may continue to slow down, the US dollar may stay afloat. Negative news is once again having a negative impact on stock indices. The deterioration in global risk appetite and uncertainty surrounding the approaching presidential election will serve to reinforce the selling pressure on the major currency pair.

At the same time, Goldman Sachs anticipates that Donald Trump’s return to the White House will decelerate the US economy due to his administration’s protectionist policies and opposition to immigration. It is unlikely that fiscal stimulus will have the desired effect. A Kamala Harris presidency will have a marginal impact on GDP growth.

In light of the current outlook, it is likely that gross domestic product growth will decelerate. The Fed will have to exert considerable effort to ensure that the US economy achieves a soft landing, similar to those seen in 1984, 1995, and 2000. Notably, in 1984, the federal funds rate was decreased by 300 basis points over a four-month period, and in 2001, it saw a 275-basis-point reduction in the first half of the year. In 1995, the federal funds rate was reduced by 75 basis points over seven months. However, the anticipated 150 basis point increase at the conclusion of the previous monetary restriction cycle did not occur.

To provide the US economy with a soft landing, the Fed must take decisive action. However, this necessitates a further cooling of the labor market. Otherwise, there is no reason for implementing a significant reduction in borrowing costs.

Weekly EURUSD trading plan

With important employment statistics for August on the horizon, the EURUSD pair is at risk of entering a period of consolidation within a range of 1.102–1.11. If the pair increases the upper boundary of the range, one may consider short trades.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.