Despite stronger-than-forecast growth in US inflation, the overall trend remains downward. This is the prevailing view among most Fed officials. Nevertheless, it remains to be seen whether this will be sufficient to halt the EURUSD pair’s decline. Let’s consider the potential outcomes and develop a trading plan.

The article covers the following subjects:

Highlights and key points

- US core inflation accelerated in September.

- FOMC officials see the CPI downtrend continuing.

- The ECB may bring the deposit rate to 2% by the end of the cycle.

- The EURUSD pair can be sold on a pullback from 1.1-1.102 or at the market price.

Weekly US dollar fundamental forecast

The US Federal Reserve has consistently emphasized that its decision-making process is not based on a single data point. Despite the acceleration of inflation in September and the rise in jobless claims to the highest level since August 2023, FOMC members’ confidence in reaching the 2% inflation target has slowed down the bearish attack on the EURUSD. The currency pair rebounded from a two-month low, but it remains to be seen whether it will find a bottom.

The Federal Reserve’s policy decisions are based on economic data, but ultimately, it is the officials who make the final decisions. Despite core inflation accelerating to 3.3% and consumer prices rising more strongly to 2.4% than Bloomberg experts had forecast, three FOMC officials dismissed the report. Chicago Fed President Austan Goolsbee stated that inflation had been in decline for a period of 12 to 18 months. His counterpart in Richmond, Thomas Barkin, believes the current trajectory is appropriate, while New York Fed President John Williams expressed confidence that prices were heading toward the 2% target. Only Atlanta Fed President Raphael Bostic was open to discussion about the need to keep the federal funds rate at 5% in November.

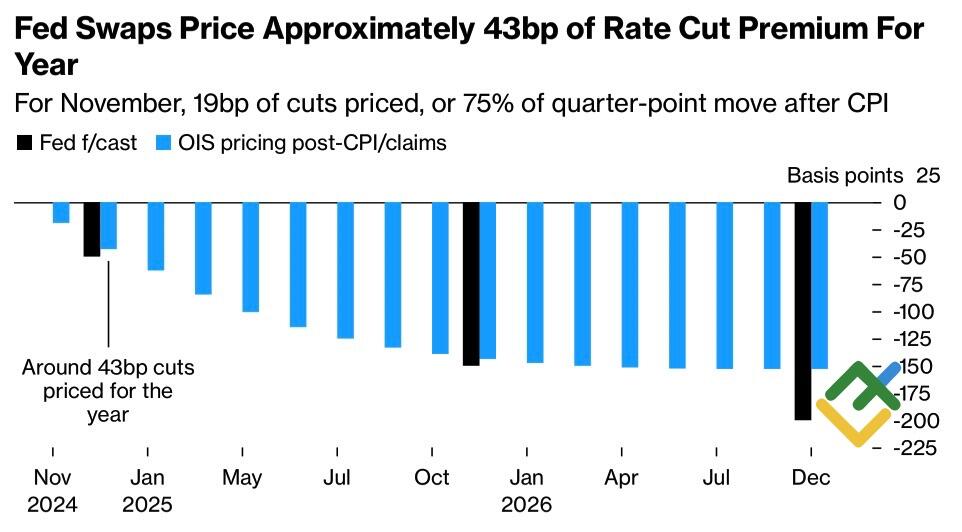

The derivatives market anticipates a 43-basis-point decline in borrowing costs in 2024. This projection is below the 47-basis-point expectation for the ECB deposit rate. The sharp decline from 70 basis points at the beginning of the month was a primary driver of the EURUSD collapse.

Market expectations on Fed interest rate

Source: Bloomberg.

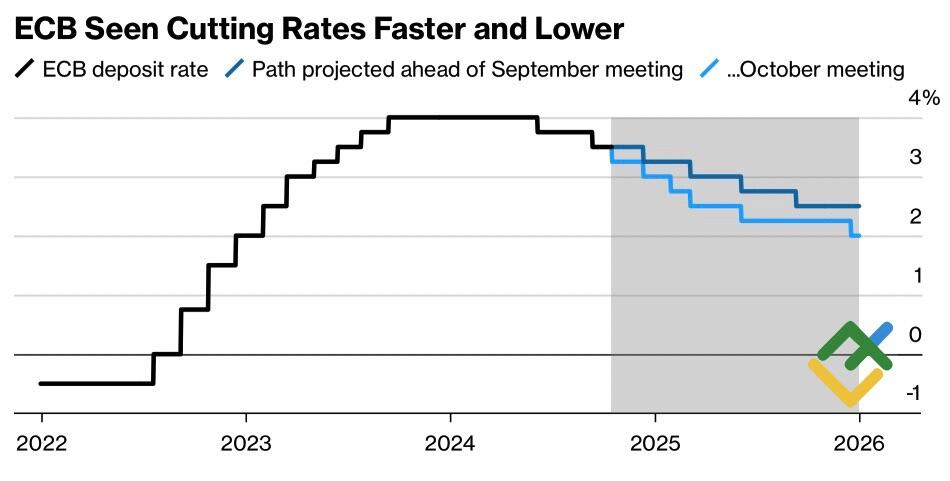

The varying pace of monetary policy expansion is a significant factor in foreign exchange rate determination. The European Central Bank’s inclination to accelerate the monetary expansion cycle is exerting downward pressure on the EURUSD pair as much as rumors of the federal funds rate remaining unchanged in November. In the minutes of the most recent ECB meeting, Chief Economist Philip Lane stressed that should incoming data indicate accelerating disinflation or a significant shortfall in the speed of economic recovery, a faster pace of rate adjustments would be appropriate.

Bloomberg experts expect that the rate will decline at all Governing Council meetings through March, followed by two additional declines in June and December. Consequently, the cost of borrowing will be reduced to 2%, below the 2.5% figure announced in the previous survey.

ECB deposit rate expectations

Source: Bloomberg.

Experts estimate that the European Central Bank’s monetary expansion will reach 150 basis points from the current level of 3.5%. Deutsche Bank projects that if similar readings of the derivatives market reach 170 basis points, the EURUSD pair will plummet to 1.07. In addition, there is a more pessimistic scenario for the euro in the event of a global trade war involving China, which could result in a fall to parity against the US dollar.

Weekly EURUSD trading plan

It will be challenging for the EURUSD pair to find a bottom before the Governing Council meeting on October 17. Against this backdrop, one can sell the major currency pair once it approaches the 1.1-1.102 range or at the market rate with the target of 1.085.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.