The US labor market report for July indicated a slowdown in employment across all indicators. This increased the likelihood of an impending recession and raised the probability of the Federal Reserve adopting a monetary expansion policy. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Highlights and key points

- A cooling job market means the Fed may cut rates sharply.

- The markets fear an impending recession.

- The US dollar was hurt the most.

- The EURUSD risks rising to 1.1015 and 1.111.

Weekly US dollar fundamental forecast

If Jerome Powell had been aware of the current information, he would have reduced rates earlier. EY Parthenon has described the July FOMC meeting as one that failed to achieve its objectives, while Moody’s has stated that a 25 bp cut in borrowing costs in September will not be sufficient. To demonstrate its commitment to a more expansionary monetary policy, the Fed should consider a 50-basis-point cut. This is an unfavorable development for EURUSD bears.

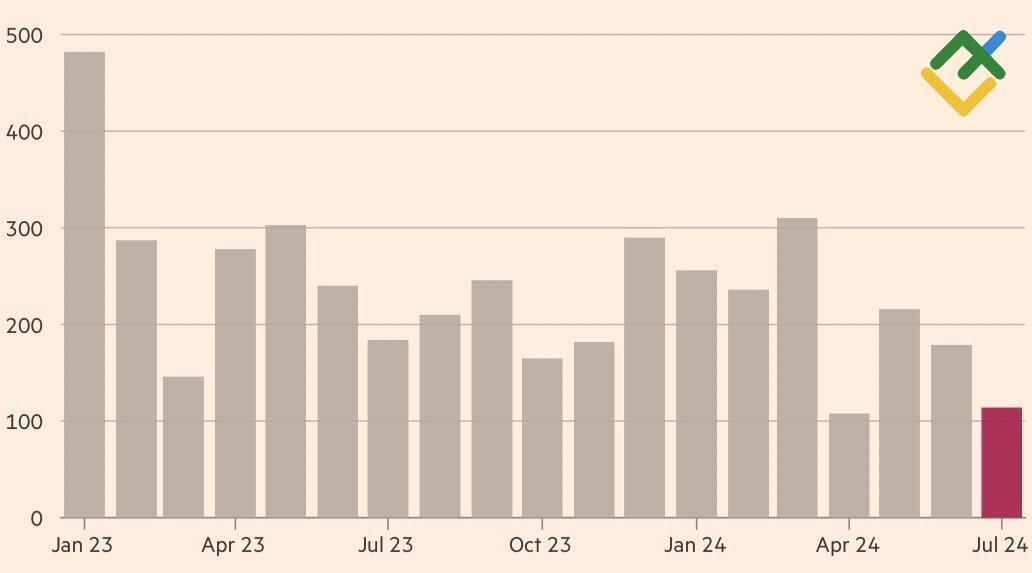

The Federal Reserve has been grappling with inflationary pressures over the past two years and has been slow to ease monetary policy in order to prevent prices from skyrocketing once again. Following the release of disappointing US labor market statistics, the situation has taken an unexpected turn. Investors are questioning whether the Fed has failed to act in a timely manner. The recent rise in unemployment to a nearly three-year peak of 4.3%, the slowdown in nonfarm payrolls to 3.6%, and the most modest job gains of 114k since the pandemic, with the exception of April 2023, have led to concerns that the central bank may be unable to achieve a soft landing and that the economy may be headed towards recession.

US employment

Source: Financial Times.

Goldman Sachs has increased the probability of an economic downturn over the next 12 months from 15% to 25%. Meanwhile, Citigroup and JP Morgan anticipate that the Federal Reserve will reduce the federal funds rate by 125 basis points by the end of the year. Derivatives market indicators show that the odds of monetary expansion by half a point in September increased from 26% to 81%.

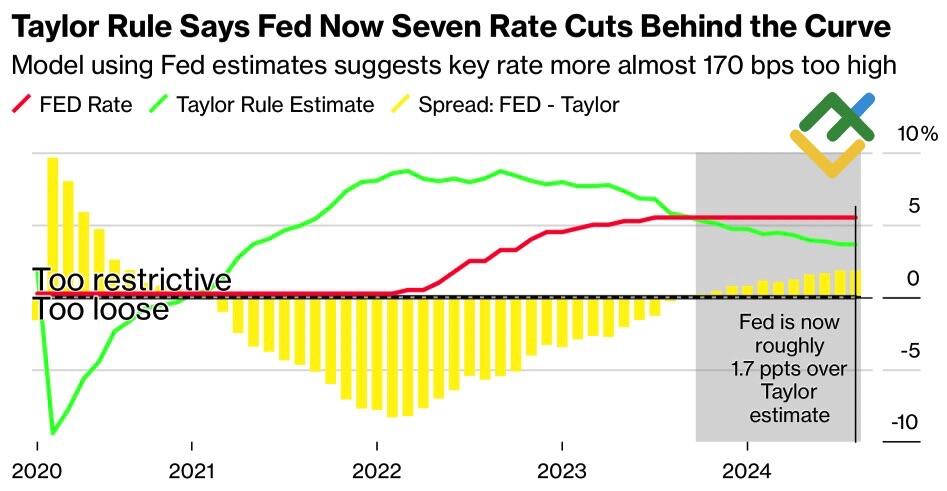

Monetary policy is starting to look overly tight. The divergence between actual rates and the rates demanded by the Taylor rule linking inflation and unemployment has reached its highest level since 2020. If this divergence is not addressed promptly, recession risks will increase significantly. This is particularly noteworthy given that the yield curve, which has been in inversion for an extended period, is beginning to move out of that position. Historically, this has been an indicator of an imminent downturn in the US economy.

Divergence in actual and preferred Fed funds rate

Source: Bloomberg.

According to the Sahm rule, if the average unemployment rate rises 0.5% or more from its yearly low in three months, the US economy has slipped into a recession. In the United States, the figure is 0.53%.

Therefore, concerns about a recession prompted markets to anticipate that the Federal Reserve would reduce interest rates, which enabled the euro to appreciate against its US counterpart and reach above 1.09. However, should EURUSD bears worry? According to the Dollar Smile concept, the US dollar tends to strengthen in the period preceding a recession. In addition, economic weakness reduces the probability of Democratic victory in the upcoming elections, while the Trump factor is likely to support the USD index.

Weekly EURUSD trading plan

Despite the elevated risks of a continued EURUSD rally towards 1.1015 and 1.111, the pair’s upside potential appears constrained. Long trades initiated in the 1.079-1.08 area can be kept open.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.