In situations where words outnumber actions, skepticism about the feasibility of promises inevitably arises. Investors are leaning towards perceiving Donald Trump’s tariff threats as empty rhetoric, continuing to open long trades on the EURUSD pair. Let’s discuss this topic and develop a trading plan.

The article covers the following subjects:

Major Takeaways

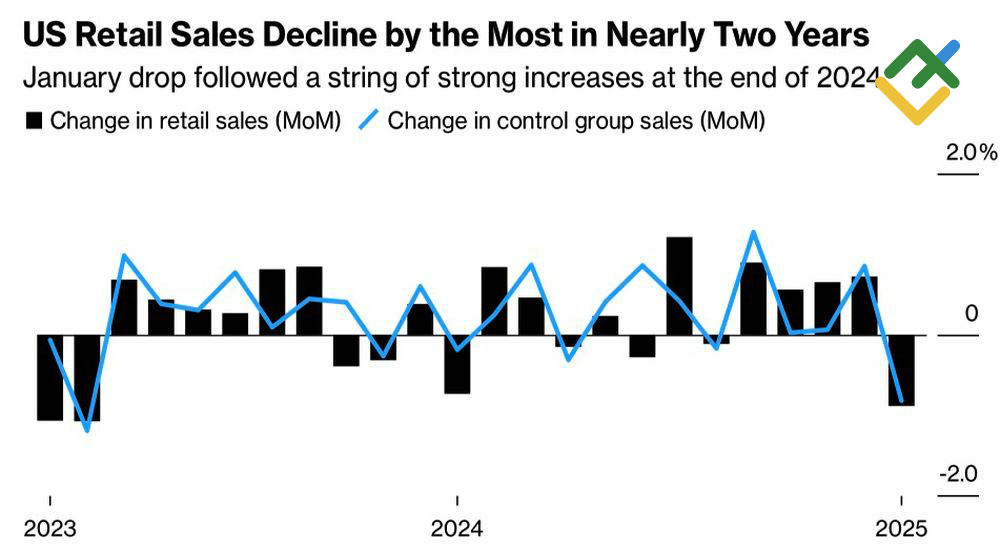

- Declining retail sales have hurt the US dollar.

- Speculators have reduced their long positions in the greenback for the fourth consecutive week.

- The euro has strengthened on positive news.

- The EURUSD pair may surge to 1.0615 and 1.071.

Weekly US Dollar Fundamental Forecast

The US Federal Reserve’s reluctance to reduce interest rates provides a safeguard for the US dollar. However, as the market becomes increasingly weary of President Donald Trump’s tariff threats and the US Treasury’s discussions regarding lower yields on 10-year notes, the EURUSD pair has skyrocketed. Furthermore, US retail sales in January have shown the worst performance in two years, and the greenback faces significant challenges.

US Retail Sales

Source: Bloomberg.

Investors have lost patience with the constant uncertainty surrounding tariffs, and markets are increasingly perceiving Trump’s threats as mere preparation for imminent agreements. Speculators have been reducing their net long positions for the fourth consecutive week, suggesting a shift in sentiment. However, they remain close to extreme levels, implying that the EURUSD pair has room for further growth.

Speculative Positions on US Dollar

Source: Bloomberg.

Investors are disregarding the different pace of monetary expansion between the Federal Reserve and the European Central Bank, as this factor is already reflected in the main currency pair’s quotes. At the same time, a batch of positive eurozone data is enabling EURUSD bulls to extend their gains.

The currency bloc’s economy expanded in the fourth quarter, notching a modest 0.1% growth, which is still better than zero GDP change. Markets are not concerned about the upcoming parliamentary elections in Germany on February 23. In fact, the likelihood of a victory for the opposition conservatives, Friedrich Merz, is seen as beneficial for the euro, as the victors are expected to ease fiscal constraints. In addition, rumors of the imminent commencement of peace negotiations regarding Ukraine have been a source of optimism for those favoring the EURUSD pair. The region has been the most affected by the armed conflict, and signs of an end to the conflict allow for capital repatriation.

While there is understandable euphoria, the question remains whether it will be long-lived. Donald Trump is not abandoning tariffs; he has only postponed them. The positivity from eurozone GDP and PMI is largely due to the front-loading of US imports in anticipation of the duties. The ongoing geopolitical tensions between Moscow and Kiev necessitate a more nuanced approach to peace negotiations, which are unlikely to be resolved swiftly.

The US Treasury’s plans to reduce the yield on 10-year Treasury notes by implementing a combination of measures, including cutting government spending, changing the issuance structure to favor short-term securities, and increasing oil production, may be perceived as a risky strategy. There is a high probability that the prevailing greed in the market will sooner or later give way to fear, thus reigniting demand for the US dollar. This is likely to occur in the second half of March, providing euro bulls sufficient time to capitalize on the opportunity.

Weekly EURUSD Trading Plan

Long trades can be kept open as the EURUSD pair is projected to pierce the resistance level of 1.0535. Once this level is breached, the quotes will likely surge to 1.0615 and 1.071. However, the upward movement may not be as rapid as what was witnessed in early February. Moreover, the uptrend may reverse as the pair approaches the resistance levels.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.