The deceleration in the US economy has prompted investors to reassess the US dollar’s prospects. Speculators are selling the US dollar, pushing the EURUSD pair higher. Will the employment statistics for August have an impact on the current situation? Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The Fed’s tight monetary policy is cooling the US economy.

- The labor market has reached an inflection point where unemployment risks rising sharply.

- Europe offers positive news.

- Depending on the employment data, the EURUSD pair may fall to 1.1 or rise to 1.12.

Daily US dollar fundamental forecast

If you place a glass of hot water in a freezer, the water will cool down eventually. The Fed’s tight monetary policy has had a similar effect to that of a freezer on the US economy. During the period of economic growth in the US, capital flowed into the US stock market, resulting in a strengthening of the US dollar. As the economy began to cool, stock prices dropped, and the US dollar was caught in a wave of sell-offs. Will the August employment report have an impact?

In a notable change, speculators have adopted a net short position on the US dollar for the first time in six months, with a total of $8.8 billion allocated to this strategy. In May, there were net long positions of $32.6 billion. The US dollar is being divested as a result of a cooling economy, rising recession risks, and declining stock indices. For the S&P 500 index, unfavorable US macroeconomic data is a negative factor, as the Fed will likely cut interest rates, but shareholders do not want to see a hard landing.

The yield curve has inverted for the first time in several months, a development that has preceded four previous economic downturns in the US. In addition, unemployment rates are rising rapidly, indicating that the economy is approaching a tipping point. In light of these developments, Jerome Powell has pledged to take all necessary measures to prevent the labor market from freezing.

US Treasury bond yield curve

Source: Financial Times.

The indications of a decline are becoming increasingly evident with each passing day. Following a decline in job openings and an increase in layoffs, the ADP employment report was a disappointing indicator. In August, the indicator saw a modest increase of 99K, representing the slowest pace since the beginning of 2021. The results fell short of the lowest forecast from Bloomberg experts, and the data for July was revised downward.

Coupled with positive news from Europe, this development enabled the EURUSD pair to regain a value above 1.11. Meanwhile, German manufacturing orders saw a 2.9% increase in July, a notable contrast to the consensus estimate of -1%. The 4.6% increase in June indicates that the German economy is not as weak as it may have appeared.

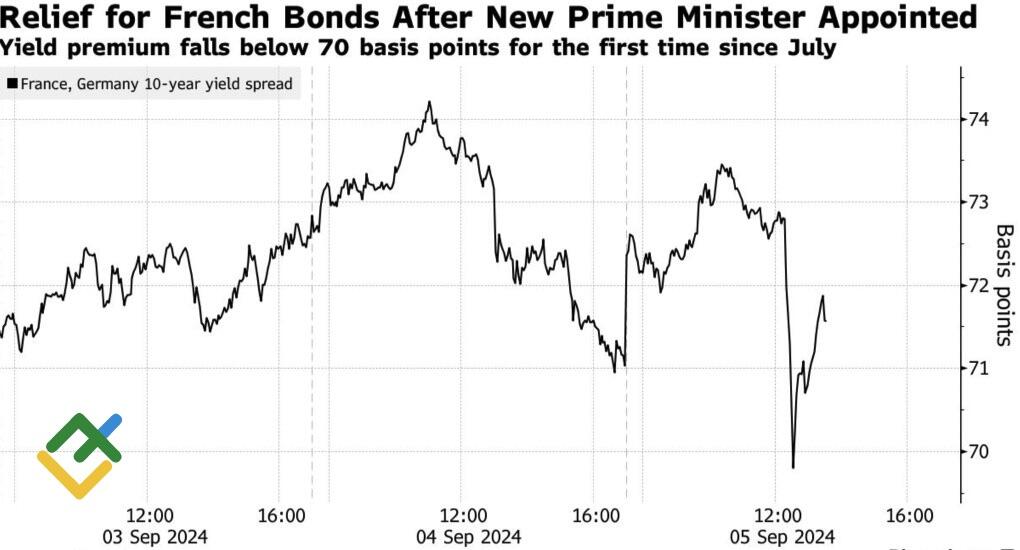

France has appointed a new prime minister, Michel Barnier, who previously served as a Brexit negotiator. His appointment has reduced political risk and narrowed the yield spread between French bonds and their German counterparts, which is positive for the euro.

France-Germany bond yield spread

Source: Bloomberg.

Daily EURUSD trading plan

However, the triumph of EURUSD bulls may prove to be short-lived. Should the US labor market recover in August from the disruption caused by Hurricane Beryl, there will be compelling reasons to sell the major currency pair with the target of 1.1. Conversely, disappointing employment figures could exacerbate the likelihood of a recession, prompt the Fed to pursue a more aggressive reduction in the federal funds rate, and potentially drive the euro down to 1.12.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.