Investors’ pessimism at the beginning of the year about the prospects for the US economy and its currency triggered a rapid rally in the USD index. What is the outlook for the US dollar in 2025? Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Major Takeaways

- The US economy exceeded expectations in 2024.

- The Fed started cutting rates later than expected.

- The central bank’s intention to pause and Trump’s policy will support the US dollar in 2025.

- The EURUSD may plummet deeper if it breaches the support level of 1.0385.

Weekly US Dollar Fundamental Forecast

The US dollar is on track for its best quarterly performance since 2022, thanks to the Fed’s intention to pause the rate cut cycle and Donald Trump’s policies. The latter is too controversial, creating uncertainty and sending investors to safe-haven assets, and the US dollar is the best among them. As anticipated, EURUSD bulls have failed to push the pair higher.

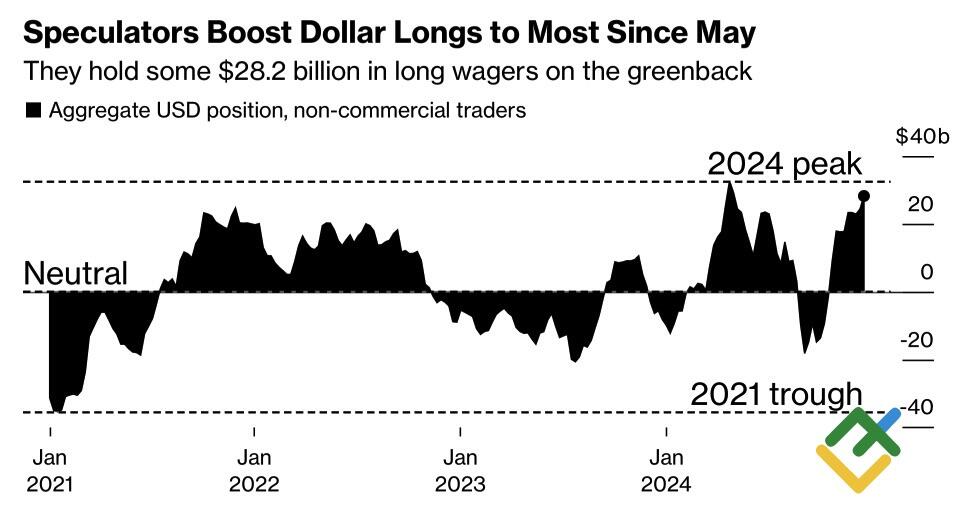

Donald Trump has argued that a strong dollar creates a serious currency problem for the US and undermines the competitiveness of US companies. At the same time, his policies will only exacerbate the problem. The “America First” principle, backed by fiscal stimulus and trade tariffs, will widen the divergence in economic growth between the US and the rest of the world, stimulating capital flows into the US and strengthening the US currency. Against this backdrop, speculators have built up net longs on it, reaching the highest number since May.

Speculative Positions on US Dollar

Source: Bloomberg.

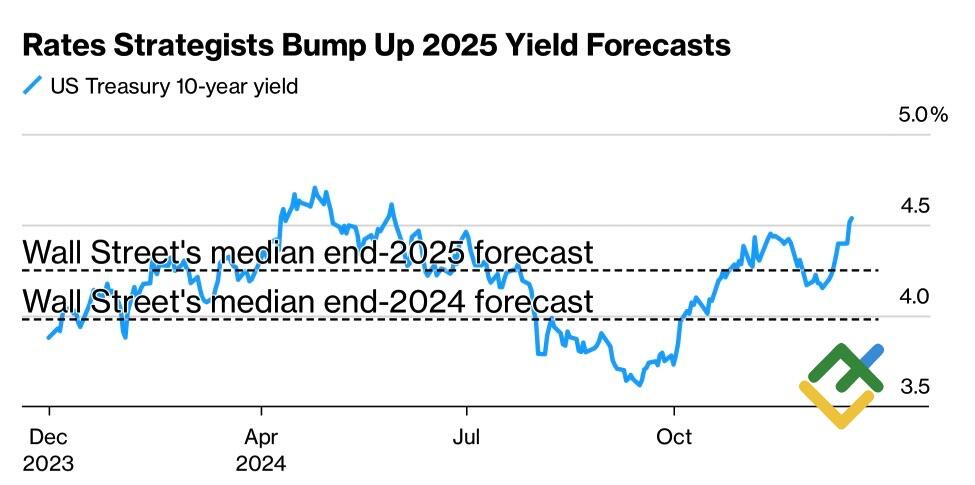

In 2024, the US dollar will be the best Forex currency thanks to its undervaluation. At the end of 2023, Bloomberg experts believed that the Fed’s aggressive monetary tightening would slow GDP growth to 1%. In fact, the US economy expanded by 3%. Wall Street thought that US Treasury yields would decline after the Fed cut rates, but they actually soared. The monetary easing cycle began only in September, not at the beginning of the year as expected.

US Treasury Bond Yield Change and Forecast

Source: Bloomberg.

Interestingly, the major banks also expect debt market rates to decline in 2025. According to their consensus forecast, the 10-year Treasury yield will fall to 4.25% or about 25 basis points from current levels. Do experts project the economy to cool down and the Fed to continue its monetary expansion cycle? Such an option does exist, but the preferable scenario is one in which interest rates rise due to fiscal stimulus, rising budget deficits, accelerating inflation, and the Fed’s pause. Thus, the US dollar will strengthen.

The current market expectations may be wrong. It is not certain that Donald Trump will be able to implement all his ideas; US inflation may slow down, and the economy will cool. In such a scenario, EURUSD quotes will skyrocket. Even against the backdrop of Eurozone weakness and the ECB continuing to cut interest rates.

Weekly EURUSD Trading Plan

The precise nature of the forthcoming developments remains uncertain. Meanwhile, markets are preparing for the Christmas season and entering a period of reduced activity, which could be considered consolidation from a trading perspective. The low liquidity in the market may trigger sharp fluctuations in the EURUSD pair, potentially including a decline if the support level of 1.0385 is breached. However, it may be reasonable to adopt a wait-and-see approach.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.