The slowdown in US core inflation, coupled with the moderately dovish rhetoric of Fed officials, has encouraged EURUSD bulls to attack. However, the market’s resilience and the strength of the opposing forces led to a rally that failed to gain traction. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The disinflationary trend in the US remains in place.

- The derivatives market has increased the odds of two Fed rate cuts.

- The ECB is concerned about deflation and slowing GDP growth.

- Short trades on the EURUSD pair can be opened with targets at 1.012 and 1.000.

Weekly US Dollar Fundamental Forecast

The United States must ensure that the US dollar remains the world’s reserve currency. Following the release of US inflation data, Treasury Secretary Scott Bessent’s first public statement erased all of the EURUSD pair’s gains. The Trump administration is committed to maintaining the strength of the US dollar, which could drag the major currency pair down.

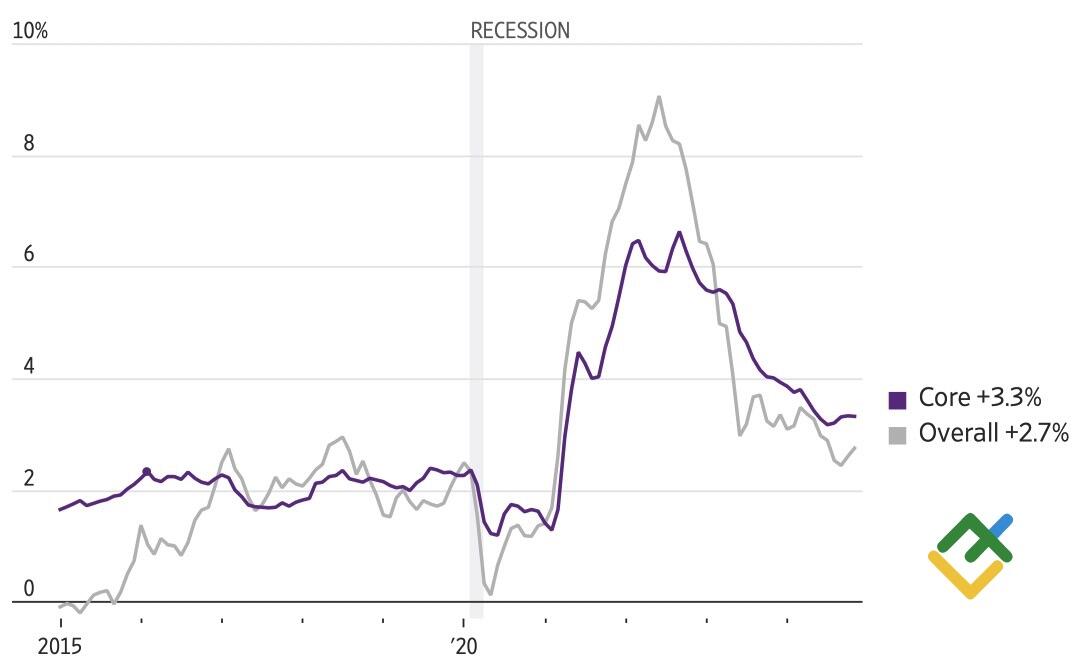

The Consumer Price Index (CPI) data reveals a mixed picture. Consumer prices rose from 2.7% to 2.9% y/y, marking the strongest performance in almost a year. However, the primary contributing factor to this shift was a 4% surge in natural gas prices. At the same time, core inflation decelerated from 3.3% to 3.2% y/y and 0.2% m/m, notching the lowest growth rate in six months.

US Inflation Change

Source: Wall Street Journal.

Investors immediately reacted to the fresh economic data, which indicated a potential change in monetary policy. US Treasury yields dropped, stock indices posted strong performances since Donald Trump’s election victory, and the derivatives market revised its views on the federal funds rate. The probability of a rate cut in 2025 decreased from 26% to 16%, and the odds of more than one act of monetary expansion increased from 35% to 50%.

The comments from Federal Reserve officials further fueled the market’s reaction. New York Fed President John Williams stated that the disinflationary trend remained in force. His counterpart from the Federal Reserve Bank of Richmond, Thomas Barkin, believes that the latest data confirms the movement of prices towards the target. Austan Goolsbee of the Federal Reserve Bank of Chicago argues that this trend in inflation continues to improve.

Against this backdrop, the EURUSD rally appeared well-founded. Risk appetite is growing globally, debt rates are falling, and the likelihood of the Fed resuming its monetary expansion cycle is increasing. In addition, speculators are gradually reducing their long positions on the US dollar amid rumors about the phased introduction of duties on imports.

Meanwhile, even if the Fed cuts rates, it will clearly do it slower than other regulators. The concerns expressed by ECB Chief Economist Philip Lane regarding the potential return of deflation to the eurozone were followed by a dovish speech by Luis de Guindos, Vice President of the European Central Bank (ECB). The official indicated that the ECB was more concerned about growth prospects than the return of inflation to the target range, suggesting that monetary policy would continue to be loosened.

Weekly EURUSD Trading Plan

The US dollar and the euro have their own vulnerabilities, which increases the risk of consolidation of the major currency pair. Nevertheless, if Donald Trump does fulfill his election promises after the inauguration, EURUSD bulls will be forced to flee the battlefield. A strategy that suggests selling the EURUSD pair with targets at 1.012 and 1.000 is still working, so it would be advisable to stick to it.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.