During his first presidential term, Donald Trump initially bolstered the economy through fiscal stimulus measures, subsequently slowing it down by implementing tariffs. In the current term, however, the approach will be reversed. How will the EURUSD pair respond to this? Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Trump’s tariffs will come at a bad time for inflation.

- Import duties will increase by an average of 10%.

- The Fed may cut rates sooner than expected.

- One can open positions on the EURUSD on a breakout of the 1.0255–1.0335 range.

Weekly US Dollar Fundamental Forecast

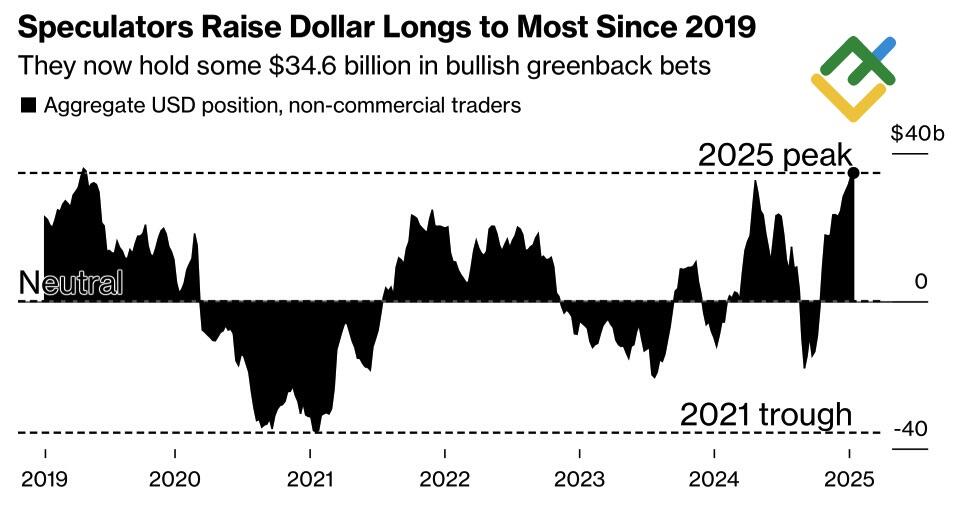

Donald Trump’s political pledges have influenced trader sentiment, leading to a significant increase in net longs on the US dollar since 2019. The president-elect has committed to address the various challenges confronting America with considerable urgency and determination. When such statements are made, there is a perception that significant developments are imminent. Consequently, the future of the EURUSD pair may not be as dismal as expected.

Non-commercial Traders’ Positions on US Dollar

Source: Bloomberg.

From a technical standpoint, there are compelling reasons for traders to expect the greenback to appreciate. The US economy is evidently stronger than the European one, as reflected in the IMF’s forecast of a 2.8% growth for the US in 2024, compared to an estimated 0.8% growth for the currency bloc. According to the Wall Street Journal’s consensus forecast of 73 experts, inflation in the US is projected to accelerate to 2.7% by the end of 2025, surpassing the 2.3% predicted in the October survey. By the end of 2026, the personal consumption expenditure (PCE) index is estimated to reach 2.6%. Additionally, the impact of Donald Trump’s tariffs will boost the PCE by 0.5%.

Experts project an increase in import duties of 23% in China and 6% in other regions, leading to an average tariff rise of 10% across all countries. This timing is particularly challenging, as high inflation persists following the pandemic-induced price shock.

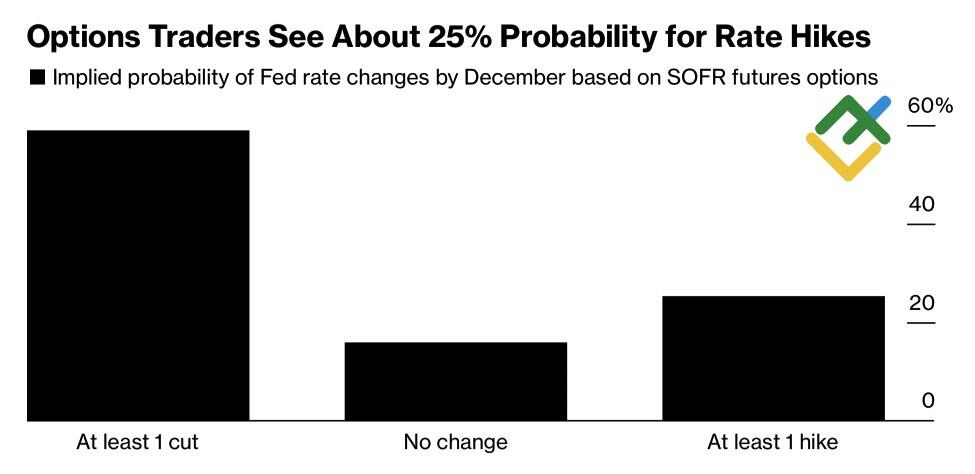

As it was expected, the likelihood of a federal funds rate hike in 2025 is rising in the derivatives market. Current forecasts indicate a 25% chance of a rate increase, although Wall Street Journal experts suggest a 50 basis point drop in borrowing costs.

Derivatives Market’s Expectations on Fed Policy

Source: Bloomberg.

Against this backdrop, the US dollar is poised to gain strength. However, its 8% rally in the fourth quarter indicates that the USD exchange rate has already incorporated a number of positive factors. Consequently, stretched speculative longs on the USD index are more indicative of its vulnerability than a reason for optimism. Should any unexpected events occur, the EURUSD pair will have a catalyst for a pullback.

During Donald Trump’s early days in office, investors will likely focus on tariffs, which are a more straightforward area to begin with. However, the sequence of actions has shifted compared to the previous Trump administration. Initially, they introduced fiscal stimulus, bolstered the economy, and established a form of financial cushion that enabled it to survive trade wars.

Presently, Donald Trump’s actions carry the risk of initially weakening the United States and subsequently fueling its GDP through tax cuts. If the economy experiences a slowdown, the Fed is expected to resume its cycle of monetary expansion, which is likely to boost the EURUSD pair.

Weekly EURUSD Trading Plan

The phased introduction of tariffs will initially weaken the US dollar, after which it will rise. Conversely, large-scale import duties will send the major currency pair to parity, followed by a recovery. It is advisable to open long trades at 1.0335 and short trades at 1.0255 on the EURUSD pair.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.