Has the US economy reached a point where high inflation is no longer a concern? The market is skeptical. The greenback benefited from rising Treasury yields and the prospect of a 25-basis-point Fed rate cut in September. Let’s discuss this topic and make a trading plan for theEURUSD pair.

The article covers the following subjects:

Highlights and key points

- Core inflation in the US unexpectedly accelerated.

- The Fed faces a new problem.

- The ECB’s dovish rhetoric will put pressure on the euro.

- The EURUSD pair risks slumping to 1.0945 sooner than expected.

Weekly US dollar fundamental forecast

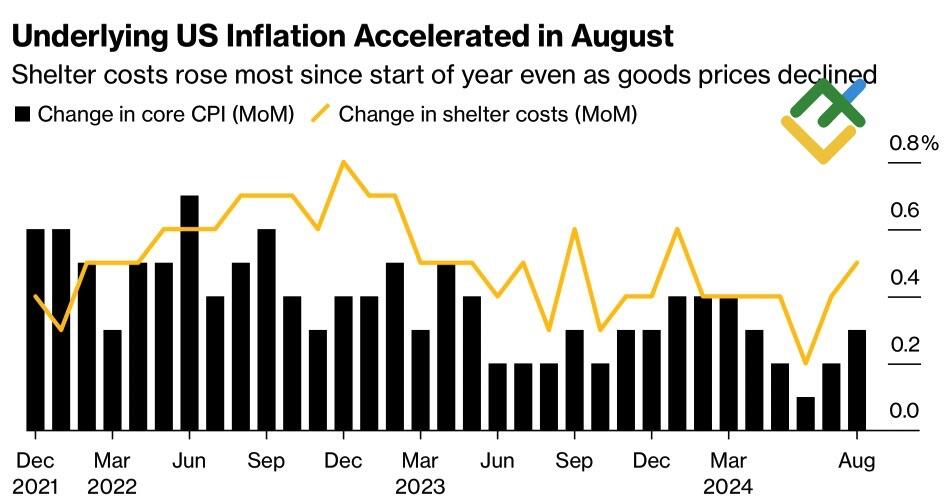

The US inflation report for August presented a challenging outlook for Treasury bonds and prompted a swift reaction in US stock indices. The acceleration of core inflation to 0.3% m/m fueled investor uncertainty about the Fed’s aggressive monetary expansion cycle, spurring Treasury yields, which had reached a two-year low the previous day, and allowing EURUSD bears to approach the psychologically important 1.1 level.

US inflation rate change

Source: Bloomberg.

Investors were more concerned with the acceleration in the three-month core inflation index from 1.6% to 2.1% y/y than with the slowdown in consumer prices from 2.9% to 2.5% y/y. Despite the assertion by Joe Biden’s chief economic advisor and former FOMC member, Lael Brainard, that the latest report signals a shift away from high prices, the Fed is confronted with a significant challenge. The latest data indicated no significant cooling of the labor market but did highlight the stubborn nature of inflation. If inflation resumes its previous upward trajectory, as it did in the 1970s, the central bank may find itself facing the same challenges it did then. Its predecessors prematurely declared victory over CPI and paid for it with a double-dip recession.

In such a situation, the optimal course of action is to start the easing of monetary policy with a standard 25-basis-point step. The derivatives market increased the probability of this outcome in September to 87% from 66%. Notably, the market still anticipates a recession.

They continue to advocate for a 100-basis point reduction in the federal funds rate in 2024, with a 50-basis point cut penciled in for November. This is the reason why the EURUSD pair is moving downward.

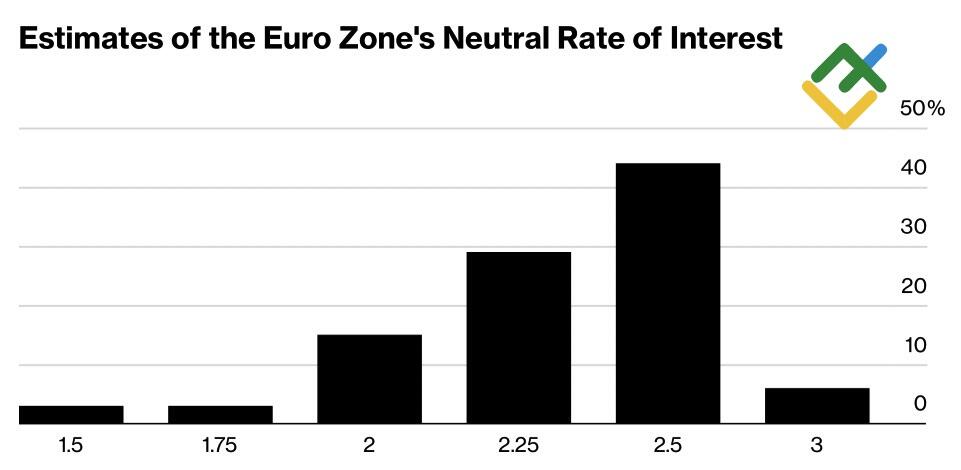

The ECB may accelerate the decline of the major currency pair. All 68 Bloomberg experts project a 25-basis-point reduction in the deposit rate to 3.5% on September 12. Their forecasts show a decline in borrowing costs to a neutral level of 2.5% and two rounds of monetary expansion in 2024. Another is scheduled for December. However, as soon as Christine Lagarde mentions October and the central bank’s forecasts indicate the Eurozone economy’s weakness and a continued decline in inflation, the EURUSD pair will plummet.

Expectations on ECB neutral rate of interest

Source: Bloomberg.

The US economy is currently performing well, but the Fed may face challenges in maintaining its current monetary expansion. There is a risk of reigniting inflation if the Fed is too aggressive in its approach. Meanwhile, the Eurozone is facing economic headwinds, with the potential for deflation. This could prompt the ECB to adopt a more dovish stance, which could further contribute to the downward pressure on the main currency pair.

Weekly EURUSD trading plan

If Christine Lagarde does make a hint of a deposit rate cut in October, the EURUSD pair risks reaching the second of the two previously outlined bearish targets of 1.1 and 1.0945 sooner than expected. Against this backdrop, consider selling the euro against the US dollar.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.